Virtu Financial's (VIRT) Triton Unlocks Efficiency for Groupama

Virtu Financial, Inc. VIRT recently announced that its Triton Valor execution management system (EMS) has been deployed by Groupama Asset Management, the asset management arm of a large France-based financial services and insurance firm. This collaboration to use Triton Valor for trading fixed income highlights the core value proposition of VIRT, which is gaining popularity owing to its unique products. However, the stock lost 1.6% on Oct 3, replicating a broader decline in markets.

This move bodes well for Virtu Financial’s Execution Services segment as it aims to diversify its revenue base. This partnership will give rise to more commissions earned and, in turn, greater contribution by this segment to the company’s top line in the future. The integration of Virtu Financial’s Triton Valor EMS with Groupama's trading system will bring together all workflows, like negotiated trading and automated execution and provide tools to assemble pre-trade analytics, sources of liquidity and real-time feeds, all in one place. These features of Triton Valor EMS should help clients make decisions faster. Hence, Groupama will be able to streamline and improve trading workflows with Triton Valor.

Virtu Financial is continuously improving Triton Valor’s fixed income capabilities to provide pre-trade transparency, efficiency in operations and better control to clients. All these features will make Triton Valor more attractive to clients as they can assess individual trade difficulties and experience better liquidity. Virtu Financial has also closely knit Triton Valor with its advanced trading capabilities and data handling, which will step up its game in today’s fragmented and complex collection of over-the-counter data.

This partnership highlights Virtu Financial’s unwavering focus on developing cutting-edge technologies to deliver liquidity in markets and transparent trading solutions to clients. This should help further solidify its market-leading position as a financial services provider by enhancing its core value proposition, technology platform and ability to provide a full multi-asset class analytics and trading solution.

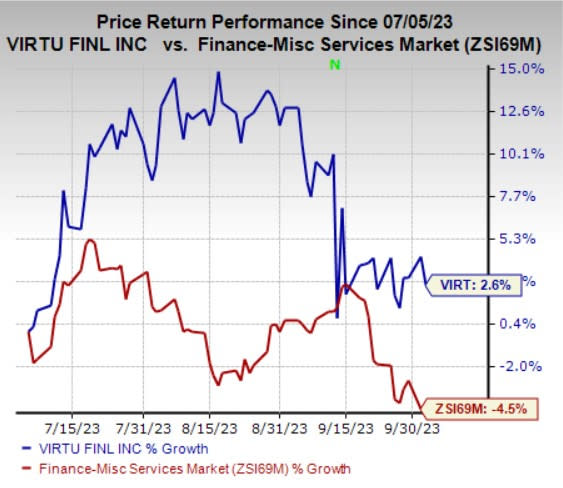

Zacks Rank and Price Performance

VIRT currently has a Zacks Rank #4 (Sell).

Shares of Virtu Financial have gained 2.6% in the past three months against the industry’s 4.5% decline.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the Financial – Miscellaneous Services space include Axos Financial, Inc. AX, Houlihan Lokey, Inc. HLI and MidCap Financial Investment Corporation MFIC. Each of these companies presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Axos Financial’s earnings surpassed estimates in each of the last four quarters, the average surprise being 11.6%. The Zacks Consensus Estimate for AX’s 2023 earnings and revenues indicates a rise of 6.9% and 14.2%, respectively, from the year-ago actuals.

The bottom line of Houlihan Lokey beat estimates in three of the trailing four quarters, missing once, the average beat being 7.4%. The Zacks Consensus Estimate for HLI’s 2023 revenues indicates a rise of 2.8% from the year-ago tally. The consensus mark for HLI’s 2023 earnings has moved 0.2% north in the past 60 days.

MidCap Financial Investment’s earnings outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 5.7%. The Zacks Consensus Estimate for MFIC’s 2023 earnings and revenues indicates a rise of 13.4% and 19.4% from the respective year-ago actuals. The consensus mark for MFIC’s 2023 earnings has moved 0.6% north in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Virtu Financial, Inc. (VIRT) : Free Stock Analysis Report

Houlihan Lokey, Inc. (HLI) : Free Stock Analysis Report

AXOS FINANCIAL, INC (AX) : Free Stock Analysis Report

MidCap Financial Investment Corporation (MFIC) : Free Stock Analysis Report