Virtus Investment Partners Inc Reports Mixed Q4 2023 Results

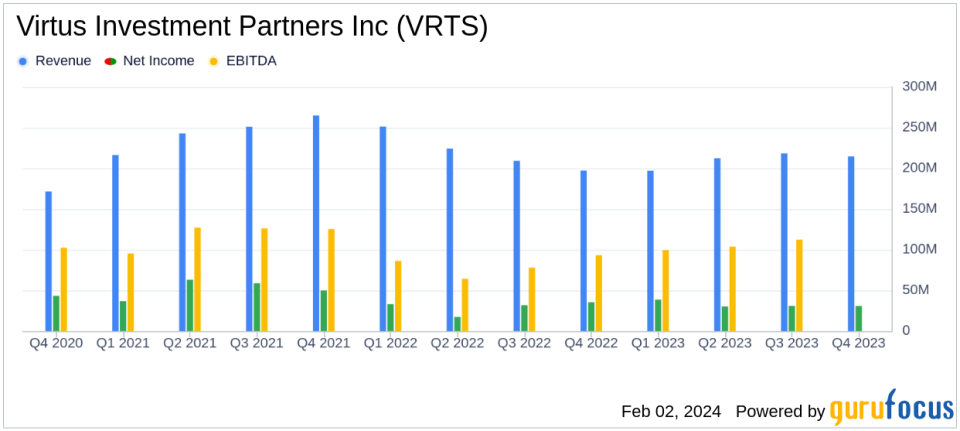

Adjusted Earnings Per Share: Increased to $6.11 from $5.17 in Q4 2022.

Revenue: Grew by 8% year-over-year to $214.6 million.

Operating Income: Rose by 25% from the same quarter last year to $39.0 million.

Assets Under Management (AUM): Increased to $172.3 billion, up 15% from Q4 2022.

Total Sales: Declined to $6.2 billion, a 14% decrease from Q4 2022.

Net Flows: Experienced net outflows of $3.8 billion.

Share Repurchases: Repurchased 97,952 shares for $20.0 million during the quarter.

Virtus Investment Partners Inc (NYSE:VRTS) released its 8-K filing on February 2, 2024, detailing its financial results for the fourth quarter of 2023. The company, a prominent provider of investment management and related services to individuals and institutions, reported an 8% increase in revenue year-over-year, reaching $214.6 million. However, the company faced challenges with net outflows of $3.8 billion, despite a 15% increase in assets under management to $172.3 billion.

Performance Highlights and Challenges

VRTS's adjusted earnings per share saw an 18% increase to $6.11, compared to $5.17 in the same quarter of the previous year. This growth in adjusted earnings is significant for an asset management firm, as it reflects the company's ability to generate profit despite market volatility and investor behavior. However, the company's net income attributable to VRTS decreased by 13% year-over-year, and diluted earnings per share fell by 12% to $4.21. The decrease in net income and EPS reflects the challenges faced by the company, including net outflows and a competitive market environment.

Financial Achievements and Industry Importance

The increase in operating income by 25% to $39.0 million and the operating margin improvement from 15.7% to 18.2% are notable achievements for VRTS. These metrics are crucial in the asset management industry as they demonstrate the company's efficiency and ability to control costs while growing revenue. Furthermore, the company's strategic share repurchases, totaling $45.0 million for the year, signal confidence in its intrinsic value and a commitment to delivering shareholder returns.

Detailed Financial Analysis

VRTS's balance sheet reflects a working capital of $100.6 million as of December 31, 2023, with a slight decrease from the previous quarter. The company's net debt position was $19.2 million, or 0.1x EBITDA, showcasing a strong balance sheet and financial flexibility. The company's cash flow activities, including repaying the remaining balance of the revolving credit facility and returning capital to shareholders through stock repurchases, highlight its operational strength and prudent financial management.

"The increase in operating income and adjusted earnings per share reflects our focus on delivering value to our clients and shareholders, despite the challenging market conditions," said a spokesperson for VRTS.

Outlook and Analysis

While VRTS has demonstrated resilience in its adjusted earnings and operating income, the net outflows present a challenge that the company must address. The asset management industry is sensitive to market fluctuations and investor sentiment, and VRTS's ability to attract and retain assets will be critical in the coming quarters. The company's focus on boutique investment strategies and client service will be key factors in navigating the competitive landscape and achieving long-term growth.

Virtus Investment Partners Inc's full earnings report and additional details can be accessed through their 8-K filing. Investors and analysts will be looking forward to the company's investor conference call and webcast to gain further insights into their financial results and strategic initiatives.

For more in-depth analysis and up-to-date financial news, visit GuruFocus.com, where value investors can find reliable information and tools to make informed investment decisions.

Explore the complete 8-K earnings release (here) from Virtus Investment Partners Inc for further details.

This article first appeared on GuruFocus.