Virtus Investment Partners Inc (VRTS): A High-Performing Asset Management Stock with a GF Score ...

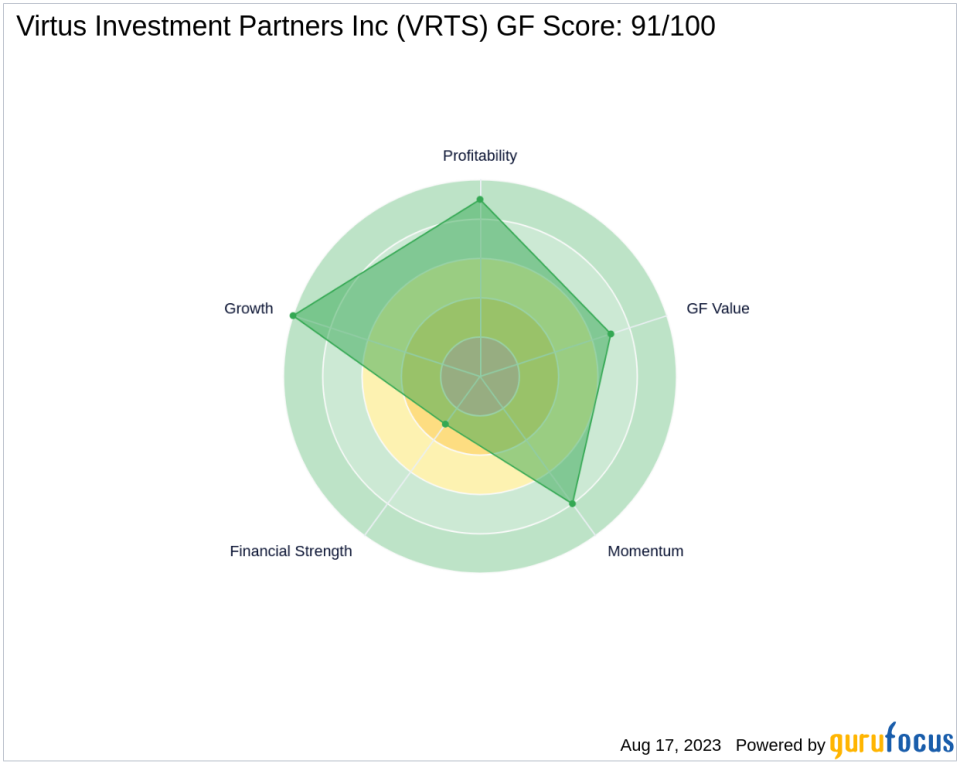

Virtus Investment Partners Inc (NASDAQ:VRTS) is a distinguished player in the Asset Management industry. As of August 17, 2023, the company's stock price stands at $203.23, reflecting a gain of 3.84% today, despite a slight dip of 1.45% over the past four weeks. With a market capitalization of $1.47 billion, Virtus Investment Partners Inc has a GF Score of 91 out of 100, indicating the highest outperformance potential. This article will delve into the components of the GF Score and what they reveal about VRTS's financial strength, profitability, growth, value, and momentum.

Financial Strength Analysis

The Financial Strength Rank of VRTS is 3 out of 10, suggesting a relatively weak financial situation. This rank is determined by factors such as interest coverage (0.99), debt to revenue ratio (2.70), and Altman Z score (0.89). The low interest coverage and high debt to revenue ratio indicate a significant debt burden, while the low Altman Z score suggests potential bankruptcy risk.

Profitability Rank Analysis

On the other hand, VRTS's Profitability Rank is 9 out of 10, indicating a high level of profitability and business stability. This rank is based on factors such as operating margin (17.80%), Piotroski F-Score (5), and a consistent profitability trend over the past 10 years. The high operating margin and consistent profitability suggest that VRTS has been successful in maintaining its business operations profitably.

Growth Rank Analysis

VRTS's Growth Rank is 10 out of 10, reflecting robust revenue and profitability growth. This rank is determined by the 5-year revenue growth rate (16.80%), 3-year revenue growth rate (19.00%), and 5-year EBITDA growth rate (19.30%). These high growth rates indicate that VRTS has been successful in expanding its business operations and improving its profitability over time.

GF Value Rank Analysis

The GF Value Rank of VRTS is 7 out of 10, suggesting that the stock is reasonably valued. This rank is determined by the price-to-GF-Value ratio, which takes into account historical multiples, past returns and growth, and future business performance estimates. A GF Value Rank of 7 indicates that VRTS's stock is neither overvalued nor undervalued, but rather fairly priced.

Momentum Rank Analysis

VRTS's Momentum Rank is 8 out of 10, indicating strong stock price performance. This rank is determined by the standardized momentum ratio and other momentum indicators, suggesting that VRTS's stock price has been performing well relative to the market.

Competitor Analysis

When compared to its main competitors in the Asset Management industry, VRTS stands out with its high GF Score. Blackrock Municipal 2030 Target Term Trust (NYSE:BTT) has a GF Score of 57, Eaton Vance Tax-Managed Buy-Write Opp (NYSE:ETV) has a GF Score of 41, and PIMCO Dynamic Income Opportunities Fund (NYSE:PDO) has a GF Score of 19. This comparison suggests that VRTS is a more attractive investment option in the Asset Management industry.

Conclusion

In conclusion, despite its relatively weak financial strength, Virtus Investment Partners Inc (NASDAQ:VRTS) demonstrates strong profitability, growth, and momentum, with a fair valuation. Its high GF Score of 91 suggests the highest outperformance potential, making it a promising investment option in the Asset Management industry. However, investors should also consider the company's financial strength and monitor its debt situation closely.

This article first appeared on GuruFocus.