Virtus Investment's (VRTS) October AUM Dips 4.1% Sequentially

Virtus Investment Partners, Inc. VRTS recorded a sequential decline of 4.1% in its preliminary assets under management (AUM) balance for October 2023 on the back of unfavorable market returns. The company reported a month-end AUM of $155.82 billion, which reflected a fall from the Sep 30, 2023 level of $162.5 million.

The company offered services to $2.4 billion of other fee-earning assets. This was excluded from the above-mentioned AUM balance

In October, Virtus Investment’s open-end funds’ balance decreased 4.3% from the end of the previous month to $51.8 billion. Also, the closed-end funds’ balance fell 2.2% to $9.26 billion.

Further, the Institutional accounts’ balance sequentially slipped 3.8% to $57.9 billion. Retail separate accounts’ balance of $36.8 billion fell 4.8% from the prior month.

Elevated operating expenses are expected to hurt Virtus Investment’s bottom line to an extent in the near term. Yet, its integrated multi-boutique business model in a rapidly growing industry is likely to support its performance.

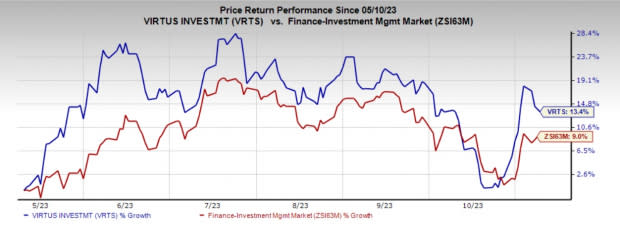

Over the past six months, shares of Virtus Investment have gained 13.4% compared with the 9% upside of the industry it belongs to.

Image Source: Zacks Investment Research

Currently, Virtus Investment carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Competitive Landscape

Cohen & Steers, Inc. CNS reported a preliminary AUM of $72.2 billion as of Oct 31, 2023, which reflects a decrease of 4% from the prior-month level. Market depreciation of $2.1 billion, net outflows of $732 million and distributions of $154 million led to the decline.

Cohen & Steers recorded total institutional accounts of $29.8 billion at the end of October 2023, declining 4.6% from the September-end level. Of the total institutional accounts, advisory accounts were $17.3 billion, while the rest were sub-advisory.

Victory Capital Holdings VCTR reported an AUM of $148.89 billion for October 2023. This reflected a 3% decline from the $153.51 billion reported as of Sep 30, 2023.

By asset classes, at the end of October, VCTR’s U.S. Mid Cap Equity AUM fell 4.5% from the September level to $26.97 billion. The U.S. Small Cap Equity AUM of $13.64 billion dipped 6.9%. Further, the U.S. Large Cap Equity AUM decreased 2.7% to $11.28 billion. VCTR’s global/Non-U.S. Equity AUM was down 2.2% to $14.48 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Virtus Investment Partners, Inc. (VRTS) : Free Stock Analysis Report

Cohen & Steers Inc (CNS) : Free Stock Analysis Report

Victory Capital Holdings, Inc. (VCTR) : Free Stock Analysis Report