Visa: A Great Company That Is Fairly Priced

Thesis Summary

Visa's (V) position in the global payment technology industry identifies an enterprise that performs financially well and follows a strategic approach to development despite the evolution of the fintech industry. In the first quarter of the fiscal year 2024, Visa showed substantial growth in its GAAP net income and EPS due to the rise in payment volumes and cross-border transactions. Visa's fast expansion through acquisitions and partnerships, as well as its utilization of fintech innovations such as tap-to-pay technologies, is another element that supports its position as the top payment company. The DCF valuation suggests that Visa stock is fairly valued as it accounts for prospective growth and operational efficiencies. Nevertheless, the assessment is cautious due to possible counterbalance from competitive forces, regulatory changes, and global economic factors, which may affect future profitability. Despite these challenges, Visa is a promising investment opportunity to consider, given that the stock price represents its strong financial performance and expectations for future growth.

Latest Earnings

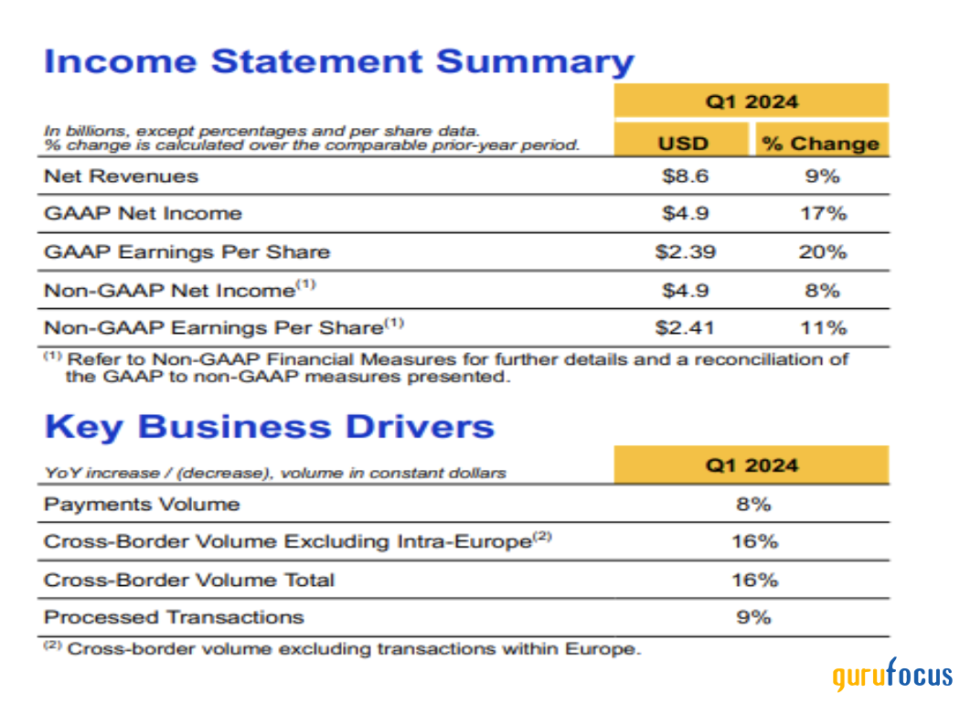

Visa's first quarter of fiscal 2024 showed a solid financial performance, with the GAAP net income jumping to $4.9 billion, up 17%, and EPS increasing by 20% to $2.39 compared to the previous year. The growth was supported by the combination of net earnings from equity investments and the operations of costs related to transactions, even in the constant background of litigation costs in the comparison year. The company saw the net revenue rise by 9% to 8.6 billion dollars, mainly driven by the increased payment volumes, cross-border transactions, and processed transactions, which demonstrates Visa's remarkable presence in the digital payment ecosystem.

Source: Investor slides

It is to be noted that the non-intra-Europe cross-border volume increased by 16%, which illustrates VISA's global solid position. Operational efficiencies caused a 6% essential decline in operating expenses under GAAP line items, mainly due to lesser litigation provisions. Equally, the data processing and other revenues increased by 14 percent and 18 percent, respectively. Visa's strategic focus on expanding its digital payment infrastructure and fostering partnerships coupled with successful cost management has strengthened its financial health, which has earned the firm leadership in the global payments industry.

Future Outlook

The prospects of growth and investment for Visa are based on solid Q1 2024 performance, strategic expansions, and its fintech innovations. The Company reported earnings that beat analysts' expectations with an 8.9% increase in net revenues to $8.6 billion powered by 8% growth in the payment volume and an impressive 16% surge in the cross-border volume. Visa's acquisitions like Pismo and Prosa, coupled with strategic partnerships with major financial institutions globally, clearly indicate its focus on further strengthening its digital payment capabilities and markets. Through its adoption of fintech innovations such as tap-to-pay technologies and strategic collaborations with fintech giants, Visa's involvement in the fintech space clearly demonstrates its flexibility and scalability in providing digital payment solutions.

Visa is financially strong, with good operating margins and effective dividend and share repurchase strategies that show its ability to produce positive shareholder returns. Analyst estimates compiled for 2024 show a continuation of revenue and earnings per share (EPS) growth, which firmly confirms Visa to be a leader in the payment processing sector. The company's strategic investments, market expansion initiatives, and fintech innovations make it well-placed for continued growth, meaning Visa stock has become an attractive investing opportunity. Its capability to stay dynamic in the ever-changing payment system hints at a favorable future, consolidating its position as a good investment option and reason for having an attractive return.

Valuation

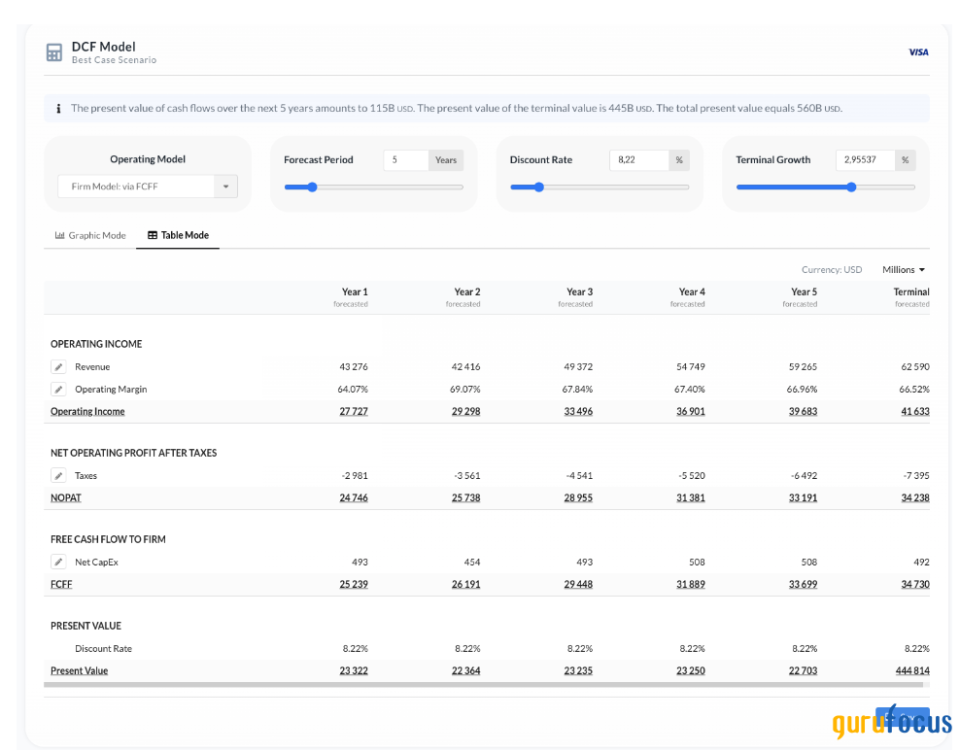

The DCF valuation from "Alphaspread" shows Visa's financial prospects are depicted with robust optimism. The graph shows an upward trend of operating income within the next five years, a valuable signal of Visa's potential for earnings growth. The operating margin is projected to escalate to 66%, indicative of increasing operational efficiency and profitability. The model further reveals an expected increase in revenues from $43.3 billion to $62.6 billion, which translates to a notable growth rate over the forecast period.

Source: Alphaspread valuation

With the increasing NOPAT numbers, it is evident that the profitability of Visa, net of taxes, is on an upward trend. This denotes that the company is increasing its profits and effectively handling its tax liabilities. The impressive NOPAT growth validates robust financial health and solid operational performance and gives investors confidence in Visa.

The FCFF's year-over-year increase is the most important sign. It indicates that at least the amount of funds generated from operations is estimated to be more, which could be paid out as dividends to the shareholders, repurchased by the company, reduced debt, or invested back in growth initiatives. This is the most essential function of the model because it makes the value of the company and that of the stock in the future.

From the perspective of the present value of the cash flows to be expected in the future, which are discounted at a rate of 8.22%, the company has a moderate risk level. The discount rate, symbolic of Visa's strong position and assured cash installments, determines the present recognized value of future income. The numbers indicate that Visa's current stock is at the correct expected cash flow value.

Source: Alphaspread valuation

The terminal value, a significant component of the DCF, is based on a growth rate of about 2.95%, thus implying that the market believes that Visa will continuously grow beyond the immediate forecasting period. The slowing down of growth, according to rapidly maturing business, is still an essential component of the result; it shows that the company is not concerned about the need to be more concerned with the growth phase.

Therefore, according to the DCF model, Visa shares are priced at current levels that almost correspond to their fair value if current growth assumptions hold. The model signifies the company with a solid financial position and a forecast of growth associated with heavy demand, which is, in turn, only transient. It can dissuade some value investors even if the stock does not present a good discount or create a sufficient margin of safety. On the contrary, for growth-oriented investors who think that Visa can beat these estimates, the stock could still be an attractive investment opportunity. The model depicts Visa as a financially healthy firm, but its stock price incorporates its outstanding business fundamentals and upside potential.

Risks

Investing in Visa stock, while promising due to the company's solid market position and financial health, carries certain risks. The stock's current valuation suggests it is reasonably priced, leaving little room for error in growth projections. Any slowdown in consumer spending or disruptions in cross-border transactions could adversely affect Visa's transaction volumes and, consequently, its revenue. Additionally, the evolving landscape of digital payments poses a competitive risk, with fintech innovations and new payment platforms potentially encroaching on Visa's market share. Regulatory challenges and changes in interchange fee structures in various jurisdictions could also impact profitability. Lastly, the global economic environment could affect transaction volumes and cross-border payment profitability, including interest rate changes and currency fluctuations. These factors collectively represent a risk profile that potential investors must weigh against the company's growth prospects and operational strengths.

Conclusion

Visa's robust earnings growth, strategic acquisitions, and fintech innovations suggest a bullish future, yet the stock price already reflects these strengths, indicating it's fairly valued. For investors, Visa offers stability and consistent performance without the discount typically sought by value investors, making it an attractive proposition primarily for those banking on its continuous market dominance and innovation to drive returns.

This article first appeared on GuruFocus.