Visa (V) August Payments & Cross-Border Volumes Up: An Analysis

Visa Inc. V reported encouraging volume and transaction results for the quarter-to-date period, showing both booming e-commerce businesses and cross-border volume growth. This gives us a general idea about the industry’s current flow. The financial transaction juggernaut witnessed 7% year-over-year growth in U.S. payments volume last month.

Payments Volume

Credit payments volume in the United States increased 5% in the quarter-to-date period while debit payments rose 6%. These growth percentages include a sequential rise in payments volume growth rate in August.

While card not present volume increased 9% year over year in August, card present volume only climbed 4%. This can signify that e-commerce businesses are still prospering, at least at a better degree than brick-and-mortar businesses.

For the fiscal fourth quarter, the Zacks Consensus Estimate for U.S. payments volume growth is pegged at 6.5%. The metric witnessed a 6% increase in the quarter-to-date period. Hence, V has a few miles left to cover in the third month. Its top line depends heavily on payments volume.

The Zacks Consensus Estimate for Visa’s fiscal fourth quarter revenues is pegged at $8.6 billion, indicating 9.8% year-over-year growth. Similarly, the consensus mark for earnings per share is pegged at $2.23, suggesting 15.5% growth from a year ago.

Processed Transactions

Per the regulatory filing by Visa, although its global processed transaction growth numbers have declined considerably from the start of the year, it remained stable at 10% in the quarter-to-date period. During this time, the processed transaction volume (the key catalyst for data processing revenues) was 154% of the 2019 level.

The Zacks Consensus Estimate for Visa’s fiscal fourth quarter data processing revenues suggests an 11.5% year-over-year increase.

Cross-Border Volume

Total cross-border volume increased 18% year over year in August, following a 17% jump in July. Excluding intra-Europe transactions, cross-border volume (that boosts the company’s international transaction revenues) rose 20% year over year in July and August each. The ongoing increase in travel is expected to keep the volumes up, especially in the Asia Pacific region.

The Zacks Consensus Estimate for V’s fiscal fourth quarter international transaction revenues suggests a 10.9% year-over-year increase.

Full-Year Estimates & Surprise History

The Zacks Consensus Estimate for Visa’s fiscal 2023 revenues is pegged at $32.6 billion, indicating 11.2% year-over-year growth, thanks to growing payments, transactions and cross-border volumes. The consensus mark for earnings per share is pegged at $8.65, suggesting 15.3% growth from a year ago.

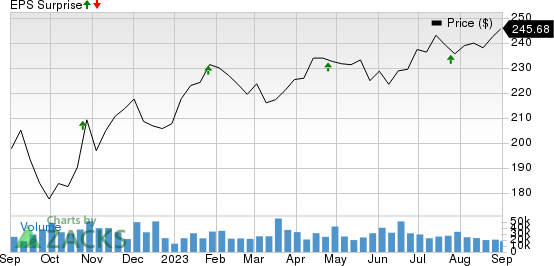

Visa’s earnings beat estimates in all the last four quarters, the average surprise being 5.2%. This is depicted in the graph below.

Visa Inc. Price and EPS Surprise

Visa Inc. price-eps-surprise | Visa Inc. Quote

Zacks Rank & Key Picks

Visa currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Business Services sector are Paysafe Limited PSFE, FirstCash Holdings, Inc. FCFS and PagSeguro Digital Ltd. PAGS. While Paysafe currently sports a Zacks Rank #1 (Strong Buy), FirstCash and PagSeguro carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Paysafe’s current year bottom line suggests 1.3% year-over-year growth. Headquartered in London, PSFE beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 154%.

The Zacks Consensus Estimate for FirstCash’s current year earnings indicates a 6.4% year-over-year increase. Fort Worth, TX-based FCFS beat earnings estimates in all the past four quarters, with an average surprise of 7.3%.

The Zacks Consensus Estimate for PagSeguro’s current year bottom line suggests 13% year-over-year growth. Based in Sao Paulo, Brazil, PAGS beat earnings estimates in all the past four quarters, with an average surprise of 9.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Visa Inc. (V) : Free Stock Analysis Report

FirstCash Holdings, Inc. (FCFS) : Free Stock Analysis Report

PagSeguro Digital Ltd. (PAGS) : Free Stock Analysis Report

Paysafe Limited (PSFE) : Free Stock Analysis Report