Visa (V) Enhances Offerings With Virtual Corporate Cards

Visa Inc. V recently announced that it had enhanced its digital wallet capabilities by incorporating access to virtual corporate cards in Visa Commercial Pay for employees. Visa and Conferma Pay jointly built Visa Commercial Pay to transform how businesses transact globally.

This move bodes well for Visa as persistent innovation in its services should help with client retention. With this new move, financial institutions can add virtual cards to an employee’s digital wallet, thereby enhancing security and convenience for corporates. Visa also led the expansion of Visa Commercial Pay to the Latin America & Caribbean region. Such expansions will help V diversify its business and leverage a dynamic business landscape in this region.

Visa Commercial Pay also contains virtual B2B payment solutions for businesses to enhance cash flow and discard orthodox manual processes. Visa’s secure payment environment builds trust for businesses and enables them to move to secure and automated processes. Visa is leveraging the advanced tokenization technology by providing a commercial token account to be used for payments across CNP payment methods and Point of Sale. Enabling secure payments and easing the payment process for businesses bodes well for Visa. Shifting more transactions from the physical to the digital ecosystem will help improve the number of processed transactions, thereby resulting in top-line growth.

Visa’s expansion and enhancement to its digital wallet technology comes at an opportune time. Per Juniper Research, virtual card spending is expected to increase more than three-fold by 2028 from $3.1 trillion in 2023. Regions Bank will roll out the new digital wallet technology for its treasury management customers.

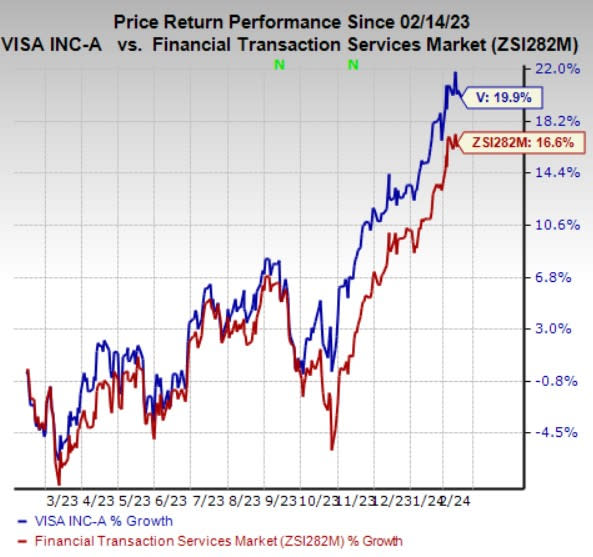

Price Performance

Shares of Visa have gained 19.9% in the past year compared with the industry’s 16.6% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Visa currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Business Services space are Envestnet, Inc. ENV, Mastercard Incorporated MA and PagSeguro Digital Ltd. PAGS. While Envestnet sports a Zacks Rank #1 (Strong Buy), Mastercard and PagSeguro carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of Envestnet outpaced estimates in three of the last four quarters and met the mark once, the average surprise being 3.2%. The Zacks Consensus Estimate for ENV’s 2023 earnings suggests an improvement of 7.5% from the year-ago reported figure.

Mastercard’s earnings outpaced estimates in all the trailing four quarters, the average surprise being 3.5%. The Zacks Consensus Estimate for MA’s 2024 earnings suggests an improvement of 17.1% from the year-ago reported figure. The consensus mark for revenues suggests growth of 12% from the prior-year reading. The consensus mark for MA’s 2024 earnings has moved 1.2% north in the past 30 days.

The bottom line of PagSeguro outpaced estimates in each of the last four quarters, the average surprise being 9%. The Zacks Consensus Estimate for PAGS’s 2023 earnings suggests an improvement of 14.1% from the year-ago reported figure. The consensus mark for revenues suggests growth of 3.1% from the year-ago reported number. The consensus mark for PAGS’s 2023 earnings has moved 2.9% north in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

Envestnet, Inc (ENV) : Free Stock Analysis Report

PagSeguro Digital Ltd. (PAGS) : Free Stock Analysis Report