Visa (V) & Hyundai Card Unite to Provide Data-Driven Solutions

Visa Inc. V partnered with Hyundai Card, a Korean leader in the credit card space, to build on payment data and provide data-driven solutions. Both companies will leverage the other’s expertise in growing their businesses organically.

This move bodes well with Visa’s aim to use data science in driving innovative payment experiences for customers. Using data to cater to individuals incessantly evolving preferences should help Visa retain its customers and build loyalty.

Moreover, under this partnership, Hyundai Card will feature Visa as its preferred global payment brand, which is a major milestone. Hyundai Card will also assist in Visa’s ambitious initiatives, such as B2B payments and virtual cards. All these should help boost Visa’s top line in the future. This collaboration is expected to solidify Visa’s presence in South Korea and expose more business opportunities in international markets with Hyundai Card.

Hyundai Card will benefit from Visa’s global network spanning 200 countries in offering its unique data analytics platform around the world. Currently, Hyundai Card offers this platform to its Private Label Credit Card partners. Moreover, Hyundai Card will leverage Visa’s data capabilities and assets to improve its data analytics platform, “Domain Galaxy”. The company partners with retailers to gain insights into transaction data and offers benefits and loyalty rewards based on identified purchasing patterns.

Visa is expected to help Hyundai Card transform from a traditional finance company to a technology company. Both these companies share common philosophies regarding value creation using data and driving payment innovations. This partnership is beneficial for customers as they will be provided with tailormade and innovative solutions as an outcome of valuable insights gained from data.

Zacks Rank and Price Performance

Visa currently carries a Zacks Rank #3 (Hold).

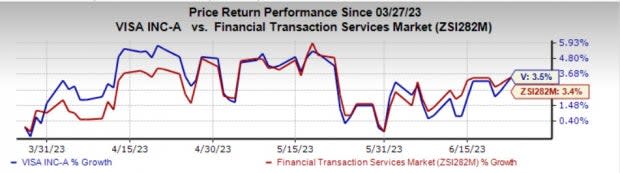

Shares of Visa have gained 3.5% in the past three months compared with the industry’s 3.4% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the Financial Transaction Services space are Usio, Inc. USIO, Remitly Global, Inc. RELY and Paysafe Limited PSFE. The companies currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Usio 2023 earnings indicates a 140.7% increase from the prior-year reported number. Also, the consensus mark for revenues for the year indicates 19.1% growth. The consensus estimate for earnings witnessed one upward estimate revision over the past 60 days against none in the opposite direction.

The Zacks Consensus Estimate for Remitly Global’s 2023 earnings indicates a 7.4% increase from the prior-year reported number. Also, the consensus mark for revenues for the year indicates 36.8% growth.

The Zacks Consensus Estimate for Paysafe’s 2023 earnings is pegged at $2.2 per share, which witnessed one upward estimate revision over the past 60 days against none in the opposite direction.

PSFE’s earnings beat estimates in three of the last four quarters and missed once, the average surprise being 190.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Visa Inc. (V) : Free Stock Analysis Report

Remitly Global, Inc. (RELY) : Free Stock Analysis Report

Usio Inc (USIO) : Free Stock Analysis Report

Paysafe Limited (PSFE) : Free Stock Analysis Report