Vishay (VSH) Bolsters Opto Offerings With IR Module Upgrades

Vishay Intertechnology VSH recently upgraded its family of infrared (IR) transceiver modules, namely TFBS4xx and TFDU4xx, with its in-house integrated circuit (IC) and surface emitter chip technology.

The IR modules incorporate a PIN photodiode, infrared emitter and low power control IC, offering 20% longer link distance and improved ESD robustness to 2 kV for IrDA applications.

These devices, available in top and side-view surface-mount packages, support data rates up to 115.2 kbit/s and 1-meter link distances, ensuring long-term availability and cost savings.

Vishay is expected to gain solid traction across energy meters and monitors, industrial automation controls, mobile phones and medical equipment applications on the back of these upgraded devices.

Moreover, the latest feature upgrades will likely bolster the company’s Optoelectronics offerings.

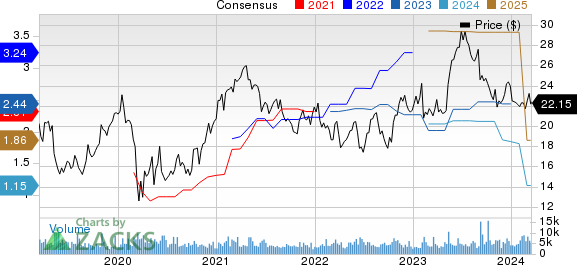

Vishay Intertechnology, Inc. Price and Consensus

Vishay Intertechnology, Inc. price-consensus-chart | Vishay Intertechnology, Inc. Quote

Strengthening Optoelectronics Portfolio

Apart from these recent upgrades, Vishay recently upgraded its family of IR modules, namely TSOP18xx, TSOP58xx and TSSP5xx, with its latest in-house integrated circuit technology.

The IR modules, now available in minicast packages, offer 50% lower current consumption, improved ESD robustness, wider supply voltage range, 20% higher dark-ambient sensitivity and enhanced performance under strong DC light.

Further, the company introduced VEMD2074, a high-speed silicon PIN photodiode with enhanced sensitivity for visible light, offering fast switching times of 70 ns and low capacitance for precise signal detection in wearable devices.

Vishay also launched VCNL36828P, a compact, fully integrated proximity sensor featuring a vertical-cavity surface-emitting laser. The proximity sensor offers a 20% smaller package, 20% lower idle current and 40% higher sunlight cancellation, enhancing efficiency in space-constrained, battery-powered applications.

Additionally, the company expanded its opto offerings by introducing three new IR sensor modules, TSMP95000, TSMP96000 and TSMP98000. These newly released devices, which are designed for remote control systems, bring features like pin-to-pin compatible replacements, wider supply voltage range, smaller bandwidth for better noise strength, higher ESD withstand capability and robust performance under strong DC light.

To Conclude

All the above-mentioned endeavors to strengthen the company’s optoelectronics offerings will likely aid Vishay in capitalizing on growth opportunities present in the global optoelectronics market. Per a report from Expert Market Research, the global optoelectronics market is expected to reach $25.31 billion by 2032, witnessing a CAGR of 14.8% during the period of 2024-2032.

A Mordor Intelligence report indicates that the global optoelectronics market will hit $47.6 billion in 2024 and reach $62.9 billion by 2029, witnessing a CAGR of 5.7% between 2024 and 2029.

However, macroeconomic uncertainties and a softening demand environment across industrial end markets remain major concerns for the company. Vishay’s shares have lost 7.6% in the year-to-date period, underperforming the Zacks Computer & Technology sector’s growth of 10.2%.

The Zacks Consensus Estimate for first-quarter 2024 revenues is pegged at $733.19 million, indicating a fall of 15.8% year over year.

The consensus mark for first-quarter 2024 earnings is pegged at 21 cents per share, indicating a 73.4% decline from the year-ago figure.

Zacks Rank & Stocks to Consider

Vishay currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader technology sector are CrowdStrike CRWD, Badger Meter BMI and AMETEK AME, each carrying a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of CrowdStrike have gained 28.7% in the year-to-date period. The long-term earnings growth rate for CRWD is 22.31%

Shares of Badger Meter have lost 1.4% in the year-to-date period. The long-term earnings growth rate for BMI is 12.27%.

Shares of AMETEK have gained 10.2% in the year-to-date period. The long-term earnings growth rate for AME is 9.19%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report