Vishay (VSH) Boosts MOSFET Offerings With New Modules

Vishay Intertechnology VSH recently introduced synchronous buck regulator modules, namely, SiC931, SiC951, and SiC967.

Notably, these 6 A, 20 A, and 25 A microBRICK synchronous modules with constant on-time architecture ensure ultrafast transient response, tight ripple regulation and loop stability, regardless of output capacitor type, including low ESR ceramic capacitors.

Further, offering 69% smaller size than other solutions, these 10.6 mm by 6.5 mm by 3 mm compact devices boast enhanced power density, reduced design complexity and time to market, and a wide input voltage range from 4.5 V to 60 V.

The SiC931, SiC967, and SiC951 are all programmable devices with adjustable switching frequencies, current limit, soft start, and PMBus 1.3 compliant operation, offering sequential, tracking and simultaneous functions.

We note that Vishay remains well-poised to gain strong traction across applications like point-of-load converters in servers, cloud computing, industrial automation, surveillance systems, consumer electronics and 5G telecom equipment, among others, on the back of the underlined devices.

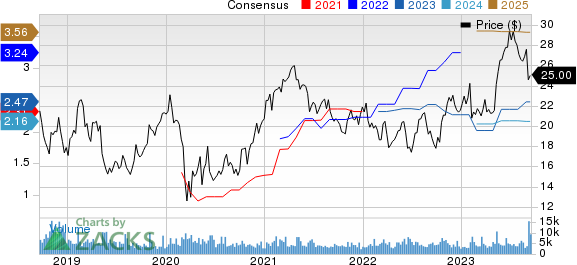

Vishay Intertechnology, Inc. Price and Consensus

Vishay Intertechnology, Inc. price-consensus-chart | Vishay Intertechnology, Inc. Quote

Growth Prospects

The latest move positions the company well to expand its footprint in the global MOSFET market.

Per a Mordor Intelligence report, the global MOSFET market size is expected to grow at a CAGR of 3.2% during the forecast period of 2023-2028.

A Future Market Insights report predicts the power MOSFET market size to reach $40.1 billion by 2032, witnessing a CAGR of 9.3% between 2022 and 2032.

We believe that growing prospects in this promising market are likely to instill investors’ optimism in the stock.

Vishay has gained 16.7% on a year-to-date basis, outperforming the industry’s decline of 22.6%.

Expanding Portfolio

Vishay’s latest move is in sync with the company’s growing efforts to strengthen its overall product portfolio.

Apart from the latest launch, the company recently unveiled SIHP054N65E, a fourth-generation E series power MOSFET, enhancing energy efficiency, reducing on-resistance, and offering a 59% lower resistance times gate charge, particularly for telecom, industrial and computing applications.

Vishay also launched TSMP95000, TSMP96000, and TSMP98000, three infrared sensor modules for remote control systems, offering pin-to-pin compatible replacements, wider supply voltage range, smaller bandwidth for better noise strength, higher ESD withstand capability and robust performance under strong DC light.

Further, the company unveiled a series of IHPT solenoid-based haptic actuators bundled with patent licenses for Immersion’s IMMR haptic technology.

The partnership with Immersion not only simplifies the design-in process for the newly released devices but also eliminates the need for separate licenses for haptic effects implementation.

The abovementioned endeavors, along with several other product launches, will likely aid Vishay’s overall financial performance in the upcoming period.

However, geopolitical tensions, inflationary pressure and a weak demand environment remain major concerns for the company.

Notably, the model estimate for Vishay’s 2023 revenues is pegged at $3.42 billion, which indicates a decline of 2.3% from 2022.

Zacks Rank & Stocks to Consider

Currently, Vishay carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Asure Software ASUR and Badger Meter BMI. While Asure Software sports a Zacks Rank #1 (Strong Buy), Badger Meter carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Asure Software shares have gained 83.4% in the year-to-date period. The long-term earnings growth rate for ASUR is currently projected at 27%

Badger Meter shares have gained 68.9% in the year-to-date period. BMI’s long-term earnings growth rate is currently projected at 15.05%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH) : Free Stock Analysis Report

Immersion Corporation (IMMR) : Free Stock Analysis Report