Vishay (VSH) Expands Product Portfolio With New MOSFET

Vishay Intertechnology VSH launched Siliconix SiZF4800LDT, an 80 V symmetric dual n-channel power MOSFET, which enhances power density, efficiency and thermal performance, reduces component counts and simplifies designs.

The device, available in a 3.3 mm by 3.3 mm PowerPAIR package, saves 50% board space and offers a low on-resistance times total gate charge of 131mΩ*nC, enhancing power density and efficiency in high-frequency switching applications.

Further, the MOSFET features flip-chip technology, offering 54% lower thermal resistance and a 38% higher continuous drain current than its closest competing device.

Vishay is expected to gain solid traction across industrial and telecom applications on the back of its latest launch.

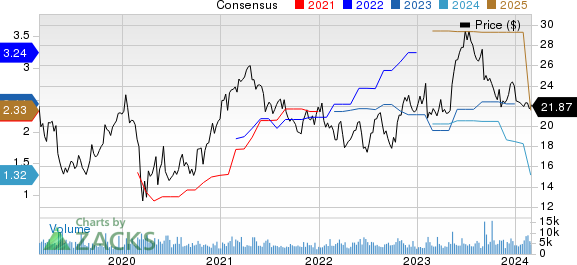

Vishay Intertechnology, Inc. Price and Consensus

Vishay Intertechnology, Inc. price-consensus-chart | Vishay Intertechnology, Inc. Quote

Expanding MOSFET Offerings

Apart from Siliconix SiZF4800LDT, Vishay launched Siliconix SiSD5300DN, a 30 V n-channel TrenchFET Gen V power MOSFET, offering enhanced thermal performance and increased power density for various power conversion applications.

Further, the company introduced synchronous buck regulator modules, SiC931, SiC951 and SiC967, with adjustable switching frequencies, current limit, soft start, PMBus 1.3 compliance, ultrafast transient response, tight ripple regulation and a 69% smaller size.

Additionally, Vishay’s launch of SiHP054N65E, a fourth-generation 650 V E Series power MOSFET, offering high efficiency and power density for telecom, industrial and computing applications, remains noteworthy.

All the above-mentioned endeavors will enable Vishay to capitalize on growth opportunities present in the global power MOSFET market. Per a Future Market Insights report, the global power MOSFET market is expected to reach $60.1 billion by 2033, exhibiting a CAGR of 9.3% between 2023 and 2033.

Strength in Overall Portfolio

The latest move bodes well with the company’s continuous efforts to strengthen its overall product portfolio.

Recently, Vishay upgraded its family of infrared receiver (IR) modules, namely TSOP18xx, TSOP58xx and TSSP5xx, with its latest in-house integrated circuit technology. These devices, which include a photodetector, preamplifier circuit and IR filter, enhance battery life in mobile devices and offer robustness for outdoor applications, ensuring long-term availability and cost savings.

The company also introduced five 10 MBd high-speed optocouplers, namely VOH260A, VOIH060A and VOWH260A and dual-channel VOH263A and VOIH063A, with a wide voltage supply range and open collector output, enabling low power consumption in industrial applications.

Strength in the company’s overall portfolio offerings will likely aid its top-line performance in the upcoming period.

However, macroeconomic uncertainties and a softening demand environment across industrial end markets remain major concerns for the company. Vishay’s shares have lost 9.6% in the year-to-date period, underperforming the Zacks Computer & Technology sector’s growth of 9.2%.

The Zacks Consensus Estimate for first-quarter 2024 revenues is pegged at $733.20 million, indicating a fall of 15.8% year over year.

Zacks Rank & Stocks to Consider

Vishay currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader technology sector are CrowdStrike CRWD, Badger Meter BMI and AMETEK AME. While CrowdStrike currently sports a Zacks Rank #1 (Strong Buy), Badger Meter and AMETEK carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of CrowdStrike have gained 25.7% in the year-to-date period. The long-term earnings growth rate for CRWD is 36.07%

Shares of Badger Meter have gained 2.2% in the year-to-date period. The long-term earnings growth rate for BMI is 12.27%.

Shares of AMETEK have gained 8.4% in the year-to-date period. The long-term earnings growth rate for AME is 9.19%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report