Vishay (VSH) Expands PTCEL Series, Boosts Resistors Offerings

Vishay Intertechnology VSH expanded its PTCEL series with the launch of new inrush current limiting positive temperature coefficient (PTC) thermistors.

These devices offer high voltage and energy handling capabilities, with R25 values ranging from 60 Ω to 1 kΩ, energy handling up to 240 J, and a heat capacity of 2.3 J/K.

Further, it offers overload protection in various applications, withstands more than 100,000 inrush-power cycles, and is highly resilient against non-switching peak power up to 25 kW.

The PTCEL series comes in two sizes — PTCEL13R and PTCEL17 — suitable for low and high-energy applications. They come in tape-on reel packaging with 5mm leadwire pitches and automatic pick and place capabilities.

Vishay is expected to gain solid traction across automotive and industrial applications on the back of its latest launch. Moreover, these devices will bolster the company’s Resistors offerings.

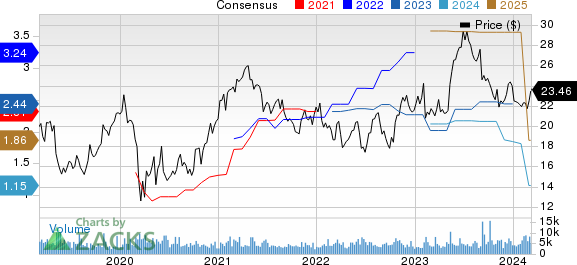

Vishay Intertechnology, Inc. Price and Consensus

Vishay Intertechnology, Inc. price-consensus-chart | Vishay Intertechnology, Inc. Quote

Expanding Resistors Offerings

Apart from these PTCEL devices, the company introduced MCB ISOA, a compact, thick film power resistor designed for mounting on a heatsink, offering a good pulse handling capability and a power dissipation capacity of up to 120W.

Additionally, the resistor comes with an optional NTC thermistor for temperature monitoring and pre-applied PC-TIM for easy installation, streamlining designs, freeing up board space and saving money.

Further, the company’s expansion of its thick-film resistor offerings with the launch of the Draloric RCS0805 e3 resistor remains noteworthy.

RCS0805 e3 comes with a resistance range of 1 Ω to 10 MΩ with tolerances of ± 0.5%, ± 1% and ± 5%. It provides an operating voltage of 150 V and an operating temperature range of -55 °C to +155 °C.

All the above-mentioned endeavors will likely help Vishay capitalize on the growth opportunities present in the resistor market. Per a Mordor Intelligence report, the resistor market is likely to hit $10.5 billion in 2024 and reach $12.28 billion by 2029, witnessing a CAGR of 3.2% between 2024 and 2029.

Strength in Overall Portfolio

The latest move bodes well with the company’s continuous efforts to strengthen its overall product portfolio.

Notably, Vishay launched Siliconix SiZF4800LDT, an 80 V symmetric dual n-channel power MOSFET that enhances power density, efficiency and thermal performance, reduces component counts and simplifies designs.

Further, the company recently upgraded its family of infrared receiver (IR) modules, namely TSOP18xx, TSOP58xx and TSSP5xx, with its latest in-house integrated circuit technology. These modules offer 50% lower current consumption, improved ESD robustness, a wider supply voltage range, 20% higher dark-ambient sensitivity and enhanced performance under strong DC light.

Strength in the company’s overall portfolio offerings will likely aid its top-line performance in the upcoming period.

However, macroeconomic uncertainties and a softening demand environment across industrial end markets remain major concerns for the company. Vishay’s shares have lost 2.1% in the year-to-date period, underperforming the Zacks Computer & Technology sector’s growth of 8.4%.

The Zacks Consensus Estimate for first-quarter 2024 revenues is pegged at $733.19 million, indicating a fall of 15.8% year over year.

Zacks Rank & Stocks to Consider

Vishay currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader technology sector are CrowdStrike CRWD, Badger Meter BMI and AMETEK AME, each carrying a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of CrowdStrike have gained 27.8% in the year-to-date period. The long-term earnings growth rate for CRWD is 36.07%

Shares of Badger Meter have gained 5.5% in the year-to-date period. The long-term earnings growth rate for BMI is 12.27%.

Shares of AMETEK have gained 10.1% in the year-to-date period. The long-term earnings growth rate for AME is 9.19%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report