Vista Outdoor Inc (VSTO) Navigates Market Pressures with Mixed Q3 FY24 Results

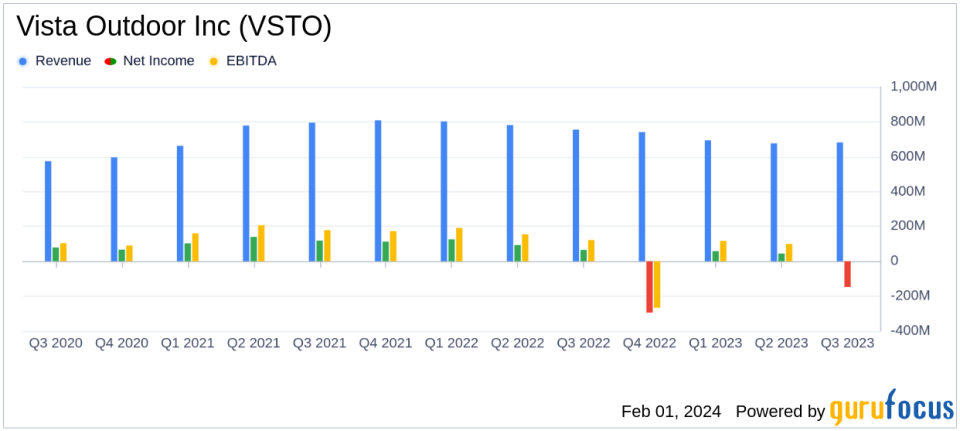

Net Sales: Reported a decrease to $682 million, down 10% year-over-year.

Net Income: A significant drop to $(148) million, including a non-cash impairment charge.

Adjusted EBITDA: Decreased 30% to $94 million with margins contracting to 13.7%.

Debt Reduction: Total debt decreased to $835 million with a net debt leverage ratio of 1.7x.

Cost Savings: Revelyst GEAR Up Transformation Program expected to drive $100 million in savings by FY27.

Future Outlook: FY24 sales guidance maintained at $2.725 billion to $2.825 billion.

Stock Performance: Capital allocation focused on debt paydown until stockholder vote.

On January 31, 2024, Vista Outdoor Inc (NYSE:VSTO) released its 8-K filing, detailing its financial results for the third quarter of Fiscal Year 2024 (FY24). The company, known for its outdoor sports and recreation products, faced a challenging quarter with net sales decreasing by 10% to $682 million compared to the same period last year. This decline was attributed to lower shipments across nearly all categories as channel inventory normalized, coupled with lower pricing at The Kinetic Group and increased discounting at Revelyst due to short-term consumer pressures.

Vista Outdoor Inc operates through two segments: Shooting Sports and Outdoor Products. The Shooting Sports segment, which includes brands like Federal Premium and Blackhawk, contributes the largest proportion of company revenue. The Outdoor Products segment offers brands such as CamelBak and Bushnell. The company primarily serves the domestic market.

The quarter was particularly tough for Vista Outdoor, with net income plummeting to $(148) million, which included a substantial non-cash impairment of goodwill and intangible assets totaling $219 million. Adjusted EBITDA also fell by 30% to $94 million, with margins contracting to 13.7%. Despite these setbacks, the company made strides in improving its balance sheet, with a notable reduction in inventory levels and a sequential decrease in total debt to $835 million, resulting in a net debt leverage ratio of 1.7x.

The Revelyst GEAR Up Transformation Program is a key initiative underway, expected to drive $100 million of run-rate cost savings by FY27 and provide a clear path to double standalone Adjusted EBITDA in FY25. This program aims to simplify the business model, increase efficiency, and drive organic growth through innovation.

Despite the challenges faced in Q3, Vista Outdoor reaffirmed its FY24 guidance, anticipating sales to be in the range of $2.725 billion to $2.825 billion, with adjusted EBITDA margins between 15.50% and 16.25%. The company's outlook remains cautiously optimistic as it expects to return to growth in the fiscal fourth quarter and see positive impacts from the GEAR Up program.

"Sales in the third quarter of Fiscal Year 2024 were in line with our expectations, EBITDA was better than we had expected and our balance sheet improved in the period as inventory decreased more than 15% year-over-year," said Andy Keegan, CFO of Vista Outdoor. "Looking ahead, we are reaffirming Fiscal Year 2024 guidance. On The Kinetic Group side, we are pleased to report the transaction process is progressing well and on track. And on the Revelyst side, we remain enthusiastic as we expect to return to growth in our fiscal fourth quarter and see positive impacts from the GEAR Up transformation program that is well underway."

As Vista Outdoor navigates a complex market environment, the company's focus on operational efficiency, cost savings, and strategic initiatives like the sale of The Kinetic Group for $1.91 billion, which is on track, are pivotal steps to create meaningful value and sustain growth in the long term.

For a more detailed analysis of Vista Outdoor's financial performance and future outlook, investors and interested parties can access the full earnings report and join the upcoming investor conference call.

Explore the complete 8-K earnings release (here) from Vista Outdoor Inc for further details.

This article first appeared on GuruFocus.