Vistra Energy (VST) Q3 Earnings Miss Mark, Revenues Fall Y/Y

Vistra Energy Corp. VST reported adjusted earnings of 3 cents per share for the third quarter of 2021, missing the Zacks Consensus Estimate of $1.52 by 98%. Also, the bottom line fell 97.1% from the year-ago quarter’s earnings.

Revenues

In the third quarter of 2021, operating revenues of $2,991 million fell 15.8% from $3,552 million in the prior-year quarter.

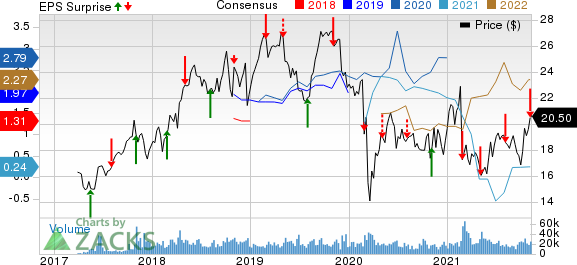

Vistra Corp. Price, Consensus and EPS Surprise

Vistra Corp. price-consensus-eps-surprise-chart | Vistra Corp. Quote

Highlights of the Release

Operating costs for the quarter amounted to $372 million, down 18.6% from 2020’s third-quarter figure of $457 million.

Operating income came in at $119 million, down 82.4% from the prior-year quarter’s number of $676 million.

In the third quarter of 2021, the company’s residential customer count slipped 0.7% from the prior-year quarter's level. Retail electric volumes in the third quarter inched up 0.4% year over year.

Financial Position

As of Sep 30, 2021, Vistra Energy had cash and cash equivalents of $351 million compared with $406 million as of Dec 31, 2020.

As of Sep 30, 2021, the company had a long-term debt (less amounts due currently) of $10,493 million, up from $9,235 million on Dec 31, 2020.

The company’s cash used in operating activities in the first three quarters was $493 million compared with the cash provided by operating activities of $2,350 million in the comparable period of 2020.

Capital expenditures including nuclear fuel purchases and long-term service agreement prepayments in the first nine months of 2021 were $790 million compared with $838 million in the comparable period of 2020.

The utility announced plans to retire $1.5 billion worth of debt by the end of 2022 and up to $3 billion by the end of 2026. It also announced plans to return a minimum $7.5 billion to its shareholders through 2026 end via share repurchases and dividends. In October 2021, it announced a $2-billion share repurchase program, which is expected to be executed by 2022 end. Management also informs about adding at least $1 billion per year to the authorization, thus totaling $4 billion worth of share repurchases between 2023 and 2026.

Guidance

The company raised its 2021 adjusted EBITDA view to the range of $1,890-$2,090 million from the prior guided range of $1,475-$1,875 million. Also, it expected the same for 2022 in the range of $2,810-$3,310 million. It anticipates total current-year and next-year capital expenditures to be $1,095 million and $812 million each.

Zacks Rank

Vistra Energy has a Zacks Rank #3 (Hold), currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

NextEra Energy, Inc. NEE reported third-quarter 2021 adjusted earnings of 75 cents per share, which beat the Zacks Consensus Estimate of 72 cents by 4.2%.

Avangrid, Inc. AGR reported third-quarter 2021 earnings of 34 cents per share, beating the Zacks Consensus Estimate of 30 cents by 13.3%.

DTE Energy Company DTE reported a third-quarter 2021 operating EPS of $1.72, which missed the Zacks Consensus Estimate of $1.83 by 6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

Avangrid, Inc. (AGR) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research