Vita Coco Co Inc (COCO) Posts Strong Full Year 2023 Results with Net Sales Up 15%

Net Sales: Full year increase of 15% to $494 million, driven by Vita Coco Coconut Water.

Net Income: Significant rise to $47 million for the full year, compared to $8 million in the prior year.

Gross Profit: Improved to $181 million, or 37% of net sales, up from 24.2% in the previous year.

Adjusted EBITDA: Full year non-GAAP Adjusted EBITDA reached $68 million, a substantial increase from $20 million.

Share Repurchase: The company repurchased 421,544 shares for $10 million at an average price of $23.72.

2024 Outlook: Net sales projected between $495-$505 million, with Adjusted EBITDA anticipated between $74-$78 million.

On February 28, 2024, The Vita Coco Co Inc (NASDAQ:COCO), a leader in the plant-based functional hydration sector, released its 8-K filing, detailing a robust performance for the fourth quarter and full year ended December 31, 2023. The company, known for its popular Vita Coco Coconut Water and other health-focused beverage offerings, operates across the United States, Canada, Europe, Middle East, Africa, and the Asia Pacific regions.

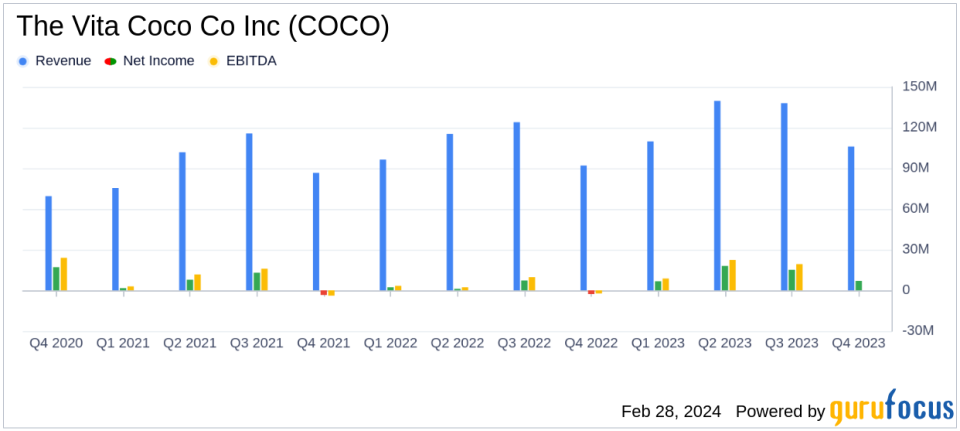

The full year 2023 results showed a 15% increase in net sales, reaching $494 million, primarily fueled by a 14% growth in Vita Coco Coconut Water sales. The company's net income saw a remarkable rise to $47 million, a significant improvement from the $8 million reported in the previous year. This performance underscores the brand's successful expansion and consumer appeal in the non-alcoholic beverage industry.

Gross profit for the year stood at $181 million, or 37% of net sales, compared to $103 million, or 24.2% of net sales in the prior year. This improvement was largely attributed to lower transportation costs, volume growth, and increased pricing for Vita Coco Coconut Water. The company's non-GAAP Adjusted EBITDA also reflected this positive trend, with a full year figure of $68 million, up from $20 million in the previous year.

Financial Highlights and Management Commentary

For the fourth quarter of 2023, The Vita Coco Co Inc reported net sales growth of 15% to $106 million, with gross profit increasing to $40 million, or 37% of net sales. This was a notable rise from the 24% of net sales in the same period last year. The company's net income for the quarter was $7 million, or $0.11 per diluted share, compared to a net loss of $(3) million, or $(0.05) per diluted share in the fourth quarter of the previous year.

Michael Kirban, Co-Founder and Executive Chairman of The Vita Coco Co Inc, expressed pride in the team's record performance, highlighting the focus on expanding consumption occasions for coconut water. CEO Martin Roper echoed this sentiment, pleased with the strong results and the health of the coconut water category.

Our focus and investment to expand consumption occasions of coconut water contributed to strong volume performance for the category and for our flagship Vita Coco Coconut Water brand," said Kirban. Roper added, "The coconut water category is healthy and our team continues to deliver strong results across our major markets as we gain branded share and benefit from our private label coconut water supply relationships."

The company's balance sheet as of December 31, 2023, showed a strong cash position with $133 million in cash and cash equivalents, and no debt. The share repurchase program, authorized by the Board of Directors, saw the company repurchase 421,544 shares for an aggregate value of $10 million at an average share price of $23.72.

Looking ahead to fiscal year 2024, The Vita Coco Co Inc expects net sales to be between $495 and $505 million, with Adjusted EBITDA projected between $74 and $78 million. This outlook is set against a backdrop of anticipated healthy coconut water volume growth, offset by the loss of some private label coconut oil business.

The company's performance reflects its ability to navigate a dynamic macro environment and maintain a focus on long-term growth. With a solid financial foundation and a positive outlook for the coming year, The Vita Coco Co Inc is well-positioned to continue its trajectory in the functional beverage space.

For detailed financial tables and further information, readers are encouraged to view the full 8-K filing.

Explore the complete 8-K earnings release (here) from The Vita Coco Co Inc for further details.

This article first appeared on GuruFocus.