Vital Farms Inc (VITL) Reports Strong Growth in Q4 and Fiscal Year 2023

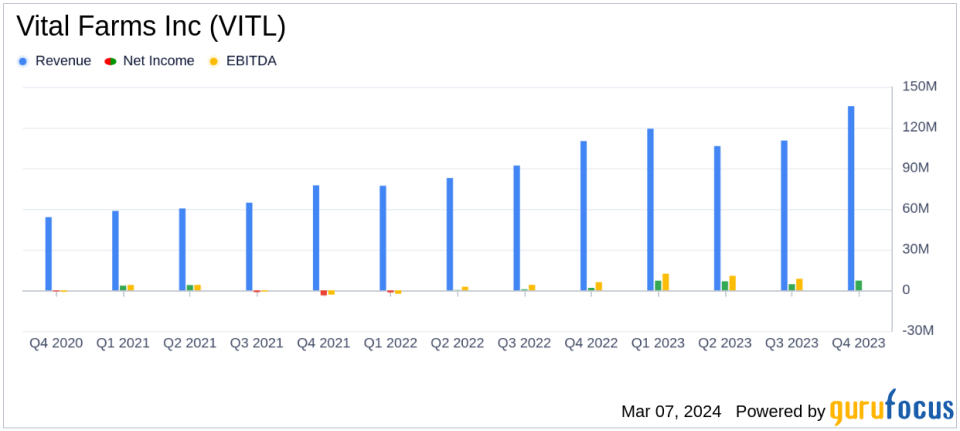

Net Revenue: Increased by 23.4% to $135.8 million in Q4 and by 30.3% to $471.9 million for the fiscal year.

Net Income: Grew to $7.2 million in Q4 and $25.6 million for the fiscal year, marking significant improvements from the previous year.

Earnings Per Share: Net income per diluted share rose to $0.17 in Q4 and $0.59 for the fiscal year.

Adjusted EBITDA: Increased to $13.9 million in Q4 and $48.3 million for the fiscal year, reflecting strong profitability.

Cash Position: Ended the year with $116.8 million in cash, cash equivalents, and marketable securities, with no outstanding debt.

Outlook for Fiscal Year 2024: Management expects net revenue of at least $552 million and Adjusted EBITDA of at least $57 million.

Vital Farms Inc (NASDAQ:VITL), an ethical food company known for its pasture-raised eggs and butter, released its 8-K filing on March 7, 2024, showcasing a robust financial performance for both the fourth quarter and the fiscal year ended December 31, 2023. The company's commitment to Conscious Capitalism has continued to resonate with consumers, leading to significant growth in revenue and profitability.

Fiscal Summary and Company Overview

Vital Farms' record fourth-quarter net revenue of $135.8 million represents a 23.4% increase over the prior year period. Excluding an extra week in the quarter, the revenue still impressively rose by 15.7%. The full-year net revenue saw a 30.3% jump to $471.9 million, with a 28.0% increase when adjusted for the additional week. Net income for the quarter surged to $7.2 million from $1.9 million, and for the year, it increased to $25.6 million from $1.2 million. Earnings per diluted share for the quarter were $0.17, up from $0.04, and for the year, they climbed to $0.59 from $0.03.

Performance and Challenges

The company's performance was driven by higher prices and volume gains, with the latter attributed to both new and existing retail customers. Gross profit margins improved due to volume gains and pricing increases across the shell egg portfolio, which helped offset rising input costs. However, increased marketing spend and higher employee-related expenses due to growth in headcount partially offset the improved gross profit performance.

Financial Achievements and Importance

Vital Farms' financial achievements, particularly the growth in net revenue and net income, are critical for a company in the Consumer Packaged Goods industry, where competition is fierce and margins can be thin. The company's ability to increase its gross margin in a challenging environment underscores its operational efficiency and pricing power. Moreover, the strong cash position and lack of debt highlight the company's financial health and its potential for sustainable growth.

Key Financial Metrics

Adjusted EBITDA, a key profitability metric, stood at $13.9 million for the quarter and $48.3 million for the year, marking significant year-over-year improvements. The company's balance sheet remains robust, with $116.8 million in cash, cash equivalents, and marketable securities, and no debt. Operating cash flow saw a nearly $60 million expansion in 2023. Capital expenditures were $11.5 million for the year, indicating ongoing investments in the company's growth.

"2023 was another outstanding year for Vital Farms. Were well positioned for a big year ahead and on track to be a $1 billion business by 2027," said Russell Diez-Canseco, Vital Farms President and CEO.

Analysis and Outlook

Vital Farms' performance in 2023 sets a positive tone for the upcoming fiscal year. Management's outlook for 2024 is optimistic, with expected net revenue of at least $552 million and Adjusted EBITDA of at least $57 million. These targets reflect the company's confidence in its brand strength and market share gains. The planned capital expenditures of $35 million to $45 million for 2024 indicate continued investment in the company's infrastructure to support long-term growth.

For detailed financial tables and a full reconciliation of non-GAAP financial measures, please refer to the original 8-K filing.

Vital Farms' commitment to ethical food production and its strong financial results make it a company to watch for value investors and those interested in sustainable and responsible businesses. With a clear growth trajectory and solid financial planning, Vital Farms Inc (NASDAQ:VITL) is poised for continued success in the Consumer Packaged Goods industry.

Explore the complete 8-K earnings release (here) from Vital Farms Inc for further details.

This article first appeared on GuruFocus.