Vital Farms's (NASDAQ:VITL) Q4: Strong Sales, Stock Soars

Egg and butter company Vital Farms (NASDAQ:NATR) beat analysts' expectations in Q4 FY2023, with revenue up 23.4% year on year to $135.8 million. The company expects the full year's revenue to be around $552 million, in line with analysts' estimates. It made a GAAP profit of $0.17 per share, improving from its profit of $0.05 per share in the same quarter last year.

Is now the time to buy Vital Farms? Find out by accessing our full research report, it's free.

Vital Farms (VITL) Q4 FY2023 Highlights:

Revenue: $135.8 million vs analyst estimates of $131 million (3.7% beat)

EPS: $0.17 vs analyst estimates of $0.07 ($0.10 beat)

Management's revenue guidance for the upcoming financial year 2024 is $552 million at the midpoint, in line with analyst expectations and implying 17% growth (vs 31.6% in FY2023)

Free Cash Flow of $21.33 million, up from $3.28 million in the previous quarter

Gross Margin (GAAP): 33.3%, up from 30.3% in the same quarter last year

Sales Volumes were up 11.6% year on year

Market Capitalization: $790.4 million

“2023 was another outstanding year for Vital Farms. This company continues to deliver on its ambitious growth targets, and we’ve again proven our resilience by executing for our stakeholders in a dynamic and challenging environment. We ended 2023 with our strongest ever quarter for net revenue, expanded distribution through new and existing retailers and built more trusted relationships with our consumers. We’re well positioned for a big year ahead and on track to be a $1 billion business by 2027,” said Russell Diez-Canseco, Vital Farms’s President and CEO.

With an emphasis on ethically produced products, Vital Farms (NASDAQ:NATR) specializes in pasture-raised eggs and butter.

Packaged Food

Packaged food stocks are considered resilient investments because people always need to eat. These companies therefore can enjoy consistent demand as long as they stay on top of changing consumer preferences. But consumer preferences can be a double-edged sword, as companies that aren't at the front of trends such as health and wellness and natural ingredients can fall behind. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

Vital Farms is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

As you can see below, the company's annualized revenue growth rate of 30.1% over the last three years was incredible for a consumer staples business.

This quarter, Vital Farms reported remarkable year-on-year revenue growth of 23.4%, and its $135.8 million in revenue topped Wall Street estimates by 3.7%. Looking ahead, Wall Street expects sales to grow 16% over the next 12 months, a deceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

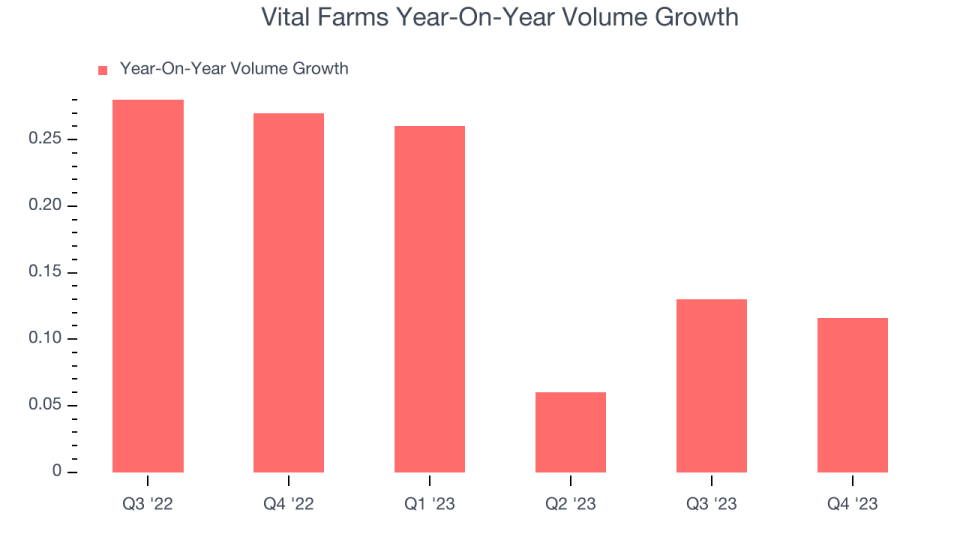

Vital Farms's average quarterly volume growth of 18.6% over the last two years has beaten the competition by a long shot. This is great because companies with significant volume growth are needles in a haystack in the stable consumer staples sector.

In Vital Farms's Q4 2023, sales volumes jumped 11.6% year on year. By the company's standards, this result was a meaningful deceleration from the 27% year-on-year increase it posted 12 months ago. We'll be watching Vital Farms closely to see if it can reaccelerate demand for its products.

Key Takeaways from Vital Farms's Q4 Results

We were impressed by how significantly Vital Farms blew past analysts' operating margin and EPS expectations this quarter. We were also glad its revenue beat, driven by volume growth of 11.6% - this type of unit growth is rare in the consumer staples industry.

Topping off the strong quarter was encouraging guidance, as management's revenue and EBITDA outlooks of $552 million and $57 million cleared Wall Street's projections. The company's long-term goal is to hit $1 billion in net revenue by 2027 with a 35% gross margin and 12-14% adjusted EBITDA margin.

Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 9.8% after reporting and currently trades at $20.86 per share.

Vital Farms may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.