Volatility 101: Should Race Oncology (ASX:RAC) Shares Have Dropped 38%?

It is a pleasure to report that the Race Oncology Limited (ASX:RAC) is up 47% in the last quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 38% in the last three years, falling well short of the market return.

View our latest analysis for Race Oncology

Race Oncology recorded just AU$228,501 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that Race Oncology comes up with a great new product, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.

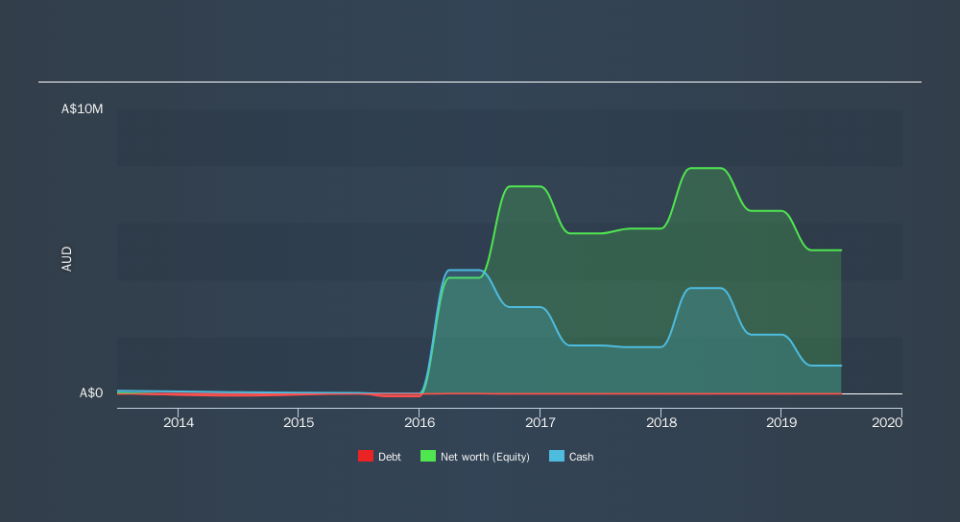

When it reported in June 2019 Race Oncology had minimal cash in excess of all liabilities consider its expenditure: just AU$797k to be specific. So if it has not already moved to replenish reserves, we think the near-term chances of a capital raising event are pretty high. That probably explains why the share price is down 15% per year, over 3 years . You can see in the image below, how Race Oncology's cash levels have changed over time (click to see the values). You can see in the image below, how Race Oncology's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Would it bother you if insiders were selling the stock? It would bother me, that's for sure. You can click here to see if there are insiders selling.

A Different Perspective

Race Oncology shareholders are up 12% for the year. While you don't go broke making a profit, this return was actually lower than the average market return of about 24%. The silver lining is that the recent rise is far preferable to the annual loss of 15% that shareholders have suffered over the last three years. We hope the turnaround in fortunes continues. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Race Oncology by clicking this link.

Race Oncology is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.