Vontier Corp (VNT) Navigates Market Challenges with Strategic Focus on Connected Mobility

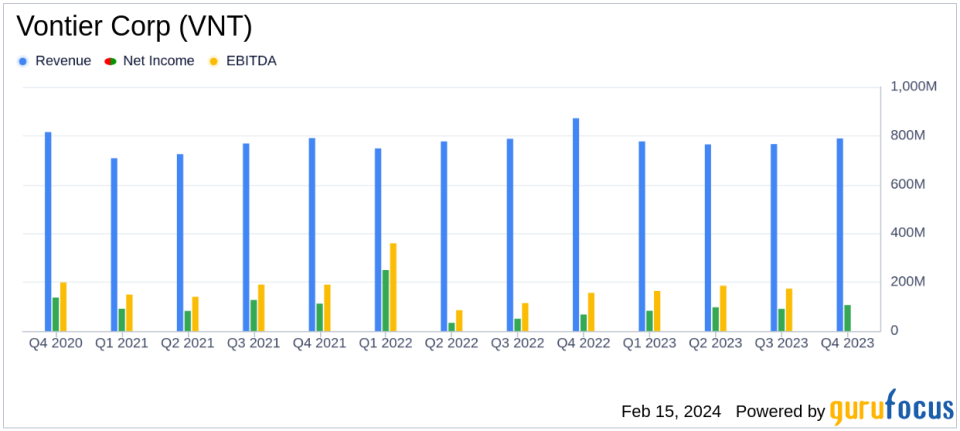

Revenue: Q4 sales of $789 million, a 10% decrease year-over-year; Full year sales of $3.1 billion, down 3%.

Net Income: Q4 GAAP net earnings of $106.2 million; Full year net earnings of $376.9 million.

Earnings Per Share (EPS): Q4 GAAP diluted net EPS of $0.68; Adjusted diluted net EPS of $0.80.

Free Cash Flow: Q4 adjusted free cash flow of $153 million, representing 122% adjusted free cash flow conversion.

Profit Margins: Q4 operating profit margin increased to 18.6%; Adjusted operating profit margin increased to 22.0%.

Debt and Share Repurchases: Completed $300 million in debt paydown and $75 million in share repurchases in 2023.

2024 Guidance: Initiates full year 2024 guidance for adjusted diluted net EPS of $3.00 to $3.15.

On February 15, 2024, Vontier Corp (NYSE:VNT) released its 8-K filing, reporting its financial results for the fourth quarter and full year of 2023. Despite a decrease in sales, the company maintained strong profit margins and robust cash flow, underscoring the effectiveness of its strategic initiatives and disciplined capital allocation.

Company Overview

Vontier, an industrial technology company spun off from Fortive in 2020, specializes in transportation and mobility solutions. Its product portfolio includes fueling equipment, sensors, point-of-sale and payment systems, telematics, and vehicle maintenance tools. With approximately $3.2 billion in 2022 sales and $578 million in operating profit, Vontier is a significant player in the hardware industry.

Financial Performance and Challenges

The company's Q4 sales saw a 10% decline to $789 million, with core sales down 7%. This was primarily due to the expected sunset of EMV-related sales. However, Vontier's operating profit margin improved, reflecting the company's ability to manage costs and maintain profitability amidst sales headwinds. The adjusted free cash flow conversion rate of 122% is particularly noteworthy, indicating strong cash generation relative to net income.

Despite these challenges, Vontier's strategic focus on its Connected Mobility strategy and the Vontier Business System has allowed it to navigate market conditions effectively. The company's disciplined approach to capital allocation is evident in its debt paydown and share repurchase activities.

Segment Performance

The Mobility Technologies segment reported a 4% increase in sales, driven by demand for alternative energy solutions and car wash technologies. Repair Solutions grew by 5%, with robust demand for tool storage and diagnostic tools. However, the Environmental & Fueling Solutions segment saw a 20% decline in sales, largely due to the anticipated decrease in EMV-related sales.

Outlook and Commentary

President and CEO Mark Morelli commented on the results, stating:

"Vontier delivered another quarter of solid underlying performance to end the year. We enter 2024 with strong momentum and uniquely positioned, with the depth and breadth of our portfolio, to serve the mobility ecosystem."

The company has initiated its full-year 2024 guidance with an adjusted diluted net EPS forecast of $3.00 to $3.15, reflecting confidence in its strategic direction and market position.

Financial Tables and Analysis

The financial statements reveal a disciplined approach to cost management and a strategic focus on profitability. The increase in operating profit margin, despite a decrease in sales, is a testament to Vontier's operational efficiency. The company's balance sheet shows a healthy cash position and a reduction in total debt, further indicating sound financial management.

Vontier's performance in 2023, characterized by solid profit margins and strong cash flow, positions the company well for 2024. The focus on Connected Mobility and operational excellence is expected to drive above-market growth and enhance shareholder returns in the coming year.

For a detailed analysis of Vontier Corp's financial results and strategic outlook, investors and interested parties are encouraged to visit GuruFocus.com for comprehensive reports and investment tools.

Explore the complete 8-K earnings release (here) from Vontier Corp for further details.

This article first appeared on GuruFocus.