Is Vornado Realty Trust (VNO) Too Good to Be True? A Comprehensive Analysis of a Potential ...

Value-focused investors are always seeking stocks that are priced below their intrinsic value. One such stock that warrants attention is Vornado Realty Trust (NYSE:VNO). Despite its seemingly attractive valuation, it is essential to consider the associated risk factors. This article aims to provide an in-depth analysis of Vornado Realty Trust (NYSE:VNO) and explore whether it is a hidden gem or a value trap.

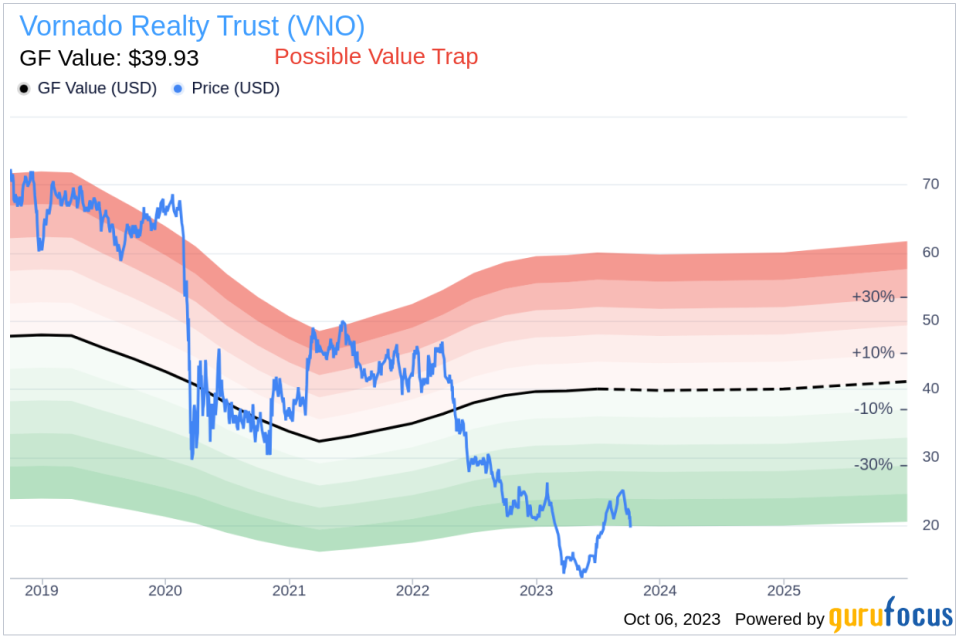

Understanding GF Value

The GF Value represents the current intrinsic value of a stock, derived from an exclusive method. It is calculated based on historical multiples, GuruFocus adjustment factor, and future estimates of business performance. The stock price is likely to fluctuate around the GF Value Line. If the price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Financial Health: The Altman Z-Score

Before delving into the details, it's crucial to understand what the Altman Z-score entails. The Z-Score is a financial model that predicts the probability of a company entering bankruptcy within a two-year timeframe. A score below 1.8 suggests a high likelihood of financial distress, while a score above 3 indicates a low risk.

Company Snapshot

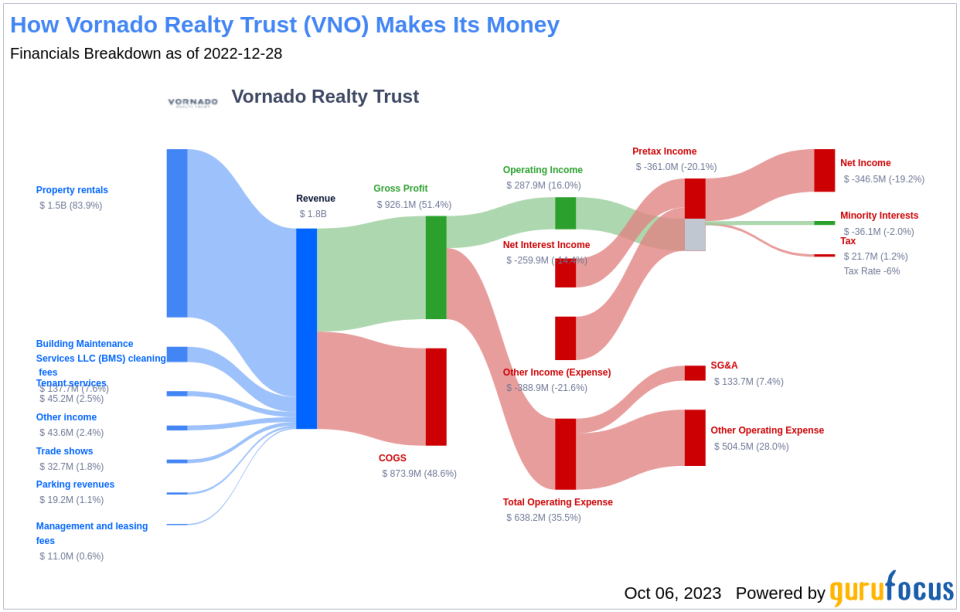

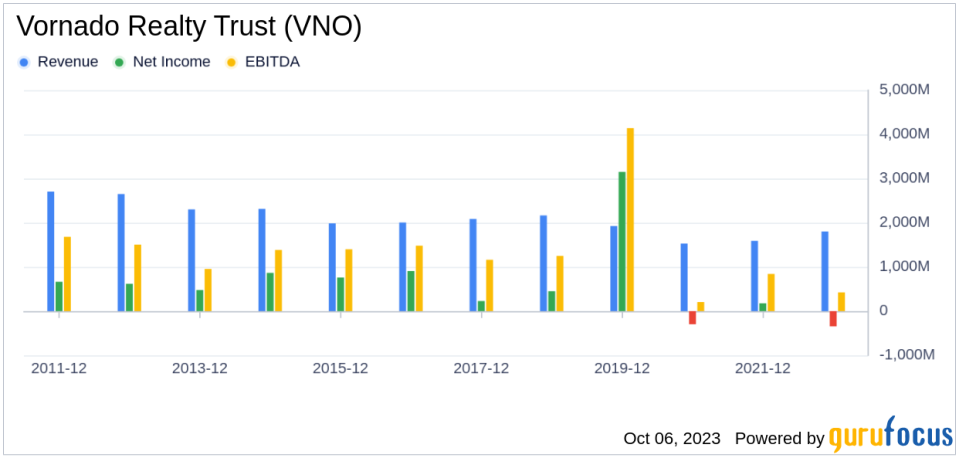

Vornado Realty Trust is a real estate investment trust with a market cap of $3.80 billion. It owns and has an ownership interest in Class A office and retail properties highly concentrated in Manhattan, with additional properties in San Francisco and Chicago. However, the company's revenues and earnings have been on a downward trend over the past five years, raising a crucial question: Is Vornado Realty Trust a hidden gem or a value trap?

Vornado Realty Trust's Financial Health

A dissection of Vornado Realty Trust's Altman Z-score reveals potential financial distress. For instance, the Retained Earnings to Total Assets ratio, which provides insights into a company's capability to reinvest its profits or manage debt, has been on a declining trend. This downward movement indicates Vornado Realty Trust's diminishing ability to reinvest in its business or effectively manage its debt, exerting a negative impact on its Z-Score.

Declining Revenues and Earnings

One of the telltale indicators of a company's potential trouble is a sustained decline in revenues. In the case of Vornado Realty Trust, both the revenue per share and the 5-year revenue growth rate have been on a consistent downward trajectory. This pattern may point to underlying challenges such as diminishing demand for Vornado Realty Trust's products, or escalating competition in its market sector. Either scenario can pose serious risks to the company's future performance, warranting a thorough analysis by investors.

The Red Flag: Sluggish Earnings Growth

Despite its low price-to-fair-value ratio, Vornado Realty Trust's falling revenues and earnings cast a long shadow over its investment attractiveness. A low price relative to intrinsic value can indeed suggest an investment opportunity, but only if the company's fundamentals are sound or improving. In Vornado Realty Trust's case, the declining revenues, EBITDA, and earnings growth suggest that the company's issues may be more than just cyclical fluctuations.

Conclusion

Despite its seemingly attractive valuation, Vornado Realty Trust might be a potential value trap. This complexity underlines the importance of thorough due diligence in investment decision-making. GuruFocus Premium members can find stocks with high Altman Z-Score using the following Screener: Walter Schloss Screen . Investors can find stocks with good revenue and earnings growth using GuruFocus' Peter Lynch Growth with Low Valuation Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.