VSE Corp (VSEC) Announces Strategic Moves and Preliminary 2023 Earnings

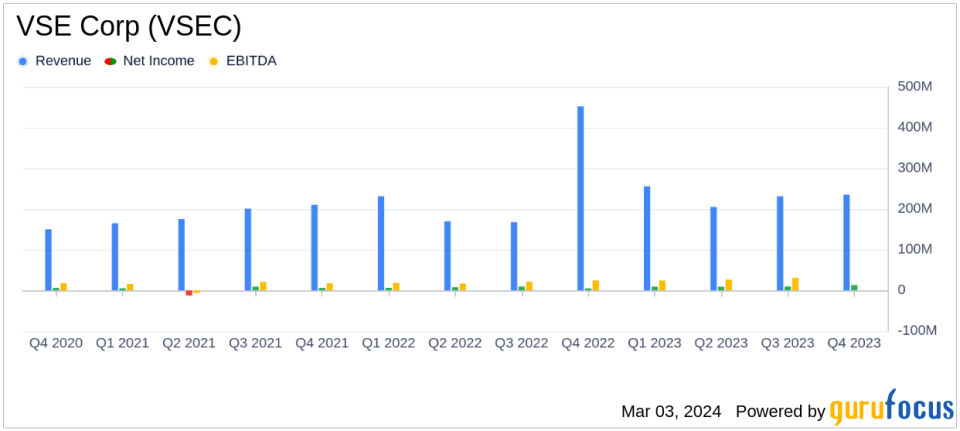

Revenue: Approximately $860 million for FY 2023.

GAAP Net Income: Approximately $43 million for FY 2023.

Adjusted EBITDA: Approximately $114 million for FY 2023.

Free Cash Flow: Approximately $(40) million for FY 2023.

Strategic Actions: Acquisition of Turbine Controls Inc. and divestiture of Federal & Defense segment assets.

2024 Guidance: Aviation segment revenue growth of 24% to 28% and Adjusted EBITDA margin of 15% to 16%.

On March 1, 2024, VSE Corp (NASDAQ:VSEC) released its 8-K filing, unveiling a series of strategic actions aimed at expanding its Aviation aftermarket presence and enhancing overall growth and profitability. The company, a leading provider of aftermarket distribution and repair services, announced the acquisition of Turbine Controls Inc. (TCI), the divestiture of its Federal & Defense segment assets, and the initiation of a strategic review process for its Fleet segment.

Company Overview

VSE Corp operates primarily through two segments: Aviation and Fleet. The Aviation segment offers aftermarket parts distribution and maintenance, repair, and overhaul services for components and engine accessories to various aviation operators. The Fleet segment focuses on part distribution, engineering solutions, and supply chain management services for the medium and heavy-duty fleet market. VSE Corp's strategic actions underscore its commitment to simplifying its business model and strengthening its position in the lucrative Aviation aftermarket.

Strategic Developments and Financial Highlights

President and CEO John Cuomo highlighted the significance of the acquisition of TCI, a market leader in the Aviation MRO business, for approximately $120 million. This move is expected to broaden VSE's OEM Authorized MRO capabilities and expand its market reach. The divestiture of the Federal & Defense segment assets for $44 million is part of VSE's strategy to streamline operations and focus on core growth areas.

The preliminary financial results for the fourth quarter and full year of 2023 show revenues of approximately $235 million and $860 million, respectively. GAAP Net Income is estimated at around $13 million for the fourth quarter and $43 million for the full year. Adjusted EBITDA is projected to be approximately $31 million for the fourth quarter and $114 million for the full year, with Adjusted EPS at roughly $0.85 and $3.31, respectively. However, the company reported a negative free cash flow of approximately $(40) million for the full year.

For the full year 2024, VSE Corp anticipates its Aviation segment to experience a revenue growth of 24% to 28%, with an Adjusted EBITDA margin between 15% and 16%. The Fleet segment is expected to see a revenue growth of 13% to 17% and an Adjusted EBITDA growth of 8% to 12%.

Financial Metrics and Importance

Key financial metrics such as revenue growth and Adjusted EBITDA margins are critical for VSE Corp, particularly within the Aerospace & Defense industry where aftermarket services play a significant role in ensuring the longevity and efficiency of transportation assets. The company's strategic focus on these areas suggests a targeted approach to capitalizing on high-margin opportunities and a commitment to delivering value to stakeholders.

Analysis and Future Outlook

The strategic divestiture and acquisition moves by VSE Corp, coupled with its preliminary financial results, indicate a transformative phase aimed at optimizing its portfolio for sustainable growth. The company's focus on the Aviation segment, which is expected to drive significant revenue growth, positions it well within the competitive aftermarket services industry. However, the negative free cash flow presents a challenge that the company will need to address to ensure financial stability and investor confidence.

Investors and stakeholders can expect further details during VSE Corp's upcoming earnings call on March 7, 2024, where the company will provide additional updates and insights into its strategic initiatives and financial performance.

For more detailed financial analysis and news on VSE Corp (NASDAQ:VSEC) and other value investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from VSE Corp for further details.

This article first appeared on GuruFocus.