Is vTv Therapeutics Inc (VTVT) Modestly Undervalued?

Despite a daily loss of 19.8% and a 3-month loss of 32.94%, vTv Therapeutics Inc (NASDAQ:VTVT) has a Loss Per Share of 0.24. The question that arises is whether the stock is modestly undervalued. This article provides an in-depth valuation analysis of vTv Therapeutics. We encourage readers to follow through for a better understanding of the company's intrinsic value and financial performance.

Company Overview

vTv Therapeutics Inc is a clinical-stage biopharmaceutical company focused on developing orally administered treatments for diabetes. The company's lead program is TTP399, a potential adjunctive therapy to insulin for the treatment of type 1 diabetes. As of August 24, 2023, the stock price is $0.51, with a market cap of $41.60 million. The estimated fair value (GF Value) is $0.7, suggesting that the stock may be modestly undervalued.

Understanding the GF Value

The GF Value is a proprietary measure that assesses a stock's intrinsic value. It's calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides an overview of the stock's fair trading value. If the stock price is significantly above the GF Value Line, it's considered overvalued, and the future return is likely to be poor. Conversely, if it's significantly below the GF Value Line, the future return is expected to be higher.

According to the GF Value calculation, vTv Therapeutics Inc (NASDAQ:VTVT) appears to be modestly undervalued. Given its relative undervaluation, the long-term return of its stock is likely to be higher than its business growth.

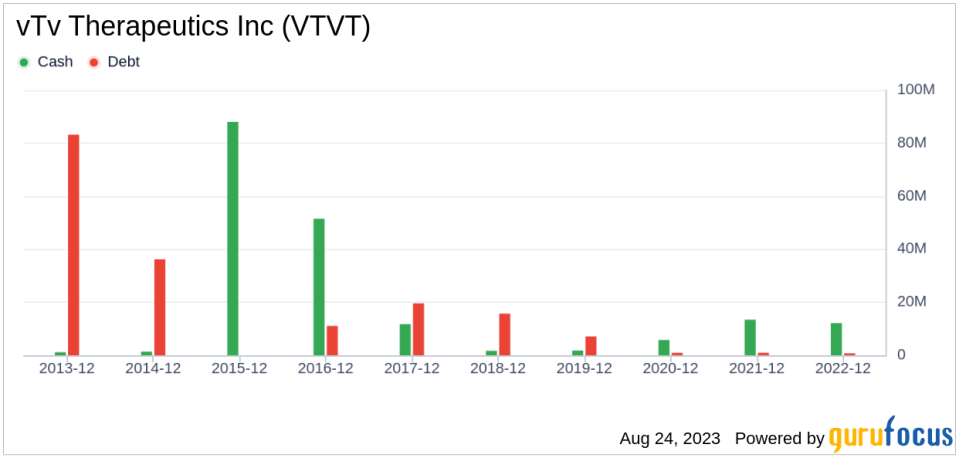

Financial Strength

Assessing the financial strength of a company is crucial before investing in its stock. Companies with poor financial strength pose a higher risk of permanent loss. The cash-to-debt ratio and interest coverage provide insights into a company's financial strength. vTv Therapeutics has a cash-to-debt ratio of 30.21, ranking better than 64.64% of 1499 companies in the Biotechnology industry. However, its overall financial strength is 3 out of 10, indicating that it's weak.

Profitability and Growth

Investing in profitable companies carries less risk, especially those with consistent profitability over the long term. vTv Therapeutics has been profitable 0 years over the past 10 years. Its operating margin of -305100% is worse than 99.42% of 1029 companies in the Biotechnology industry. GuruFocus ranks vTv Therapeutics's profitability as poor.

Growth is a critical factor in a company's valuation. The faster a company is growing, the more likely it is to be creating value for shareholders, especially if the growth is profitable. vTv Therapeutics's 3-year average annual revenue growth rate is -33.3%, ranking worse than 85.88% of 765 companies in the Biotechnology industry. However, its 3-year average EBITDA growth rate is 20.5%, ranking better than 68.51% of 1264 companies in the Biotechnology industry.

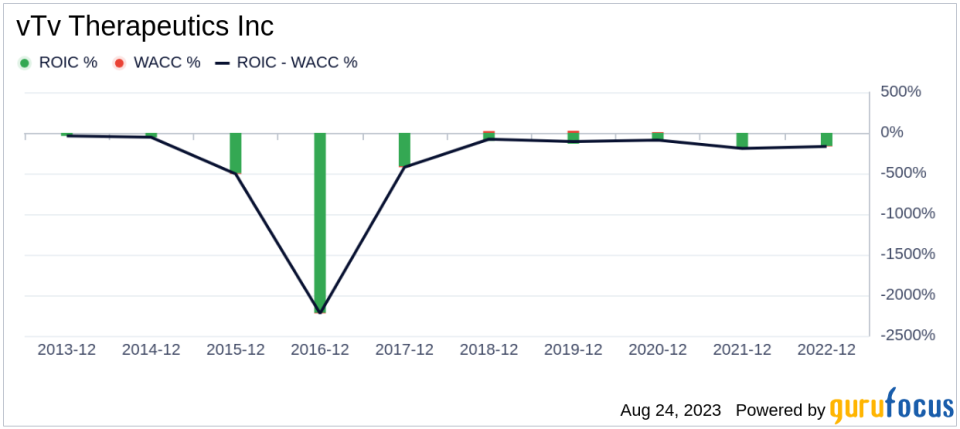

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) can help evaluate its profitability. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. Over the past 12 months, vTv Therapeutics's ROIC was -251.2 while its WACC was 7.05.

Conclusion

In conclusion, vTv Therapeutics Inc (NASDAQ:VTVT) appears to be modestly undervalued. While its financial condition is poor and its profitability is weak, its growth ranks better than 68.51% of 1264 companies in the Biotechnology industry. To learn more about vTv Therapeutics stock, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.