Vulcan Materials Co Reports Robust Earnings Growth and Margin Expansion for Q4 and Full Year 2023

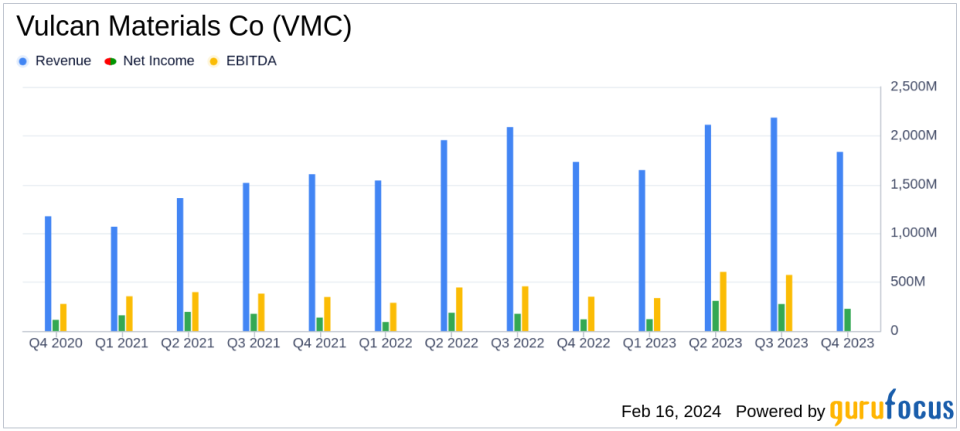

Revenue Growth: Full year revenues increased to $7.78 billion from $7.32 billion in the previous year.

Profitability Surge: Net earnings attributable to Vulcan soared to $933 million, up from $576 million year-over-year.

Earnings Per Share: Earnings from continuing operations per diluted share rose to $7.06, compared to $4.45 in the prior year.

Aggregates Performance: Aggregates segment gross profit per ton increased to $7.67, with cash gross profit per ton at $9.92.

Capital Allocation: Vulcan returned $428 million to shareholders and maintained a disciplined capital management approach.

Operational Efficiency: Adjusted EBITDA reached over $2 billion, marking a 24% increase from the previous year.

Positive Outlook: Management expects continued earnings growth and strong cash generation in 2024.

On February 16, 2024, Vulcan Materials Co (NYSE:VMC) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known as the United States' largest producer of construction aggregates, reported significant growth in earnings and an expansion in gross profit margins, reflecting the strength of its aggregates business.

Vulcan Materials Co (NYSE:VMC) achieved a notable increase in fourth-quarter earnings per share, which surged by 89% to $1.72, compared to $0.91 in the same period of the previous year. The full-year revenues climbed to $7.78 billion, up from $7.32 billion in 2022, while the gross profit for the year reached $1.95 billion, a substantial increase from $1.56 billion in the prior year.

Financial Performance and Challenges

Tom Hill, Vulcan Materials Chairman and CEO, highlighted the company's exceptional year, with over $2 billion in Adjusted EBITDA, a 24 percent increase over the prior year, and a 360 basis points expansion in EBITDA margin. The company's aggregates cash gross profit per ton consistently improved each quarter on a year-over-year basis, ending the year at $9.46 per ton, a 21 percent improvement over the previous year. Hill emphasized the durability of Vulcan's aggregates-led business, which has seen six consecutive years of unit profitability improvement despite a continuously shifting macroeconomic backdrop.

The company's aggregates segment reported a 30 percent increase in fourth-quarter gross profit to $424 million, or $7.67 per ton, with a 400 basis points expansion in gross profit margin. The cash gross profit improved to $9.92 per ton, driven by continued pricing momentum, solid execution, and moderating inflationary pressures. The improvements in unit profitability were widespread across the company's footprint, marking the seventh consecutive quarter of year-over-year growth.

However, the company is not immune to challenges. The forward-looking statements in the report indicate that Vulcan faces risks including general economic and business conditions, competitive factors, pricing, energy costs, and other uncertainties. These challenges could potentially lead to problems if not managed effectively.

Financial Achievements and Industry Importance

The financial achievements of Vulcan Materials Co (NYSE:VMC) are particularly important in the Building Materials industry, where the company's ability to manage costs and maintain pricing power directly impacts profitability. The aggregates segment's strong performance, with increased shipments and higher freight-adjusted sales prices, demonstrates Vulcan's competitive advantage and operational efficiency.

Furthermore, the company's disciplined capital management, reflected in the return of $428 million to shareholders through stock repurchases and dividends, and the maintenance of a healthy debt to Adjusted EBITDA ratio, underscores its commitment to shareholder value and financial stability.

Key Financial Metrics and Commentary

Key financial details from Vulcan's Income Statement, Balance Sheet, and Cash Flow Statement reveal a robust financial position. The company's cash and cash equivalents stood at $931.1 million as of December 31, 2023, a significant increase from $161.4 million in the previous year. The total debt to Adjusted EBITDA ratio was 1.9 times, or 1.5 times on a net debt basis, indicating a strong balance sheet.

Capital expenditures for maintenance and growth projects totaled $625 million for the full year, with expectations to spend $625 to $675 million in 2024. The company also made strategic reserve purchases and divested its concrete operations in Texas, generating cash proceeds that can be redeployed into its aggregates-led franchise.

Tom Hill provided a positive outlook for 2024, stating, "We are well positioned to deliver another year of earnings growth and strong cash generation in 2024. The pricing environment remains positive, and we expect pricing momentum and operational execution will lead to attractive expansion in aggregates unit profitability, regardless of the macro demand environment."

"Six consecutive years of unit profitability improvement during a continuously shifting macro backdrop demonstrates the durability of our uniquely positioned aggregates-led business. We carry momentum into 2024, and our focus is the same - compounding unit margins through all parts of the cycle and creating value for our shareholders through improving returns on capital." - Tom Hill, Chairman and CEO of Vulcan Materials Co (NYSE:VMC)

In conclusion, Vulcan Materials Co (NYSE:VMC) has demonstrated a strong financial performance in 2023, with significant earnings growth and margin expansion. The company's focus on operational efficiency, strategic capital allocation, and a positive pricing environment positions it well for continued success in 2024. Value investors and potential GuruFocus.com members may find Vulcan's disciplined approach and robust financials an attractive opportunity within the Building Materials industry.

Explore the complete 8-K earnings release (here) from Vulcan Materials Co for further details.

This article first appeared on GuruFocus.