W.P. Carey Inc (WPC) Reports Mixed Results Amid Office Portfolio Exit

Net Income: Q4 net income fell to $144.3 million, a 31.1% decrease from the previous year, while full-year net income rose to $708.3 million.

Diluted Earnings Per Share (EPS): Q4 EPS was $0.66, with full-year EPS at $3.28.

Adjusted Funds from Operations (AFFO): Q4 AFFO per diluted share decreased by 7.8% to $1.19, with full-year AFFO per diluted share down 2.1% to $5.18.

Dividends: The Q4 cash dividend was $0.860 per share, reflecting a strategic exit from office assets and a lower payout ratio.

Real Estate Portfolio: Investment volume for Q4 was $345.6 million, totaling $1.3 billion for the year.

Balance Sheet: WPC settled all outstanding forward sale agreements, issuing shares for net proceeds of $384 million.

2024 AFFO Guidance: The company narrows its AFFO guidance range to $4.65 - $4.75 per diluted share.

On February 9, 2024, W.P. Carey Inc (NYSE:WPC) released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The real estate investment trust, which specializes in single-tenant industrial, warehouse, and retail properties, faced a mixed financial landscape as it navigated strategic changes in its office portfolio.

Strategic Office Portfolio Exit

W.P. Carey's strategic exit from its office assets was a significant move in 2023, culminating in the spin-off of Net Lease Office Properties (NLOP) and the sale of numerous office properties. This initiative reduced office exposure to below 3% of total Annual Base Rent (ABR) and is expected to be completed in the first half of 2024. The company's CEO, Jason Fox, commented on the transition:

"Our 2023 fourth quarter and full year results largely reflected the near-term impacts of executing the office exit strategy we announced in September... Looking ahead, we view 2024 as a transitional year, establishing a new baseline from which to grow AFFO."

Financial Performance and Challenges

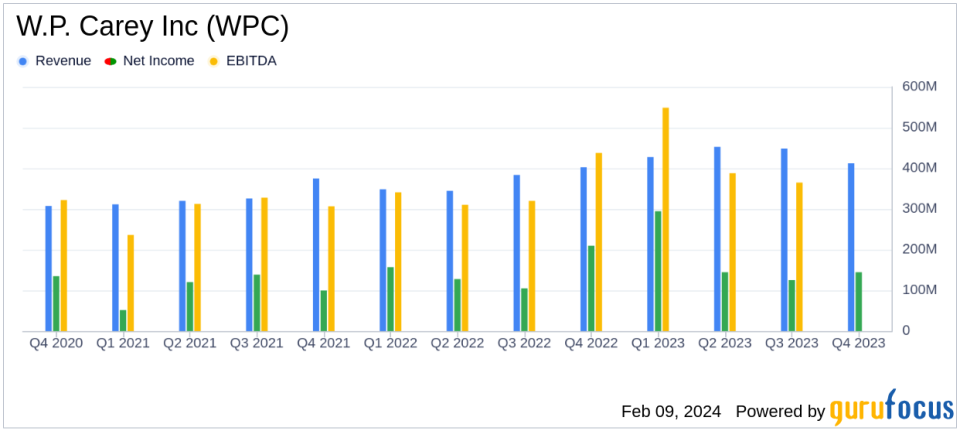

While net income for the fourth quarter decreased, the full-year figure showed an improvement, driven by a higher aggregate gain on the sale of real estate and the impact of net investment activity and rent escalations. However, the company's AFFO per diluted share saw a decline both for the quarter and the year, primarily due to the impact of the office portfolio exit and higher interest expenses.

The company's real estate revenues, including reimbursable costs, increased by 2.1% for the quarter and 18.4% for the year, reflecting the strength of its lease revenues and the impact of net investment activity. However, lease revenues faced headwinds from reclassifications related to the U-Haul and State of Andalusia portfolios and the spin-off.

Balance Sheet and Capitalization

W.P. Carey strengthened its balance sheet by settling all outstanding forward sale agreements, resulting in net proceeds of $384 million. The company also received approximately $344 million, net of transaction expenses, from NLOP in connection with the spin-off. The senior unsecured credit facility was amended and restated, increasing the capacity to $2.0 billion and extending its maturity to 2029.

2024 Outlook

The company's guidance for 2024 AFFO per diluted share has been narrowed, reflecting a cautious but strategic approach to the year ahead. The anticipated full-year investment volume is between $1.5 billion and $2.0 billion, with a disposition volume of between $1.2 billion and $1.4 billion.

W.P. Carey's performance in 2023 and its strategic moves set the stage for a year of transition in 2024. Investors will be watching closely to see how the company's portfolio adjustments and capital allocation strategies will drive growth and value in the evolving real estate market.

Explore the complete 8-K earnings release (here) from W.P. Carey Inc for further details.

This article first appeared on GuruFocus.