W.R. Berkley (WRB) Q3 Earnings Top Estimates, Revenues Up Y/Y

W.R. Berkley Corporation’s WRB third-quarter 2021 operating income of $1.32 per share beat the Zacks Consensus Estimate of 94 cents by 40.4%. The bottom-line doubled year over year.

The company benefited from high premiums and investment income as well as improving combined ratio.

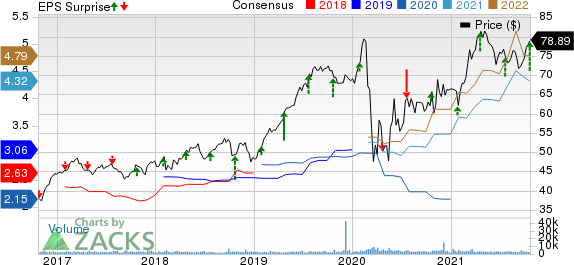

W.R. Berkley Corporation Price, Consensus and EPS Surprise

W.R. Berkley Corporation price-consensus-eps-surprise-chart | W.R. Berkley Corporation Quote

Behind the Headlines

W.R. Berkley’s net premiums written for the quarter under review were $2.3 billion, up 23.7% year over year, primarily due to higher premiums written at the Insurance and Reinsurance & Monoline Excess segment.

Operating revenues came in at $2.4 billion, up 20.2% year over year, on the back of higher net premiums earned and net investment income.

Investment income increased 26.1% year over year to $179.8 million.

Total expenses increased 14.1% to $2.1 billion, primarily due to higher losses and loss expenses, other operating costs and expenses, and expenses from non-insurance businesses.

Catastrophe losses of $73.8 million in the quarter widened from $72.7 million incurred in the year-ago quarter.

Underwriting income increased 80% in the quarter. The consolidated combined ratio (a measure of underwriting profitability) was 90.4%, improving 330 basis points (bps) year over year.

Segment Details

Net premiums written at the Insurance segment increased 23.3% year over year to $2 billion in the quarter, primarily due to higher other liability, short-tail lines, workers' compensation, commercial automobile, and professional liability. Combined ratio improved 480 bps to 89.3%.

Net premiums written in the Reinsurance & Monoline Excess segment increased 27% year over year to $318 million on higher casualty reinsurance and monoline excess. The combined ratio deteriorated 810 bps to 98.4%.

Financial Update

W.R. Berkley exited the third quarter with total assets worth $31.5 billion, up 10.4% from year-end 2020.

Tangible book value per share increased 6.3% from 2020 end to $36.39 as of Sep 30, 2021.

Cash flow from operations was $828 million in the third quarter of 2021, up 48.7% year over year.

The company’s return on equity expanded 660 bps to 16.6%.

The company repurchased shares for $93 million.

Zacks Rank

W.R. Berkley currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other Insurers

Among other insurance industry players, which have reported third-quarter earnings so far, The Travelers Companies TRV and RLI Corp. RLI beat the Zacks Consensus Estimate for earnings while The Progressive Corporation PGR missed the same.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research