W&T Offshore Inc Reports Mixed 2023 Results and Optimistic Outlook for 2024

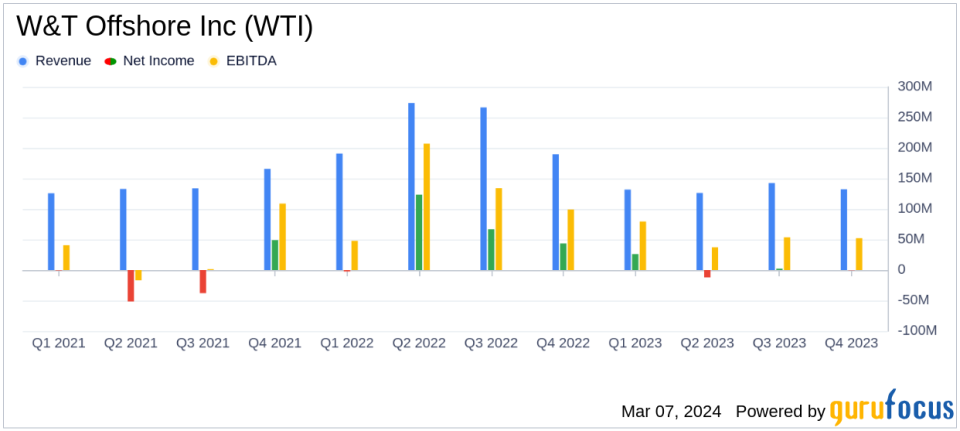

Net Income: W&T Offshore Inc reported a full year 2023 net income of $15.6 million, or $0.11 per diluted share.

Adjusted Net Loss: The company recorded an adjusted net loss of $21.7 million, or ($0.15) per share for the full year.

Production: Full year production averaged 34.9 MBoe/d, with a 51% liquids mix.

Adjusted EBITDA: W&T Offshore generated $183.2 million in adjusted EBITDA for 2023.

Free Cash Flow: The company produced $63.3 million in free cash flow during the year.

Acquisitions: W&T Offshore completed two accretive acquisitions for a total of $99.4 million, adding significant reserves and production capacity.

Dividend: A quarterly cash dividend policy was initiated, with $0.01 per share paid in December 2023 and declared for the first quarter of 2024.

On March 5, 2024, W&T Offshore Inc (NYSE:WTI) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, an oil and gas exploration and production entity focused on the Gulf of Mexico, reported a net income for the year of $15.6 million, or $0.11 per diluted share, and a net loss of $0.4 million for the fourth quarter. Despite the mixed results, W&T Offshore remains optimistic about its future, particularly due to its strategic acquisitions and consistent generation of free cash flow.

Financial Performance and Challenges

W&T Offshore's performance in 2023 was marked by strong production levels at the midpoint of its latest guidance, delivering 34.9 thousand barrels of oil equivalent per day (MBoe/d) with a 51% liquids mix. However, the company faced challenges, including a net loss in the fourth quarter, primarily due to natural production declines and unplanned downtime. Adjusted for certain non-recurring items, the adjusted net loss for the full year was $21.7 million, or ($0.15) per share. These challenges underscore the importance of the company's strategic initiatives, such as acquisitions and operational efficiency, to maintain profitability and shareholder value.

Strategic Acquisitions and Dividend Declaration

W&T Offshore's financial achievements in 2023 included the completion of two accretive acquisitions totaling $99.4 million, which were funded with cash on hand. These acquisitions are expected to increase proved reserves, production, and free cash flow per share. The company also declared a quarterly dividend for the first quarter of 2024, reflecting its commitment to returning value to shareholders.

Key Financial Metrics

Key details from W&T Offshore's financial statements reveal solid adjusted EBITDA of $183.2 million for the full year and $44.9 million for the fourth quarter. The company also generated $115.3 million in net cash from operating activities and $63.3 million in free cash flow for the year. These metrics are important as they demonstrate the company's ability to generate cash and fund operations and strategic initiatives without relying on external financing.

"We continued to deliver solid results in 2023, while executing on our strategic vision focused on Free Cash Flow generation," said Tracy W. Krohn, W&Ts Board Chair and Chief Executive Officer. "We have reported 24 consecutive quarters of positive Free Cash Flow and generated Adjusted EBITDA of $183.2 million in 2023."

Analysis of Company Performance

W&T Offshore's performance in 2023 reflects a balance between operational success and the challenges of the oil and gas industry. The company's focus on free cash flow generation and strategic acquisitions has positioned it well for future growth. The management's outlook for 2024 is optimistic, with plans to integrate recent acquisitions, potentially increase production, and reduce costs. The company's ability to maintain a strong balance sheet and cash position, despite industry volatility, bodes well for its ability to capitalize on future opportunities.

For a detailed analysis of W&T Offshore Inc's financial results and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from W&T Offshore Inc for further details.

This article first appeared on GuruFocus.