W&T Offshore (WTI) Acquires Interests in US Gulf of Mexico

W&T Offshore, Inc. WTI announced that it acquired the remaining working interests in the producing properties of the U.S. Gulf of Mexico from an undisclosed seller.

In January 2022, the company signed an agreement to acquire interests in producing properties in the federal waters of the Gulf of Mexico for $47 million. The transaction was completed.

With the acquisition of the remaining working interests, W&T Offshore has strengthened its position in the recently acquired shallow-water assets of the Gulf of Mexico. It acquired oil and gas producing shallow water assets at Ship Shoal 230, South Marsh Island 27/Vermilion 191, and South Marsh Island 73 fields. The company paid a cash consideration of $17.5 million to the private seller.

The additional interests have an estimated net sales rate of 900 barrels of oil equivalent (Boe) per day, of which 80% is oil. With the acquisition, the upstream energy player added internally-estimated proved reserves of 1.4 million Boe, and proved and probable reserves of 2 million Boe.

Beside this, the acquisition adds an average of 20% working interest in more than 50 gross-producing wells. The wells are currently operated by W&T Offshore across the three shallow-water fields. The acquisition provides additional advantages from the pay sands in existing wellbores and potential opportunities for future drilling activities.

Acquisitions are crucial components of W&T Offshore’s growth strategies. The latest acquisition adds to the company’s existing high-quality portfolio in the Gulf of Mexico. Since W&T Offshore operates other properties in the Gulf of Mexico, it will be able to leverage its scale and expertise to gain synergies and maximize the value of the acquired assets. Notably, the transaction had an effective date and closing date of Apr 1, 2022.

Company Profile & Price Performance

Headquartered in Houston, TX, W&T Offshore is a leading oil and natural gas exploration, and production company.

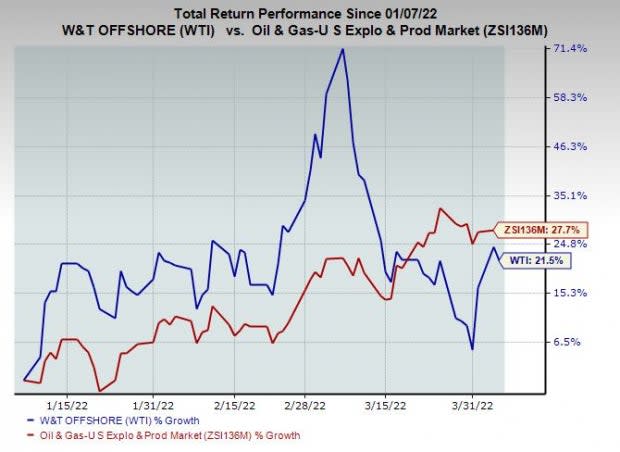

Shares of WTI have underperformed the industry in the past three months. The stock has gained 21.5% compared with the industry’s 27.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

W&T Offshore currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

TotalEnergies SE TTE is among the top five publicly-traded global integrated oil and gas companies based on production volumes, proved reserves and market capitalization. At present, the company has more than 12 years of proved reserves, and more than 20 years of proved and probable reserves.

TTE’s earnings for 2022 are expected to increase 34.7% year over year. TotalEnergies is managing long-term debt quite efficiently and trying to keep the same at manageable levels. Its debt to capital has been declining over the past few years. As of Dec 31, 2021, cash and equivalents were $21,342 million, which was enough to address the current borrowings of $13,645 million.

DCP Midstream, LP DCP, based in Denver, CO, is a leading energy infrastructure firm. For the year ended Dec 31, 2021, DCP generated $122 million of excess free cash flow, 44% higher than the 2020 level of $85 million.

DCP Midstream's earnings for 2022 are expected to increase 139% year over year. For 2022, DCP Midstream projects adjusted EBITDA of $1,350-$1,500 million, suggesting significant growth from $330 million reported in 2021.

PDC Energy, Inc. PDCE is an independent upstream operator engaged in exploring, developing and producing natural gas, crude oil and natural gas liquids. As of Dec 31, 2021, PDCE's total estimated proved reserves were 213,845 thousand barrels of oil, 240,389 MBbls of natural gas liquids and 2,159,725 million cubic feet of natural gas.

PDC Energy's earnings for 2022 are expected to increase 82.7% year over year. As of Dec 31, 2021, PDCE had $1.5 billion in total liquidity, while its credit facility currently has a total borrowing base of $2.4 billion. Moreover, PDC Energy’s debt maturity profile is favorable.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

W&T Offshore, Inc. (WTI) : Free Stock Analysis Report

PDC Energy, Inc. (PDCE) : Free Stock Analysis Report

DCP Midstream Partners, LP (DCP) : Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE) : Free Stock Analysis Report

To read this article on Zacks.com click here.