W.W. Grainger Inc (GWW) Reports Solid Q4 and Record Full Year Earnings for 2023

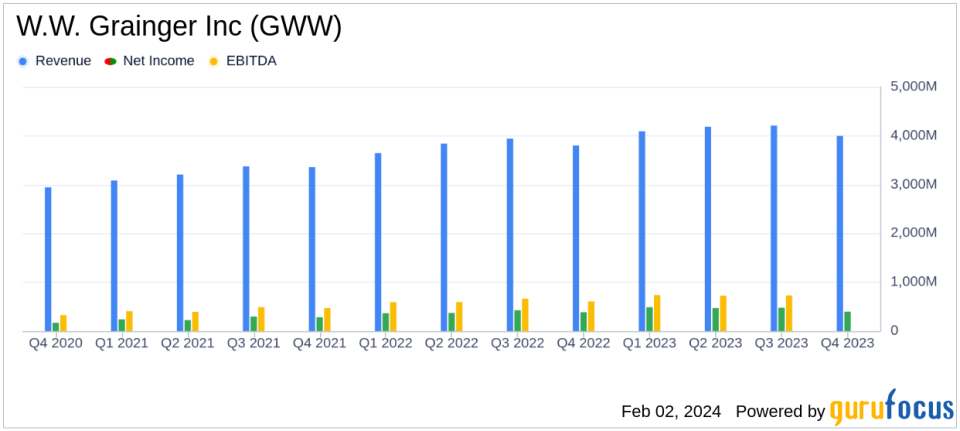

Q4 Revenue: $4.0 billion, up 5.1% year-over-year.

Full Year Revenue: $16.5 billion, an increase of 8.2% from the previous year.

Q4 Diluted EPS: Increased by 4.7% to $7.89 on a reported basis, and by 16.7% to $8.33 on an adjusted basis.

Full Year Diluted EPS: Rose by 20.5% to $36.23 on a reported basis, and by 23.6% to $36.67 on an adjusted basis.

Operating Cash Flow: Generated $2.0 billion in 2023, with $1.2 billion returned to shareholders through dividends and share repurchases.

2024 Guidance: Sales growth projected between 4% to 7%, with diluted EPS estimated at $38.00 to $40.50.

On February 2, 2024, W.W. Grainger Inc (NYSE:GWW) released its 8-K filing, detailing a strong finish to 2023 with solid fourth-quarter results and record full-year earnings. The company, a leading distributor of maintenance, repair, and operating products, continues to serve a vast customer base through its advanced e-commerce capabilities and extensive branch network.

Performance and Challenges

W.W. Grainger's performance in Q4 and the full year of 2023 reflects the company's robust sales growth and operational efficiency. The company achieved a 5.1% increase in Q4 sales and an 8.2% increase for the full year, indicating a strong market presence and effective execution of its business strategy. However, the reported operating margin saw a slight decline of 40 basis points in Q4, which the company attributes to a negative price/cost spread and inventory cost adjustments.

Financial Achievements

The company's financial achievements, including a significant increase in diluted EPS and operating cash flow, underscore its ability to generate shareholder value and maintain a strong balance sheet. These results are particularly important in the industrial distribution industry, where efficient capital management and the ability to adapt to market changes are critical for long-term success.

Key Financial Metrics

W.W. Grainger's income statement and balance sheet reveal key metrics that highlight the company's financial health. The gross profit margin for the full year was up by 100 basis points, and the operating margin increased by 130 basis points on an adjusted basis. The company's focus on SG&A leverage and cost efficiencies contributed to these improvements.

"Our strong 2023 performance was driven by the team's focused execution against our long-term strategy in a normalizing demand market," said D.G. Macpherson, Chairman and CEO. "We strengthened our advantage in both our High-Touch Solutions and Endless Assortment segments and achieved record annual sales and earnings by remaining committed to our purpose, We Keep the World Working."

Analysis of Company's Performance

The company's strategic investments in e-commerce and its ability to leverage its High-Touch Solutions and Endless Assortment segments have positioned it well for continued growth. The planned opening of a new distribution center near Houston, Texas, in 2026, is expected to further enhance its distribution capabilities.

W.W. Grainger's guidance for 2024, with anticipated sales growth and a steady operating margin, reflects confidence in its business model and market position. The company's commitment to returning value to shareholders is evident in its share repurchase and dividend strategy, which remains a cornerstone of its financial policy.

Overall, W.W. Grainger Inc's latest earnings report demonstrates a company that is effectively navigating the complexities of the industrial distribution market, capitalizing on growth opportunities, and delivering consistent shareholder value.

For more detailed information and analysis on W.W. Grainger Inc's financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from W.W. Grainger Inc for further details.

This article first appeared on GuruFocus.