Wabash (WNC) to Report Q3 Earnings: What's in the Cards?

Wabash WNC is slated to release third-quarter 2023 results on Oct 25, before market open. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share is pegged at 97 cents.

For the current quarter, the consensus estimate for Wabash’s earnings per share has decreased by 3 cents in the past seven days. Its bottom-line estimates imply growth of 32.9% from the year-ago reported number.

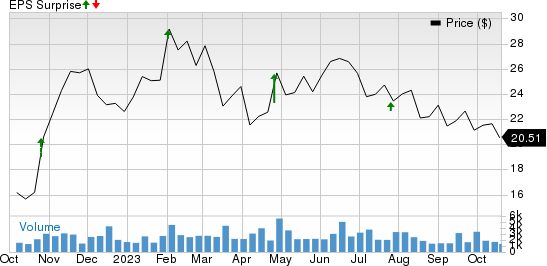

Over the trailing four quarters, Wabash surpassed earnings estimates on all occasions, the average surprise being 48.54%. This is depicted in the graph below:

Wabash National Corporation Price and EPS Surprise

Wabash National Corporation price-eps-surprise | Wabash National Corporation Quote

Q2 Highlights

Wabash topped the Zacks Consensus Estimate of earnings in its second-quarter 2023 results.

Its adjusted earnings per share of $1.54 surpassed the consensus metric of $1.32 and rocketed 235% year over year.

Consolidated revenues came in at $686.6 million, up from $642.8 million in the corresponding quarter of 2022. The metric, however, lagged the consensus estimate of $751 million.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Wabash in the quarter to be reported, as it does not have the right combination of the two key ingredients. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as elaborated below.

Earnings ESP: Wabash has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate is pegged on par with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: WNC currently sports a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors at Play

Wabash is struggling with supply constraints within transportation equipment. The company also slowed production rates by removing a shift at its main trailer facility. In the second quarter, the company shipped 11,825 new trailers, down from 13,670 reported in the corresponding quarter of 2022. The trend is likely to continue amid supply constraints and challenging market conditions.

Wabash expects third-quarter earnings per share in the range of 90 cents to $1.10 per share, down from 1.54 reported in the second quarter of 2023. Also, the company has increased its capital expenditure to support its organic growth initiatives. In the first half of 2023, Wabash’s capital expenditure increased to $55.8 million, up from $22.4 million reported in the corresponding period of 2022. A gloomy outlook and higher expenditures are likely to mar third-quarter results.

Stocks With the Favorable Combination

Here are a few players from the auto space that, according to our model, have the right combination of elements to post an earnings beat this time around.

Allison Transmission Holdings ALSN will release third-quarter 2023 results on Oct 25. The company has an Earnings ESP of +8.19% and carries a Zacks Rank #2.

The Zacks Consensus Estimate for Allison’s to-be-reported quarter’s earnings and revenues is pegged at $1.71 per share and $759.2 million, respectively. ALSN surpassed earnings estimates on all the occasions, the average surprise being 19.32%.

Oshkosh Corporation OSK will release third-quarter 2023 results on Oct 26. The company has an Earnings ESP of +8.24% and has a Zacks Rank #3.

The Zacks Consensus Estimate for Oshkosh’s to-be-reported quarter’s earnings and revenues is pegged at $2.18 per share and $2.46 billion, respectively. OSK surpassed earnings estimates twice in the trailing four quarters and missed twice, the average surprise being 27.45%.

Cummins CMI will release third-quarter 2023 results on Nov 2. The company has an Earnings ESP of +0.48% and has a Zacks Rank #3.

The Zacks Consensus Estimate for Cummin’s to-be-reported quarter’s earnings and revenues is pegged at $4.70 per share and $8.19 billion, respectively. CMI surpassed earnings estimates once in the trailing four quarters and missed thrice, the average negative surprise being 5.51%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cummins Inc. (CMI) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Wabash National Corporation (WNC) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report