Wabtec (WAB) Announces Entry Into Railcar Telematics Market

Wabtec Corporation WAB has inked a deal with Dutch company, Intermodal Telematics B.V. by virtue of which it will enter the railcar telematics market next year. Following the deal. Wabtec will create a railcar telematics platform using the IMT technology.

WAB’s new railcar telematics platform will deliver real-time information to railcar and tank container owners and operators, thereby allowing them to turn rail cargo into smart, connected assets. The transportation company aims to commence offering this railcar telematics solution in the first quarter of 2024. Per the agreement, the solution will be offered exclusively by Wabtec in North America and other heavy-haul freight markets globally.

Railcar telematics offered by WAB will include sensors, gateways, wireless communications, and analytics. The technology will be used for retrofit on existing fleets apart from making Wabtec's current railcar components smarter by integrating solutions right from production.

Expressing delight at the new development, Nalin Jain, WAB’s Group president of Digital Intelligence said “The rail industry is on the verge of a new era where the use of real-time data about the status and condition of cargo will be transformative to the customer experience and supply chain efficiency.”

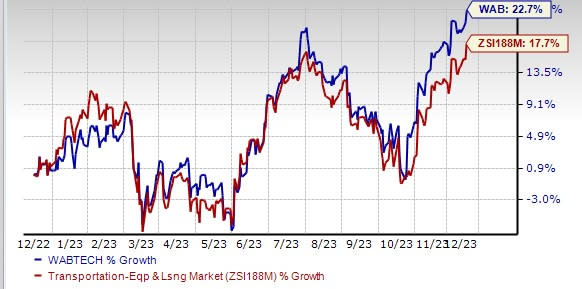

Price Performance

WAB shares have gained 22.7% in the past year outperforming its industry’s 17.7% growth.

Image Source: Zacks Investment Research

Zacks Rank and Other Key Picks

Wabtec currently carries a Zacks Rank #2 (Buy). Investors interested in the broad Transportation sector may consider other top-ranked stocks like Air Canada ACDVF and SkyWest SKYW.

Air Canada currently sports a Zacks Rank #1 (Strong Buy). An uptick in passenger traffic is aiding ACDVF. Recently, management announced plans to launch a year-round route between Montreal and Madrid. You can see the complete list of today’s Zacks #1 Rank stocks here.

The service will commence in May 2024 as part of its expanded international summer 2024 flying schedule to cater to increased demand. The Zacks Consensus Estimate for Air Canada’s 2023 and 2024 earnings has witnessed increases of 32.6% and 41.3% in the past 60 days, respectively.

SkyWest currently carries a Zacks Rank #2. SKYW's fleet modernization efforts are commendable. The company’s initiatives to reward its shareholders also bode well.

The Zacks Consensus Estimate for SKYW’s current-year earnings has risen 38.9% in the past 60 days. The Zacks Consensus Estimate for next-year earnings has jumped 33.2% in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

Air Canada (ACDVF) : Free Stock Analysis Report