Wabtec (WAB) Reaches 52-Week High: What's Aiding the Stock?

Shares of Westinghouse Air Brake Technologies Corporation, operating as Wabtec Corporation (WAB), scaled a 52-week high of $127.57 in the trading session on Dec 22, 2023, before closing a tad lower at $126.61.

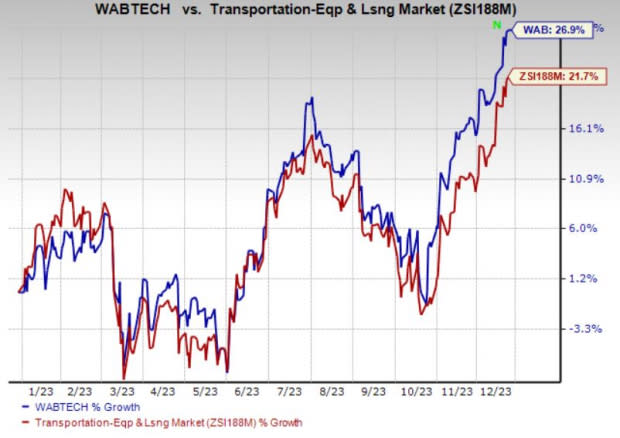

The company’s shares gained 26.9% so far this year compared with the 21.7% rise of the industry it belongs to.

Image Source: Zacks Investment Research

Let’s find out the factors supporting the uptick.

Wabtec’s bullish guidance for 2023 looks encouraging and raises optimism about this stock. For 2023, WAB now expects sales of $9.50-$9.70 billion (prior view: $9.25-$9.50 billion). Adjusted earnings per share are now estimated to be between $5.80 and $6.00 (prior view: $5.50 and $5.80). Management still anticipates strong cash flow generation, with operating cash flow conversion exceeding 90%.

Further, Wabtec’s measures to reward its shareholders through dividends and share buybacks are also appreciative. WAB repurchased shares worth $252 million and paid $92 million in the form of dividend payments during the first nine months of 2023. WAB pays out a quarterly dividend of 17 cents ($0.68 annualized) per share, which gives it a 0.57% yield at the current stock price. This company’s payout ratio is 12%, with a five-year dividend growth rate of 8.36%. (Check WAB’s dividend history here).

Wabtec’s plans to produce telematics technology for rail cars are expected to enhance its competitive position in the market. The product is likely to be ready in the first quarter of 2024.

The positive sentiment surrounding the stock is evident from the fact that the Zacks Consensus Estimate for current-year earnings has been revised upward by 4.7% over the past 60 days. Further, WAB has an encouraging track record with respect to earnings surprise, having surpassed the Zacks Consensus Estimate in three of the past four quarters (met the same in the remaining quarter). The average beat is 7.11%. Wabtec has an expected earnings growth rate of 22.43% for the current year.

Zacks Rank and Other Stocks to Consider

Currently, Wabtec sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks from the Zacks Transportation sector are Air Canada ACDVF and SkyWest, Inc. SKYW.

Air Canada currently sports a Zacks Rank #1. An uptick in passenger traffic is aiding ACDVF. Recently, management announced plans to launch a year-round route between Montreal and Madrid. You can see the complete list of today’s Zacks #1 Rank stocks here.

The service will commence in May 2024 as part of its expanded international summer 2024 flying schedule to cater to increased demand. The Zacks Consensus Estimate for Air Canada’s 2023 and 2024 earnings has witnessed increases of 32.6% and 41.3% in the past 60 days, respectively.

SkyWest currently carries a Zacks Rank #2 (Buy). SKYW’s fleet-modernization efforts are commendable. The Zacks Consensus Estimate for SKYW’s current-year earnings has improved 38.8% over the past 90 days. Shares of SKYW have surged 213.1% year to date.

SKYW delivered a trailing four-quarter earnings surprise of 32.57%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

Air Canada (ACDVF) : Free Stock Analysis Report