WAFD Rides on Loans & High Rates Amid Weak Asset Quality

WaFd, Inc. WAFD witnessed revenue growth on the back of steady loan demand. High interest rates and a strong balance sheet position will continue to support its financials. However, elevated expenses and weak asset quality pose near-term concerns.

WaFd witnessed a compound annual growth rate (CAGR) of 7.5% in revenues over the last five years (2018-2023), largely driven by improving net loan balances, which saw a CAGR of 8.8%. In the first quarter of fiscal 2024, revenues declined on a year-over-year basis, while the loan balance improved marginally.

Given the decent loan demand and expansion efforts, the company’s top line is expected to improve further. Per our estimates, total revenues are likely to decline 13.3% this year, while the same is expected to rebound and grow 3.1% and 5.1% in fiscal 2025 and 2026, respectively. Also, net loans receivables are expected to witness a CAGR of 3.1% by fiscal 2026.

The Federal Reserve raised rates 11 times from March 2022 to July 2023. With the central bank expected to maintain high interest rates in the near term, WaFd's net interest margin (NIM) is expected to keep improving, albeit at a slower pace, due to rising funding costs. We project NIM to be 2.85% this year as higher deposit costs weigh on it. Thereafter, NIM will be 2.86% and 2.95% in fiscal 2025 and 2026, respectively.

Despite the above-mentioned tailwinds, WAFD has been witnessing a constant rise in operating expenses. Over the last five fiscal years (2018-2023), expenses witnessed a CAGR of 7.3%, largely due to higher compensation and information technology costs. The uptrend continued in the first quarter of fiscal 2024. We expect total non-interest expenses to see a CAGR of 4.7% over the next three fiscal years.

WaFd’s asset quality has been weakening over the past few years. Provision for credit losses increased in fiscal 2021, 2022 and 2023 as the company continued to build reserves to combat the challenging macroeconomic backdrop. Though the bank didn’t record any provisions for the first quarter of fiscal 2024, risks of economic slowdown in the near term are expected to keep provisions high in the upcoming quarters. While we project provisions to decline in fiscal 2024 and 2025, the metric will increase in fiscal 2026.

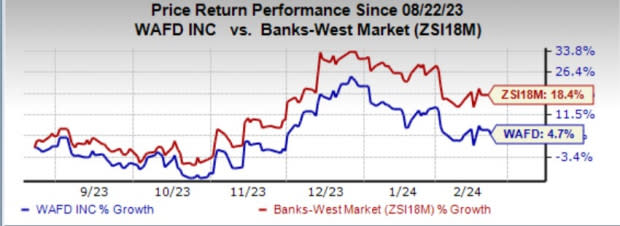

WAFD currently carries a Zacks Rank #3 (Hold). Shares of the company have gained 4.7% over the past six months compared with the industry’s growth of 18.4%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked bank stocks are Avidbank Holdings, Inc. AVBH and Zions Bancorporation ZION.

Avidbank Holdings’ 2024 earnings estimates have moved north by 16.1% in the past 30 days. The company’s shares have gained 15% over the past three months. At present, AVBH sports a Zacks Rank of 1 (Strong Buy). You can see see the complete list of today’s Zacks #1 Rank stocks here.

Zions’ 2024 earnings estimates have been revised 8.8% upward in the past 30 days. The stock has gained 17.6% over the past three months. Currently, ZION carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zions Bancorporation, N.A. (ZION) : Free Stock Analysis Report

WaFd, Inc. (WAFD) : Free Stock Analysis Report

Avidbank Holdings Inc. (AVBH) : Free Stock Analysis Report