WaFd (WAFD)-Luther Burbank (LBC) Merger Gets Regulatory Nod

WaFd, Inc. WAFD is on track to merge with Luther Burbank Corporation LBC after some delay in getting the final approvals. The merger, slated to be completed by Feb 29, has received the green light from regulatory authorities.

The deal, announced on Nov 13, 2022, garnered regulatory approvals from the Federal Deposit Insurance Corporation, the Washington State Department of Financial Institutions and the Board of Governors of the Federal Reserve System. Upon closure, this move will extend WaFd’s reach to nine western states, incorporating 10 California branches from Luther Burbank.

Brent Beardall, president, and CEO of WaFd Bank, stated, "The more we have worked with the Luther Burbank team, the more convinced we are our combined bank will create significant opportunities for current and future customers and shareholders."

Two directors from Luther Burbank, Brad Shuster and Max Yzaguirre, are set to join the board of WaFd following the completion of the merger, bringing their wealth of knowledge and industry experience to the table.

The integration process is expected to be swift, with system and brand integration targeted for completion in the first week of March 2024, ensuring Luther Burbank customers can seamlessly access the WAFD platform and its offerings.

The merger, initially set for closure on Nov 30, 2023, was extended to Feb 29, 2024, emphasizing the commitment of both parties to the deal. Shareholders of Luther Burbank and WaFd approved the merger agreement on May 4, 2023, and conditional approval was granted by the Washington State Department of Financial Institutions on Oct 13, 2023.

Under the terms of the all-stock deal, LBC shareholders will receive 0.3353 shares of WaFd common stock for each Luther Burbank common stock share. The financial implications include one-time pre-tax merger-related charges of $37 million for WaFd, with projected cost savings of 25% of Luther Burbank's 2023 non-interest expenses.

With an anticipated 7.9% accretion to WaFd's earnings per share and robust capital ratios post-closure, this strategic deal will position the company as a force to be reckoned with in the western region, boasting a broader range of technology-enabled financial solutions and an expanded regional footprint.

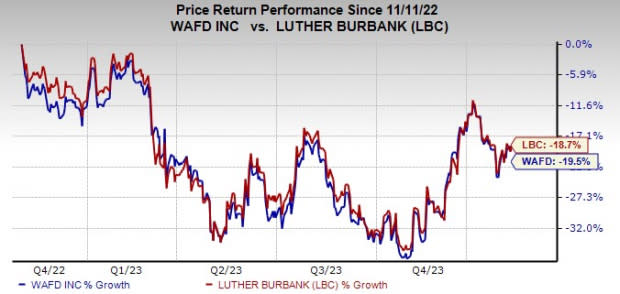

Since the announcement of the deal, shares of WAFD and LBC have lost 19.5% and 18.7%, respectively.

Image Source: Zacks Investment Research

Currently, WAFD carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Acquisition by a Peer

Last week, Webster Financial Corporation WBS completed the acquisition of Ametros Financial Corp, to broaden its financial services portfolio. Ametros, one of the country’s largest professional administrators of medical insurance claim settlements, will maintain its operations under the Ametros and CareGuard brands.

This acquisition positions WBS to tap into Ametros' rapidly growing source of low-cost, long-duration deposits. The addition of Ametros to Webster's offerings not only enhances its deposit diversity but also introduces a new stream of non-interest income. With plans for a full integration during the first quarter of 2024, this move reinforces the company’s commitment to strategic expansions.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

WaFd, Inc. (WAFD) : Free Stock Analysis Report

Webster Financial Corporation (WBS) : Free Stock Analysis Report

Luther Burbank Corporation (LBC) : Free Stock Analysis Report