Walgreens Boots (WBA) New Alliances Aid Growth, Cost Woe Stays

Walgreens Boots’ WBA various strategic partnerships are expected to benefit the company in the long run. Yet, persistent reimbursement pressure and competitive market offer tough challenges for Walgreens Boots. The stock carries a Zacks Rank #3 (Hold).

Over the past year, Walgreens has outperformed the industry. The stock has lost 23.5% compared with the industry’s 28.1% decline.

Walgreens exited second-quarter fiscal 2023 with better-than-expected earnings and revenues. The company’s U.S. Healthcare business expanded, led by key contract wins, continued partnership growth and a strong focus on execution. The company continues to play a leading role in COVID-19 vaccinations and testing, administering 2.4 million vaccinations in the reported quarter. It has reaffirmed 2023 EPS guidance, reflecting continued growth momentum.

Meanwhile, the intensifying competition in the U.S. pharmacy retail drugstore market has compelled Walgreens Boots to diversify its product offerings through new partnerships. In April 2023, Walgreens entered into a partnership with the Dublin-based biotech company, Prothena Corporation. The collaboration aims to accelerate patient identification and recruitment for Prothena’s ongoing ASCENT-2 multiple ascending dose clinical trial.

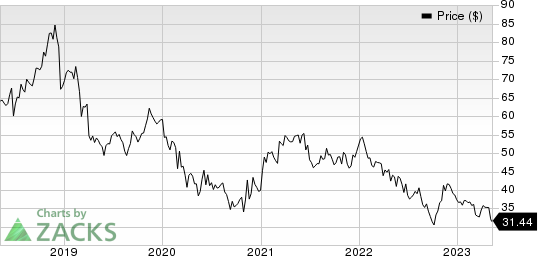

Walgreens Boots Alliance, Inc. Price

Walgreens Boots Alliance, Inc. price | Walgreens Boots Alliance, Inc. Quote

The same month, the U.S. Healthcare segment of Walgreens and VillageMD announced the expansion of Village Medical at Walgreens into Colorado, with three new primary care practices, two in Fort Collins and a third in Longmont.

In March 2023, Walgreens, in partnership with DoorDash and Uber, announced free, Same Day Rx Delivery of medications for the prevention and treatment of HIV. The latest offering is available to eligible patients within 15 miles of thousands of participating Walgreens retail pharmacies nationwide.

On the flip side, during the second quarter of fiscal 2023, Pharmacy sales were affected by a 3.5% headwind from AllianceRx Walgreens. The International segment was also impacted by an adverse currency impact of 7.5% in the second quarter.

Moreover, escalating costs and contraction of gross margin remain a concern. In the last few years, slowdown in generic introduction has been affecting Walgreens Boots’ margins. In addition, of late, increased reimbursement pressure and generic drug cost inflation have been hampering Walgreens’ margin on a significant level.

In the second quarter of fiscal 2023, gross profit fell 8.5% year over year. Gross margin contracted 260 bps to 20.2%. Selling, general and administrative expenses were up 5.6%.

Further, Walgreens Boots faces headwinds in the form of increased competition and tough industry conditions. Even though the company continues to grab market share from other traditional drug store retailers, major mass merchants such as Target and Wal-Mart are expanding their pharmacy businesses and enjoying a fair market share.

Key Picks

Some better-ranked stocks in the overall healthcare sector are Penumbra PEN, Accelerate Diagnostics AXDX and SiBone SIBN. Penumbra sports a Zacks Rank #1 (Strong Buy), while Accelerate Diagnostics and SiBone each carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Penumbra’s stock has risen 134.8% in the past year. Earnings estimates for Penumbra have increased from $1.25 to $1.47 in 2023 and $2.33 to $2.51 in 2024 in the past 30 days.

PEN’s earnings beat estimates in all the last four quarters, delivering an average surprise of 109.42%. In the last reported quarter, it reported an earnings surprise of 109.09%.

Estimates for Accelerate Diagnostics’ 2023 loss per share have remained constant at 65 cents in the past 30 days. Shares of the company have increased 10.2% in the past year compared with the industry’s rise of 9.1%.

AXDX has an estimated earnings growth rate of 14.47% for 2023 against the S&P’s growth rate of 6.47%. In the last reported quarter, Accelerate Diagnostics delivered an earnings surprise of 12.50%

Estimates for SiBone’s 2023 loss per share have narrowed down from $1.63 to $1.61 in the past 30 days and to $1.44 in the past seven days. Shares of the company have increased 75.5% in the past year compared with the industry’s rise of 9%.

SIBN’s earnings beat estimates in three of the trailing four quarters and missed the same in one, the average surprise being 11.11%. In the last reported quarter, SiBone delivered an earnings surprise of 21.95%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

Accelerate Diagnostics, Inc. (AXDX) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

SiBone (SIBN) : Free Stock Analysis Report