Walker & Dunlop Inc Reports Q4 Earnings: Transaction Volumes and Adjusted EBITDA Decline ...

Total Revenues: $274.3 million, a 3% decrease year over year.

Net Income: $31.6 million, down 24% from the same period last year.

Diluted EPS: $0.93, representing a 25% decrease year over year.

Adjusted EBITDA: Down by 5% compared to Q4 2022.

Dividend: Declared at $0.65 per share for Q1 2024, marking the sixth consecutive year of increase.

Total Transaction Volume: $9.3 billion, a 17% decrease from the previous year.

Servicing Portfolio: Grew by 6% year over year to $130.5 billion.

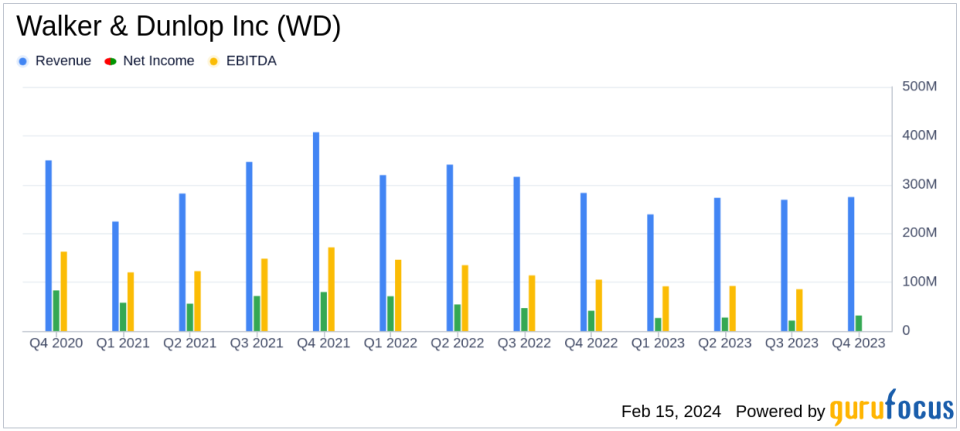

On February 15, 2024, Walker & Dunlop Inc (NYSE:WD) released its 8-K filing, detailing its financial performance for the fourth quarter of 2023. The U.S.-based commercial real estate finance company, which specializes in multifamily and other commercial real estate financing products, faced a challenging market environment yet demonstrated the resilience of its business model.

The company reported a slight decrease in total revenues to $274.3 million, a 3% dip from the same quarter in the previous year. Net income also saw a reduction, coming in at $31.6 million, which is a 24% year-over-year decline. Diluted earnings per share (EPS) followed suit, decreasing by 25% to $0.93. Despite these declines, the company's adjusted EBITDA only saw a modest 5% decrease, indicating some stability in its servicing and asset management segment.

Walker & Dunlop's transaction volume for the quarter was $9.3 billion, down 17% from the fourth quarter of 2022. This drop reflects broader market challenges, yet the company's managed portfolio grew by 6% to $147.8 billion, showcasing the strength and growth potential of its servicing portfolio.

Chairman and CEO Willy Walker commented on the results, stating:

"We ended 2023 with solid fourth quarter financial results thanks to $9.3 billion of sales and financing volume, combined with our recurring revenues from servicing and asset management, which drove our highest revenues and quarterly earnings of 2023. In an extremely challenging year -- when W&D's sales and financing volumes were off by 48% -- it is a true testament to our business model, active management, and talented team that we generated over $300 million of adjusted EBITDA, only down 8% for the year."

Walker also highlighted the company's conservative credit culture and focus on the multifamily industry, which he believes positions the company well for a potential market rebound in 2024.

Looking at the company's financial segments, the Capital Markets segment saw a 17% decrease in income from operations, while the Servicing & Asset Management segment experienced a 16% decline. Despite these decreases, the company's Board of Directors declared a dividend of $0.65 per share for the first quarter of 2024, reflecting confidence in the company's ability to generate shareholder value.

Walker & Dunlop's balance sheet remains strong, with a 6% year-over-year increase in its total servicing portfolio, now standing at $130.5 billion. The company's at-risk servicing portfolio also grew by 8%, indicating a robust pipeline for future earnings.

In summary, Walker & Dunlop's Q4 2023 earnings report reflects a company navigating a tough market environment with a solid foundation and a clear strategy for growth. While transaction volumes and net income have declined, the company's servicing portfolio growth and stable adjusted EBITDA highlight its resilience and potential for future success.

For more detailed information on Walker & Dunlop's financial performance, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Walker & Dunlop Inc for further details.

This article first appeared on GuruFocus.