Walker & Dunlop (WD): A Hidden Investment Gem or Overlooked Risk? A Comprehensive Valuation ...

Walker & Dunlop Inc (NYSE:WD) reported a daily loss of 2.58% and a 3-month loss of 2.43%. Despite this, the company maintains an Earnings Per Share (EPS) of 4.25. This leads us to question: Is the stock modestly undervalued? The following valuation analysis aims to answer this question and provide an in-depth look into the intrinsic value of Walker & Dunlop.

Company Introduction

Walker & Dunlop Inc is a US-based commercial real estate finance company. It offers a variety of multifamily and other commercial real estate financing products sold under the programs of Freddie Mac, Fannie Mae, Ginnie Mae, and the Federal Housing Administration. Despite its current stock price of $74.43, the GF Value, an estimation of the fair value, is $92, suggesting the stock might be modestly undervalued.

Assessing the GF Value

The GF Value is a proprietary measure of a stock's intrinsic value. It is calculated based on historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

At its current price of $74.43 per share and a market cap of $2.5 billion, Walker & Dunlop (NYSE:WD) appears to be modestly undervalued. This suggests that the long-term return of its stock is likely to be higher than its business growth.

Financial Strength Analysis

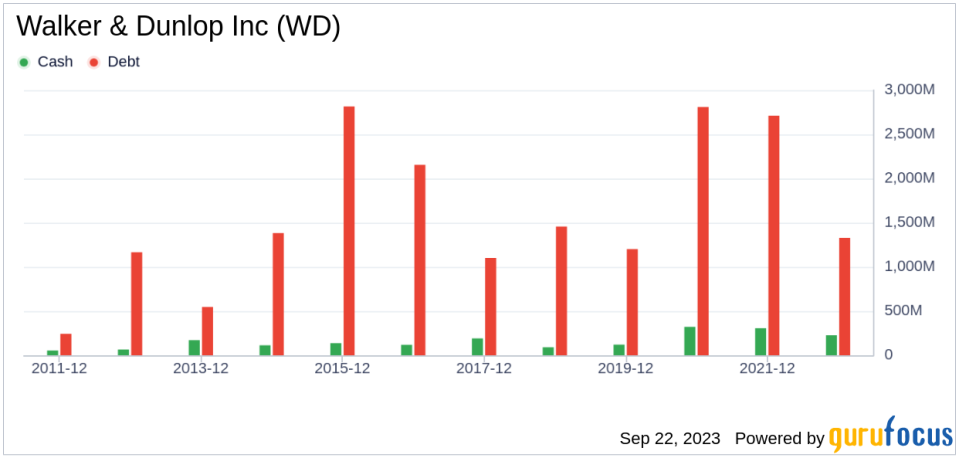

It is crucial to evaluate the financial strength of a company before investing. Companies with poor financial strength pose a higher risk of permanent loss. The cash-to-debt ratio and interest coverage are great indicators of a company's financial strength. Walker & Dunlop's cash-to-debt ratio of 0.11 is lower than 93.2% of the companies in the Banks industry, indicating poor financial strength.

Profitability and Growth

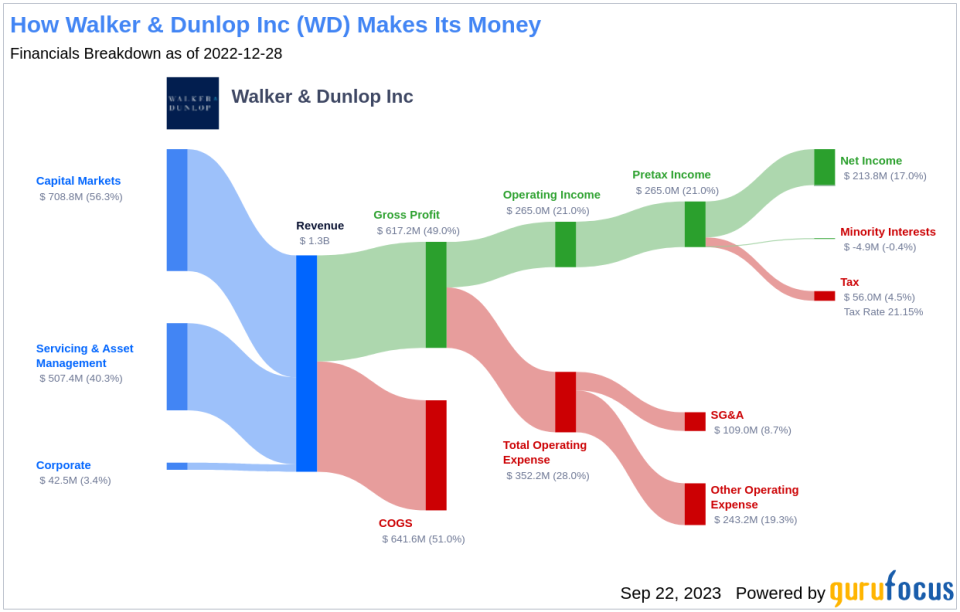

Investing in profitable companies, especially those demonstrating consistent profitability over the long term, poses less risk. Walker & Dunlop has been profitable 10 out of the past 10 years. With a revenue of $1.1 billion and an Earnings Per Share (EPS) of $4.25 in the past twelve months, the company's operating margin is 15.5%, ranking lower than 68.29% of the companies in the Banks industry. Despite this, the company's profitability is strong.

The growth of a company is a crucial factor in its valuation. Walker & Dunlop's 3-year average annual revenue growth is 13.2%, ranking better than 78.06% of the companies in the Banks industry. However, its 3-year average EBITDA growth rate is 7.2%, ranking worse than 51.28% of the companies in the Banks industry.

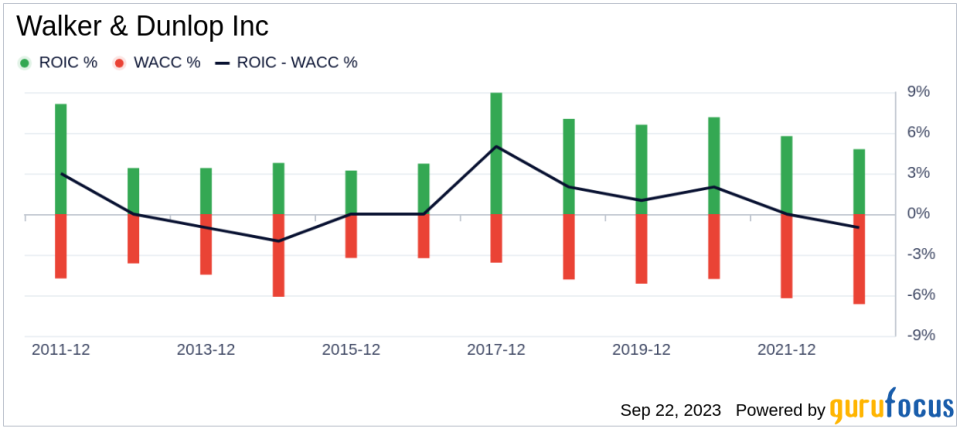

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC) is another way to assess its profitability. For the past 12 months, Walker & Dunlop's ROIC is 2.99, and its WACC is 7.74.

Conclusion

In conclusion, Walker & Dunlop's stock appears to be modestly undervalued. Despite its poor financial condition, its profitability is strong. Its growth ranks lower than 51.28% of the companies in the Banks industry. For more information about Walker & Dunlop stock, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please visit the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.