Wall Street’s #1 Analyst Sees Over 25% Upside for These 3 Tech Stocks

What does it take to be the best? On Wall Street, it takes a sharp eye for stocks and a clear view of what makes a winning investment – and not every analyst has that. TipRanks finds those who do, however, by using natural language algorithms to sort through the records of more than 5,500 analysts. The results show that Cantor's Joseph Foresi is at the head of the pack, with an 86% success rate and a 23% yearly average return on his ratings.

Foresi is a tech sector expert, with a proven record that has earned him the #1 spot in the TipRanks database. So, when he starts pointing out stocks with high potential for return, investors open up their ears. We’ve pulled up three of his recent reviews, to find out ones Foresi sees as compelling buys in the tech market.

Square (SQ)

The top competitor to PayPal in the online payment environment, Square offers online financial services and mobile payments for merchants and vendors. The company’s Square Reader allows any smartphone to read scan a credit card, while the Square Stand can turn Apple’s iPads into cash registers. The company is a great boon to small merchants and traveling vendors. The devices are money-saving, and are popular with small businesses.

In addition to its line of clever transaction gadgets, Square also offers the Square Cash App, a head-to-head competitor with PayPal’s Venmo, the combination payment transfer service/social network. Square’s Cash App boasts more than 7 million active users, and even supports Bitcoin trading.

Foresi focused on Cash App in his recent review of Square. He said, “We believe that Cash App is Square's entrance into a consumer money management platform. The Cash App can take advantage of the opportunities in people-to-people and debit usage growth. We estimate Cash App will represent incremental adjusted revenue growth of 10 percentage points on average over three years.”

At the bottom line, Foresi says of Square and Cash App: “SQ Cash looks well positioned to continue taking market share in P2P through viral, grass roots marketing & its incentivized network effect. We are positive on SQ Cash's future monetization, as it has the largest offerings for a P2P platform, and SQ looks to continue to roll out new solutions.” He further notes that Cash App is the leader in P2P Bitcoin trading, and that there is high potential for the app to tap into SQ’s merchant network as a user base for Bitcoin trading.

In line with his upbeat outlook on Cash App, and Square generally, Foresi rates SQ stock an Overweight along with $91 price target, indicating confidence in over 40% upside.

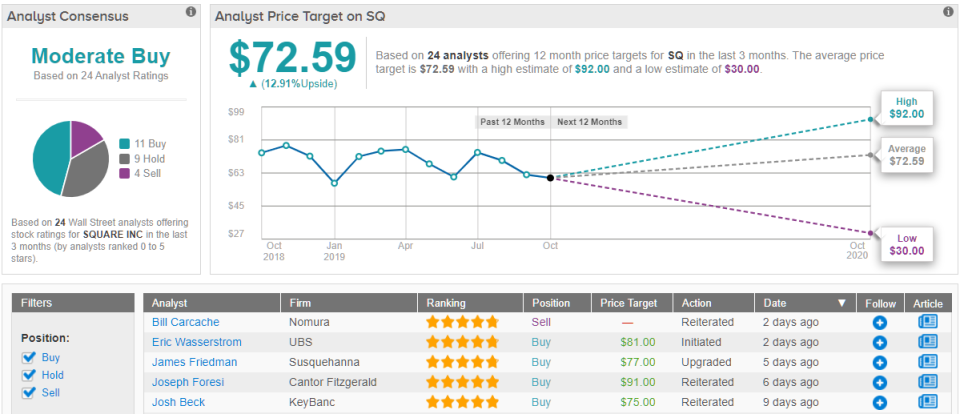

Overall, SQ has drawn optimism mixed with caution when it comes to consensus opinion among sell-side analysts. Out of 24 analysts polled by TipRanks in the last 3 months, 11 are bullish on SQ stock, 9 remain sidelined, while 4 are bearish on the stock. With a slight return potential of 13%, the stock's consensus target price stands at $72.59, revealing apprehension baked into analysts' expectations. (See Square stock analysis on TipRanks)

Virtusa (VRTU)

Founded in the island nation of Sri Lanka, off the southeast coast of India, Virtusa is a leader in the subcontinent’s information tech sector. The company’s headquarters are in Massachusetts, and it has offices throughout the US, Europe, the Middle East, and South Asia. In 2018, Virtusa brought in more than $1 billion in total revenues. Virtusa earns those revenues through its core businesses: outsourcing of IT and systems implementation for large enterprises – particularly international banks – and software companies.

Building a firm niche providing valued services to the banking industry has brought with it financial rewards. Virtusa’s billion-dollar 2018 revenue nearly matched the company’s $1.08 billion market cap, and Virtusa’s last-quarter earnings beat the forecast by 9%.

Top analyst Foresi has been impressed by Virtusa’s performance, as well as by the company’s top brass. He attended a set of management meetings last month, and came away satisfied that VRTU has plenty of profit potential going forward. He wrote, after the talks with management, “VRTU had a strong FY19, growing 22%, but revised FY20 guidance down in the most recent quarter given weakness from a top banking client. Margins are expected to expand 60 bps in FY20 and 100 bps long term. The pipeline continues grow, especially in Digital, as more companies move past the experimental phase of cloud.”

On the last point, that Virtusa’s future growth will continue to expand as clients increase their reliance of cloud software, Foresi elaborated: “Banks are shifting from the experimental phase of cloud to large transformations. Management notes wallet share is growing with clients and clients are attracted to Virtusa's scrum team transparency and ability to track the performance, a feature unique among outsourcing companies. Virtusa is able to attract clients due to a fundamental focus on engineering arbitrage & efficiency coupled with the traditional cost arbitrage benefits to clients.”

Foresi acknowledges the potential weakness in Virtusa’s model – that “outsourcing companies typically face client concentration risk” – but expects Virtusa can find a balance among its client types. He adds that it is at heart an IT company, and IT services “remains a comparatively sticky business.” Foresi sees a 26% upside potential to VRTU, giving it a $45 price target.

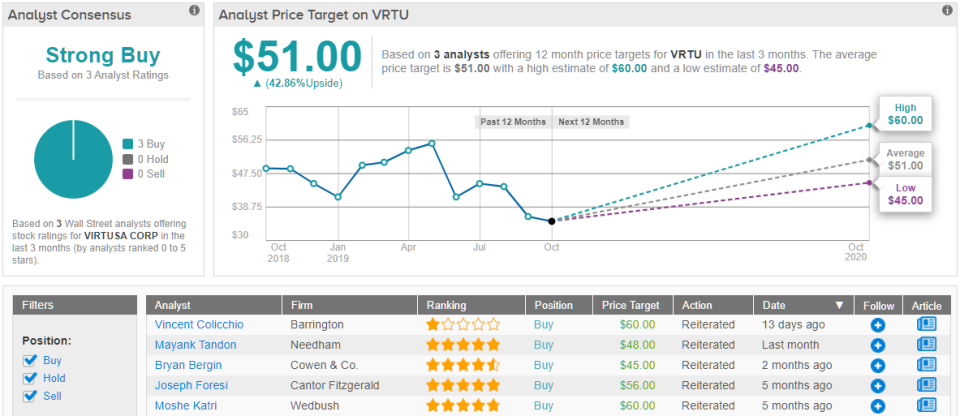

How does Foresi's bullish bet measure up against the word of the Street? Quite on point, it seems, considering TipRanks analytics exhibit VRTU as a Strong Buy. Out of 3 analysts polled in the last 3 months, all 3 are bullish on Virtusa stock. With a return potential of 43%, the stock’s consensus target price stands at $51. (See Virtusa stock analysis on TipRanks)

Exela Technologies (XELA)

Sometimes, a great stock buys comes at a bargain. XELA is a dollar stock, combining a bargain price with sky-high potential. Founded just two years ago, in Texas, the company has built its niche in the world of business process automation, offering services in cognitive automation, digital mail rooms, payment processing, and workflow automation to 3,500 customers in 50 countries. Exela Technologies has grown fast, but that growth has brought some questions.

Chief among those questions are issues of fraud. The company’s major stockholder, a company called HandsOn Global Management, has faced recurring investigations for fraudulent activity, and has had to answer to the FBI. It’s a serious matter with potential to drive away investors – especially as Exela, like so many tech start-ups – has yet to post a positive quarterly EPS. While Exela’s management has not been implicated in the fraud investigations, that its major shareholder has does raise legitimate questions of credibility.

Looking at the business end, however, pulls up a better picture. Exela has recently announced that it will enter a partnership with General Dynamics, on a contract with the US Department of Veterans Affairs. The contract, worth $900 million over the next 5 years, is part of the VA’s $2 billion Veterans Intake, Conversion, and Communication Services program. It’s the largest contract announcement in Exela’s short lifetime.

Foresi says the company showed $29 million in free cash flow in the last quarter, an important sum as it allowed payment toward short-term debt. He added that Exela spent the last quarter focusing on its balance sheet and improving leverage. He wrote, “We believe management is looking at strategic alternatives. We expect the company to deliver slight revenue growth with margin expansion over time.”

Regarding management’s outlook, Foresi said, “Management looks for cost savings in the long term from investments into optimization and restructuring charges… Digital Now growth continues due to a recent win with a large US bank. Management noted Q2 showed softness due to one-time non-cash items and expects 2H19 to pick up.”

Bottom line: The Street’s best analyst put a $6 price target on a stock with a current trading price of just $1.02, suggesting a whopping 488% upside potential. Clearly, if Exela can avoid the potential pitfalls of disreputable shareholders and too much leverage, then the way is clear for excellent returns.

Exela only has two analyst reviews in the past 3 months, but both give Buy ratings. The stock’s average price target is $4.50, giving it a high upside of 341%.