Wall Street’s Best Analyst Bets on These 3 Energy Stocks – Here’s Why You Might Want to Ride His Coattails

Wall Street’s analysts make their reputations by the quality of their stock notes, and some of them stand tall above their peers. The best analysts bring a sharp eye to the table, and a combination of solid knowledge and deep experience that lends credence to their stock calls. So, when those top analysts start selecting particular stocks as sound choices for investors, we should all take notice.

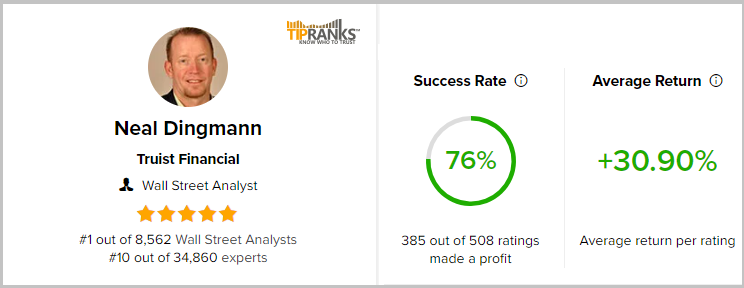

And now, the Street’s top analyst, Truist’s Neal Dingmann, has been doing just that. Dingmann holds the #1 rating out of more than 8,500 active stock analysts, a rating based on the 76 percent of his stock calls that were successful in the last 12 months. An investor following Dingmann’s advice over that 12-month period would have realized an impressive 31% return.

Dingmann is an energy stock expert and he has been selecting his picks for the coming months, so let’s take a closer look at some of his sector calls and why you might want to ride his coattails. Further adding to these stocks’ appeal, according to the TipRanks data, all are also rated as Strong Buys by the analyst consensus, with double-digit upside potential. Here are the details, along with Dingmann’s comments.

Kodiak Gas Services, Inc. (KGS)

We’ll start in the natural gas segment, where Kodiak Gas Services is a billion-dollar-plus player in the natural gas industry, offering compression services. This is a vital step in moving gas from the production sites through the pipelines to the refineries and end users. Kodiak is a contract provider of large-scale compression services and infrastructure in the US gas sector, and describes its services as ‘critical to our customers’ ability to reliably produce natural gas.’

The company was founded in 2010, and today holds leading positions in many of the major production basins across the US. The company has particularly extensive activities in the Permian Basin of West Texas. In addition to its direct compression services, Kodiak also designs and builds gas compressor stations; the firm’s revenue-generating fleet of compressor equipment totals over 3 million horsepower.

This past summer, Kodiak entered the realm of publicly traded stocks with an IPO that closed on July 3. The shares debuted at $16 per share, a value seen as low – the company had originally set an initial share price between $19 and $22. The sale totaled 16 million shares and netted the company $231.4 million in cash proceeds.

On August 9, Kodiak released its first quarterly financial results as a public company, and the results showed improving fundamentals. The top-line revenue of $203.3 million was up over 14% year-over-year. On the bottom line, net income almost doubled vs. the same period last year and resulted in EPS of 30 cents. Kodiak’s operations have been generating increased free cash flow over the last 12 months; in the year-ago quarter, the company registered a $2.2 million FCF loss, but the current report shows a positive FCF exceeding $33 million.

For Dingmann, Kodiak’s solid niche position and its recent proven ability to generate cash are key points for investor consideration. The Truist analyst writes, “Kodiak delivered solid results for its first quarter as a public company with equally as positive remaining 2023 expectations that include increased spend/earnings. The company continues to benefit from a tight gas compression market with limited competition along with company efficiencies that continue to result in nearly 100% horsepower utilization. KGS remains one of few midstream companies with demand likely to continue to outpace supply for the coming quarters resulting in solid pricing power. We forecast continued solid FCF driving attractive shareholder return and further debt repayment.”

These comments come along with a Buy rating on this newly public stock, and a $24 price target that suggests a 35% upside potential in the next 12 months. (To watch Dingmann’s track record, click here.)

In its short time as a public entity, Kodiak has already picked up 8 analyst reviews, with a 7 to 1 breakdown favoring Buys over Holds giving the stock its Strong Buy consensus rating. The $17.82 trading price and $24.25 average price target combine to imply a gain of 36% lying in wait for the coming year. (See Kodiak’s stock forecast.)

Northern Oil and Gas (NOG)

Next up is Northern Oil and Gas, an exploration and production company operating in three of North America’s most important hydrocarbon production basins: the Williston Basin of Montana and the Dakotas; the Permian Basin of Texas-New Mexico; and the Marcellus formation of western Pennsylvania. These geological formations hold the oil and gas reserves that, about 15 years ago, pushed the US to a leading position among the world’s oil and gas producers.

Northern has made the best of its strong holdings and operations in these rich hydrocarbon regions. The bulk of the company’s operations, 64% of the firm’s total activities, are in the ~183,500 net acres of its Williston Basin holdings. Northern’s Marcellus and Permian positions total 62,000 and 10,000 acres respectively and make up 16% and 20% of the company’s hydrocarbon production. Of the company’s output, 60% is in liquids, mainly crude oil but also including natural gas liquids, while 40% is natural gas.

Getting to results, we find that Northern realized $416.5 million in oil and gas sales during the second quarter of this year, a total that was down 24% year-over-year but came in almost $4.4 million above the estimates. The company’s adjusted net income per common share, its non-GAAP EPS, was listed as $1.49. While down from $1.72 in the year-ago period, the 2Q23 EPS was 15 cents better than the forecast. NOG generated $47.6 million in free cash flow during the quarter. These results were based on a record quarterly production figure of 90,878 barrels of oil equivalent per day. Production was up 4% from 1Q23, and 25% from 2Q22.

In the weeks since the 2Q23 release, Northern has announced the closure of its latest acquisition – of Northern Delaware Basin assets from Novo Oil & Gas. The transaction cost Northern a total of $468.4 million in cash, and was conducted jointly with Earthstone Energy. Northern and Earthstone have entered into a joint operating agreement regarding future development of the Novo assets.

Turning again to top analyst Dingmann, we find that he draws attention to Northern’s cash flow and its acquisition moves. Dingmann writes in his latest note on the stock, “Northern is in a unique position after completing several, what we consider to be accretive acquisitions, seeing baseline production improve and having a solid balance sheet. We forecast the company to generate a ’24 FCF yield of nearly 30%; one of the highest in our coverage group despite NOG recently hitting its 52-week high stock price. The company is in an enviable position of being the largest non-operated E&P uniquely positioned for any future accretive deal.”

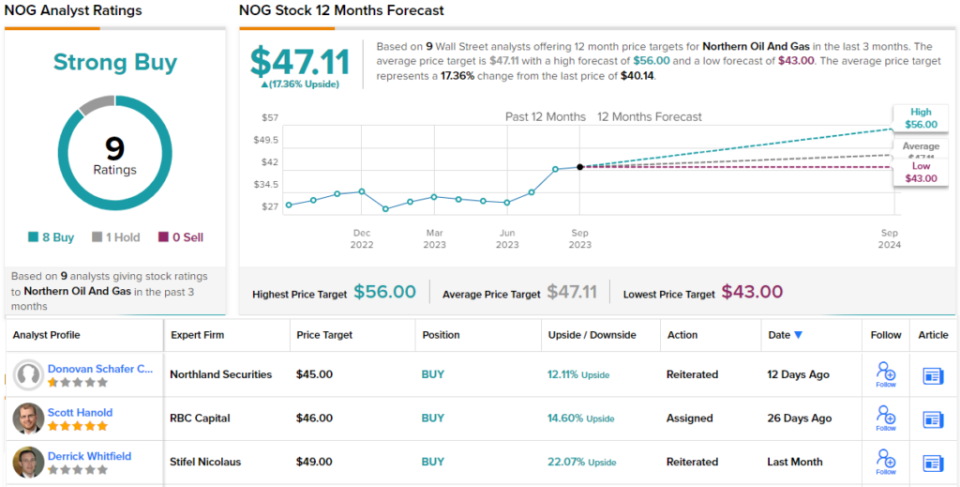

Looking ahead, the Truist analyst puts a Buy rating on NOG, and his $56 price target implies it will appreciate by 39% over the next year.

The Strong Buy consensus rating on NOG is based on 9 recent reviews from the Street’s analysts, including 8 to Buy and 1 to Hold. The average price target here is $47.11 and the selling price is $40.14; together, these figures point toward a 17% one-year upside potential. As an added bonus, NOG also offers a dividend. The current payout stands at $0.38 per quarter and yields ~3.1%. (See Northern’s stock forecast.)

Chord Energy (CHRD)

Last on our list of Dingmann’s picks is Chord Energy, another operator in the Williston Basin of the northern Plains. Chord’s activity within the larger Williston is focused primarily in North Dakota, with some extensions into Montana. With approximately 963,000 net acres of holdings, Chord is a major player among the region’s oil and gas producers.

Currently, Chord has 4 rigs in operation, using unconventional methods to release oil from the underground reservoirs. A majority of the company’s reserves are comprised of oil, some 57%; much of the rest is natural gas and natural gas products. Chord has a history of expanding its footprint through strategic acquisitions, and in May of this year the company made an agreement with XTO energy to that end. Chord will acquire approximately 62,000 net acres from XTO, in the Williston, for $375 million in cash. A large portion of the new acreage, 77%, is undeveloped.

The cash nature of that transaction shows Chord’s underlying strength – the company can generate plenty of liquid assets. In 2Q23, the company had net cash from operations of $408.2 million, and adj. free cash flow totaling $105.3 million. Chord’s cash reserves and cash flow allowed it to afford the XTO purchases, and in Q2 the company also returned $87 million in capital to shareholders. The capital return was made, in part, through a $1.36 base-plus-variable common share dividend payment, sent out on August 29. The annualized dividend of $5.44 gives a yield of ~3.4%.

Elsewhere, the company showed mixed financial results recently, with a strong top-line and a bottom-line miss in 2Q23. The revenue figure, of $912.07 million, was up 15.5% y/y, and beat the forecast by $259.7 million. At the bottom line, the non-GAAP EPS figure of $3.65 was down sharply from the $7.30 reported in the prior-year quarter, and was 18 cents below expectations.

The earnings miss did not worry Dingmann, who sees Chord’s production capabilities and FCF as the chief factors for investors’ consideration. Dingmann writes, “Chord continues to produce some of the stronger Bakken wells driven by a combination of improved well spacing, extensive analogs, efficient drilling and completions, along with a host of other improvements. The result has been consistently improved well returns in most of their key areas resulting in notable FCF that allows for material shareholder return and a recent accretive acquisition. We forecast continued stable production with potential for further accretive deals that we would prefer to be only in-basin.”

These comments complement Dingmann’s Buy rating, and his price target, set at $221, implies that the shares will appreciate by 40% over the next 12 months.

Zooming out, we find that Chord’s 8 recent analyst reviews include 7 Buys against a single Hold, for a Strong Buy consensus rating. The shares are selling for $158.23 and their $183.78 average price target suggests a 16% increase on the one-year horizon. (See Chord Energy’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.