Wall Street Best Analysts Sing the Praises of These 2 Stocks

It was a solid day for US equity markets, with all three major indices gaining throughout US trading hours. Optimism once again seems to be the prevailing sentiment on Wall Street. Nevertheless, these have been confusing times, with the markets repeatedly pulling in different directions.

So what should investors do? One strategy is to follow the experts. The very best of Wall Street’s professional stock analysts have built their reputations on consistent records of accurate stock calls and strong returns. They are not shy about publishing their opinions, and their stock reports bring valuable insights to the table.

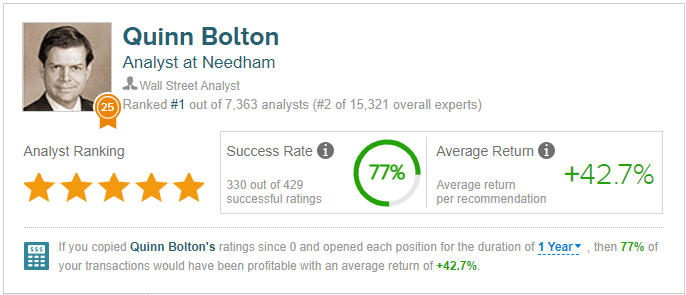

With this in mind, we’ve turned to the highest-ranked analysts in the TipRanks database, the Wall Street pros who stand out from their peers based on measurable success, to find out which stocks they like for the coming months. Specifically, we’re looking at calls from the top 2 analysts, whose success rates exceed 77% and whose calls have brought returns of 38% or better.

SiTime Corporation (SITM)

We’ll start with SiTime Corporation, a company that inhabits a highly specific – but utterly necessary – niche in the high tech field. SiTime develops and builds MEMS timing tech for electronic systems. The company’s products include clock generators, oscillators, and resonators, devices essential in maintaining stable signals in network systems.

SiTime’s niche – and its products – have been in higher demand in recent years due to the expansion of 5G networking technology. Finishing up 2020, SITM showed strong results. In 4Q20, revenue gained 43% year-over-year, to reach $40.3 million, while the full-year top line hit $116.2 million, a 38% yoy gain. Earnings came in at 10 cents per share, and while the figure came in below the estimates, the profit came as a welcome turnaround from the net losses of the three previous quarters.

Turning to the analyst community, SITM has caught the notice of Needham analyst Quinn Bolton, who holds the #1 spot in TipRanks’ analyst rankings.

“We continue to believe SiTime is a unique, high growth company with a deep competitive moat as the only supplier of internally designed, silicon-based solutions for all three segments of the $8bn+ timing market…. As the industry's leading supplier of MEMS-based timing solutions and the only company with a complete portfolio of all-silicon timing devices, we believe SiTime will be the primary beneficiary of increasing adoption of MEMS-based timing solutions,” Bolton wrote.

In line with his comments, Bolton rates the stock a Buy and his $150 price target suggests a 38% upside for the next 12 months. (To watch Bolton’s track record, click here)

As far as numbers can show, it appears that Wall Street agrees with Bolton. The stock has a Strong Buy consensus rating, based on a unanimous 5 Buy-side reviews, and the $151.20 average price target, implying a 39% one-year upside, is congruent with Bolton’s. (See SITM stock analysis on TipRanks)

PetIQ, Inc. (PETQ)

We all love our pets, so that’s where we’ll head for the next stock. PetIQ is an online distributor, as well as a manufacturer, of health and wellness products for cats and dogs. The company’s products include both consumables and non-consumables, and well-known brands include Sergeant’s and Sentry. PetIQ also offers veterinary services through a network of clinics and wellness centers around the country.

PetIQ has been struggling with earnings, reporting consistent losses. In Q3 of last year, that loss reached as low as $2.53 per share – but in the recent Q4 report, despite missing the estimates, the loss had moderated to 41 cents per share. Revenues, at $164 million, were consistent with the third quarter print and up 6.4% year-over-year. For the full year 2020, net sales increased by 10% over the previous year, to $780.1 million. Finally, in regard to COVID-19, PetIQ has reopened all of its clinics and wellness centers for operations.

Covering this stock for Oppenheimer is Brian Nagel. Nagel holds the #2 ranking out of 7,363 analysts in the TipRanks database.

“We come away from our initial review of fourth-period results increasingly encouraged with underlying trends at the company and its ability to, over time, capitalize well upon a recent COVID-19-fueled surge in pet adoptions…. As we have long indicated, in our view, the market continues to underappreciate significantly the near- and longer-term earning power of PETQ and the power of recent enhancements to its unique business model, which over time will help to support sustained sales and profit trajectories,” Nagel opined.

Nagel puts a $50 price target on PETQ, along with an Outperform (i.e. Buy) rating. His target suggests a 35% upside for the stock in the next 12 months. (To watch Nagel’s track record, click here)

What does the rest of the Street think? It turns out that they wholeheartedly agree with Nagel. With 4 Buy ratings and no Holds or Sells, the message is clear: PETQ is a Strong Buy. (See PETQ stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.