Wall Street’s Favorite Flying Car Stocks? 3 Names That Could Make You Filthy Rich

Flying cars are the future.

What seemed like fiction may soon become reality. In 2022, the flying car market was valued at about $220M, while in 2032 it is expected to grow to nearly $4B, representing astounding growth. Many companies are in the flying car space, however, it is highly competitive and only the best will survive. Below are three of the best flying car stocks to invest in.

Archer Aviation (ACHR)

Source: T. Schneider / Shutterstock.com

San Jose-based Archer Aviation (NYSE:ACHR) is one of the biggest electric vertical take-off and landing (eVTOL) aircraft companies.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Though relatively new, it’s made significant strides toward establishing itself in the flying car market through contracts. Recently, it penned a Space Act Agreement with NASA. This makes it the sole flying car company partnered with the space giant. NASA’s pursues using eVTOL technology to make the U.S. the future leader of this new form of air transportation.

Additionally, some of the technology will be used on space missions. Also, Archer Aviation is supplying the U.S. government with their Midnight model, earning a large contract of up to $142 million.

Further, Archer’s financials support the buy thesis. Currently, the company is only valued at around $1.5 billion, indicating room for significant growth. If the flying car market performs well, Archer Aviation is one of the companies at the forefront of innovation that will likely benefit. Finally, the company is narrowing down its losses, losing around $110 million in the past quarter in comparison to around $180 million 3 quarters ago.

XPENG Inc. (XPEV)

Source: Johnnie Rik / Shutterstock.com

Xpeng (NYSE:XPEV) is a leading Chinese flying car company with significant innovation in the field.

They are responsible for the development of the modular flying car concept, an eVTOL model that can quickly turn into a ground car. Through partnerships with the UAE, Egypt, Azerbaijan, Jordan and Lebanon, they are expanding into new markets. Their groundbreaking technology forges onward while receiving funding to continue with innovation.

Furthermore, XPEV’s financials are almost as strong as its fundamentals. Considering that the company has a strong EV segment, they are able to offset many of the losses that come with eVTOL development and fund research and development in the field. Truely, most eVTOL companies don’t even have revenue. However, XPENG Inc. reached a staggering $13.05B in the past quarter, while boasting a profit margin of only -10.33%. While its losses are not ideal, they are significantly better than their competitors’. In fact, they have been consistently dropping. Just a year ago, their profit margin was -57.94%.

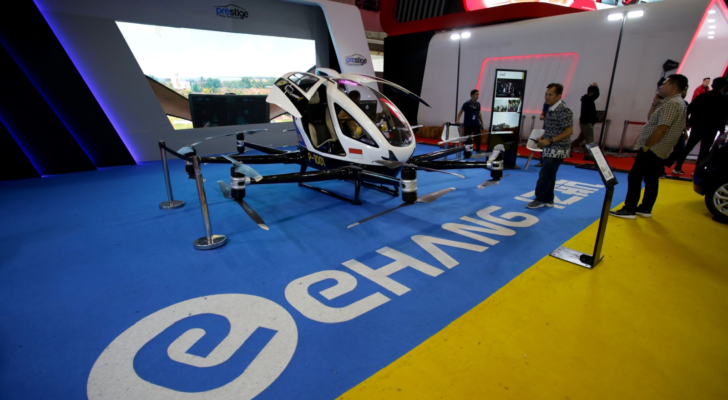

EHang (EH)

Source: Toto Santiko Budi / Shutterstock.com

EHang (NYSE:EH) is one of the largest flying car companies in China. They have created the world’s first electric Autonomous Aerial Vehicle. Additionally, EH has an impressive list of successful eVTOL models such as the EH216-S.

After thousands of tests and sales in different Chinese cities, EHang just started selling its eVTOL models to the rest of the world, setting itself up to be one of the only eVTOL companies with revenue. Their model is truly innovative. And, they are on track to reach economies of scale, placing them ahead of competition in the eVTOL space.

Finally, EH’s financials also support a buy thesis for the company. They’re one of the only eVTOL companies with revenue, reporting $56.6 M in the past quarter. Additionally, their revenue is skyrocketing, growing at over 260% year over year (YOY). While losing money, their losses are constantly shrinking as revenue increases.

On the date of publication, Tomas Levani did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Tomas is a self-taught investor with a passion for ESG investing. He has managed the portfolio of a small investment fund, interned at a Fortune 500 investment company, and started his own research firm. Through his freelance writing, he now aims to find favorable investments in companies with a mission of bettering the world.

More From InvestorPlace

The #1 AI Investment Might Be This Company You’ve Never Heard Of

Musk’s “Project Omega” May Be Set to Mint New Millionaires. Here’s How to Get In.

It doesn’t matter if you have $500 or $5 million. Do this now.

The post Wall Street’s Favorite Flying Car Stocks? 3 Names That Could Make You Filthy Rich appeared first on InvestorPlace.