Wall Street Sees 100% Upside for This Artificial Intelligence (AI) Stock No One Is Talking About

Artificial intelligence (AI) is changing almost every industry, and investors can't get enough of it. But how can you distinguish between the hype and companies that are the wave of the future? You do the same deliberate analysis you should always do with any stock you're considering adding to your portfolio. How is the company performing today? What are its challenges and opportunities? Is management promising the moon? And don't forget valuation.

Pagaya Technologies (NASDAQ: PGY) is one AI stock that hasn't yet captured market attention, but Wall Street sees plenty of upside for its stock. Should you buy it now?

Disrupting the traditional credit evaluation process

Pagaya operates a credit evaluation platform informed by AI. The digital infrastructure means it can process millions of data points and create a more accurate picture of a borrower's credit than the traditional credit score.

It has a two-sided business that works with banks and creditors to identify more loan opportunities without increasing the risk of default on one side, and then it bundles its loans and sells them as asset-backed securities (ABS) to large institutional lenders on the other side.

This isn't its best moment right now with high interest rates, but it's reporting impressive performance nevertheless.

Let's go through the 2023 fourth-quarter and full-year results:

Period | Network volume growth | Revenue growth | FRLPC change | Adjusted EBITDA | Net income |

|---|---|---|---|---|---|

Fourth quarter | 33% | 13% | 42% | $34 m +$43 m from last year | ($14 m) +$20 m from last year |

Full year | 14% | 8% | 13% | $82 m +$87 m from last year | ($128 m) +$186 m from last year |

Data source: Pagaya quarterly results. FRLPC = revenue from fees less production costs. EBIDTA = earnings before interest, taxes, depreciation, and amortization. All growth is year over year.

Management is expecting network volume to increase by about 20% in 2024, revenue to increase by about 23%, and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) to more than double.

Harnessing vast opportunities

Pagaya is marketing its product to various types of creditors, such as banks, auto lenders, and credit card networks. It works with many names you know, such as Visa, Ally Bank, and SoFi Technologies. It recently announced a partnership with Westlake Financial, an auto loan group with 50,000 dealers. Of these, 2,500 are going live with a product for used car sales, and it's expected to be in all branches by 2025. It's also in the process of developing a model for new car sales.

It recently announced the identity of its mysterious new large banking partner as U.S. Bank, the fifth-largest U.S. bank by assets. It has 15 enterprise clients in its pipeline, and its goal is to onboard two to four new, large clients annually.

Management says that banks double their average activation rate (the rate at which customers accept a loan offer generated by Pagaya's technology) for personal loans when using Pagaya's platform.

Pagaya is the top issuer of ABS loans in the U.S., and it raised $6.6 billion last year. It already announced two new rounds of funding so far in 2024, with a $290 million credit facility connected to BlackRock, UBS, JPMorgan Chase, Valley Bank, Bank Leumi, and Israel Discount Bank announced this month. All of Pagaya's loans are fully funded before issue.

Challenges and risks

There are challenges and risks here, too. Pagaya is young and doesn't have a long enough track record to demonstrate stability and viability despite how well it's performing.

It's moving closer to profitability, but it's not yet net profitable according to generally accepted accounting principles (GAAP) standards, and it's not yet cash-flow positive.

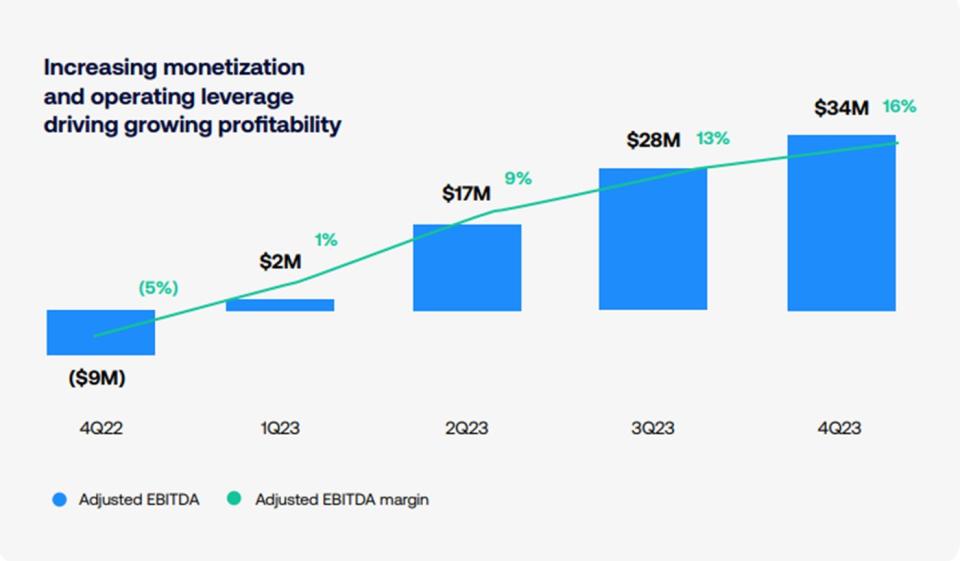

In the fourth quarter, however, core operating expenses declined as a percentage of revenue for the fifth consecutive quarter. It was the second quarter in a row with positive GAAP operating income and positive operating cash flow, and management expects to become cash-flow positive in early 2025. Adjusted EBITDA margin is increasing along with adjusted EBITDA.

Valuation and potential

Pagaya stock is up 46% during the past year, and at the current price, it trades at a price-to-sales ratio of 1.4. That's a bargain for a high-growth stock with serious disruptive opportunity.

The average Wall Street analyst forecast for Pagaya stock is $3, or about double today's price, and one analyst sees it going as high as $6 during the next 12 to 18 months, a gain of 300%.

This looks like it could be an incredible opportunity for growth-oriented investors, but at this stage, it's definitely risky. Pagaya isn't profitable yet, it's still proving itself, and it's operating in a volatile industry right now.

Should you invest $1,000 in Pagaya Technologies right now?

Before you buy stock in Pagaya Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pagaya Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Ally is an advertising partner of The Ascent, a Motley Fool company. Jennifer Saibil has positions in SoFi Technologies. The Motley Fool has positions in and recommends JPMorgan Chase and Visa. The Motley Fool recommends Pagaya Technologies. The Motley Fool has a disclosure policy.

Wall Street Sees 100% Upside for This Artificial Intelligence (AI) Stock No One Is Talking About was originally published by The Motley Fool