Wallace Weitz Bolsters Portfolio with a 1.48% Stake in Equifax Inc

Insight into Weitz's Q3 2023 Investment Moves and Top Stock Picks

Wallace Weitz (Trades, Portfolio), the seasoned portfolio manager behind Weitz Investment Management, has revealed his latest investment decisions in the third quarter of 2023. With a career that spans over four decades, Weitz has honed a unique value investing strategy that marries Benjamin Graham's principles with a keen eye for qualitative factors that influence a company's long-term success. His funds, including the Weitz Value Fund, Weitz Hickory Fund, and Weitz Partners Value Fund, reflect this thoughtful approach to stock selection.

New Additions to the Weitz Portfolio

During the quarter, Weitz expanded his portfolio with four new stocks:

Equifax Inc (NYSE:EFX) emerged as the standout addition, with Weitz purchasing 146,000 shares. This investment now accounts for 1.48% of his portfolio, valued at $26.74 million.

Microchip Technology Inc (NASDAQ:MCHP) was another significant acquisition, with 259,600 shares representing 1.12% of the portfolio, totaling $20.26 million.

Liberty Live Group (NASDAQ:LLYVK) also joined the ranks with 490,000 shares, making up 0.87% of the portfolio at a value of $15.72 million.

Key Position Increases

Weitz didn't just add new stocks; he also bolstered his positions in 11 existing holdings:

Thermo Fisher Scientific Inc (NYSE:TMO) saw an impressive 20.62% increase in shares, with Weitz adding 21,380 for a total of 125,080 shares. This adjustment had a 0.6% impact on the portfolio, with a total value of $63.31 million.

Danaher Corp (NYSE:DHR) also experienced a boost, with 17,450 additional shares bringing the total to 327,760. This 5.62% increase in share count is valued at $72.08 million.

Exiting Positions

The third quarter also saw Weitz exit positions completely in two companies:

Black Knight Inc (BKI) was one such exit, with Weitz selling all 311,400 shares, impacting the portfolio by -1%.

Strategic Reductions

Concurrently, Weitz trimmed his stakes in 17 stocks. Notable reductions include:

CoStar Group Inc (NASDAQ:CSGP) was reduced by 121,000 shares, a -11.33% decrease, impacting the portfolio by -0.58%. The stock's average trading price was $82.85 during the quarter, with a -2.99% return over the past three months and a 1.48% year-to-date return.

Liberty Broadband Corp (NASDAQ:LBRDK) saw a -16.71% reduction of 133,500 shares, affecting the portfolio by -0.57%. It traded at an average price of $89.2 and returned -11.84% over the past three months and 7.49% year-to-date.

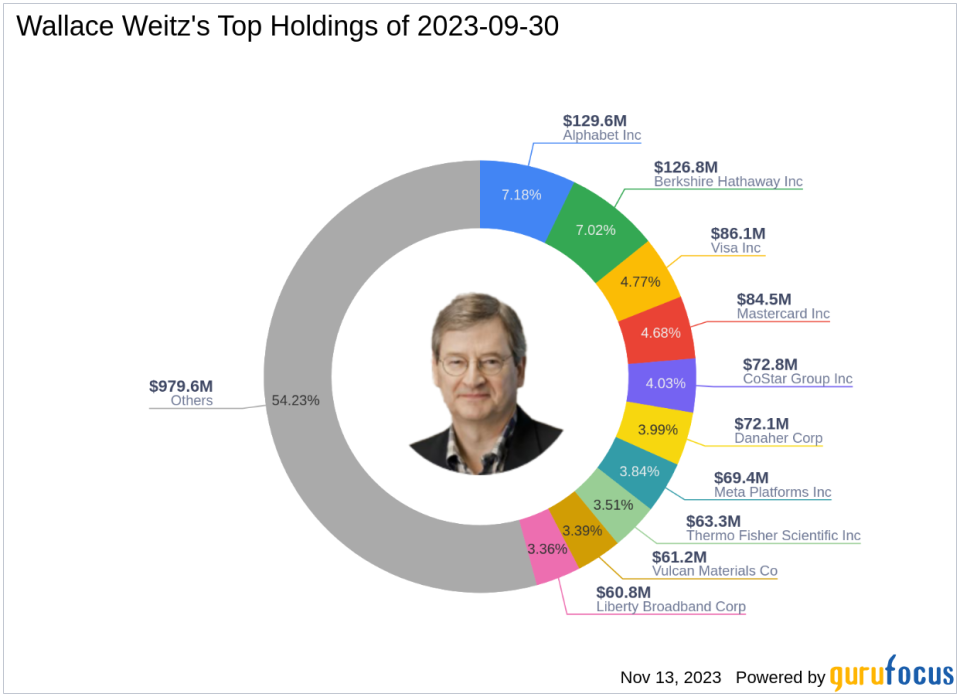

Portfolio Overview

As of the third quarter of 2023, Wallace Weitz (Trades, Portfolio)'s portfolio is composed of 52 stocks. The top holdings include 7.18% in Alphabet Inc (NASDAQ:GOOG), 7.02% in Berkshire Hathaway Inc (NYSE:BRK.B), 4.77% in Visa Inc (NYSE:V), 4.68% in Mastercard Inc (NYSE:MA), and 4.03% in CoStar Group Inc (NASDAQ:CSGP). The investments are predominantly concentrated across nine industries, showcasing Weitz's diversified approach to value investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.