Wallace Weitz Positions Global Payments Inc as a Key Player in His Q4 Portfolio

Insights from Weitz's Latest 13F Filing Highlight Strategic Investment Moves

Renowned investor Wallace Weitz (Trades, Portfolio) has disclosed his portfolio updates for the fourth quarter of 2023, revealing strategic moves that reflect his evolved approach to value investing. As the portfolio manager of Weitz Value Fund, Weitz Hickory Fund, and Weitz Partners Value Fund since 1983, Weitz has honed a philosophy that marries Benjamin Graham's price sensitivity and margin of safety with a focus on qualitative factors that influence a company's long-term success.

Summary of New Buys

Wallace Weitz (Trades, Portfolio)'s latest 13F filing shows the addition of 2 new stocks to his portfolio:

Global Payments Inc (NYSE:GPN) stands out as the primary new holding, with 230,000 shares that make up 1.55% of the portfolio, valued at $29.21 million.

Liberty Global Ltd (NASDAQ:LBTYA) is the second significant addition, comprising 1,406,500 shares and representing 1.39% of the portfolio, with a total value of $26.22 million.

Key Position Increases

Wallace Weitz (Trades, Portfolio) also bolstered his stakes in 8 existing holdings:

Veralto Corp (NYSE:VLTO) saw a substantial increase of 249,446 shares, bringing the total to 358,699 shares. This represents a 228.32% surge in share count and a 1.09% impact on the portfolio, totaling $29.51 million in value.

Danaher Corp (NYSE:DHR) experienced the second-largest increase with an additional 20,250 shares, resulting in a total of 348,010 shares and a 6.18% rise in share count, valued at $80.51 million.

Summary of Sold Out Positions

In the fourth quarter of 2023, Wallace Weitz (Trades, Portfolio) completely exited one holding:

Liberty Global Ltd (NASDAQ:LBTYK) was sold off entirely, with 1,436,500 shares liquidated, impacting the portfolio by -1.48%.

Key Position Reductions

Portfolio adjustments also included reductions in 22 stocks, with notable changes in:

Gartner Inc (NYSE:IT) was reduced by 56,550 shares, leading to a 40.38% decrease in shares and a -1.07% portfolio impact. The stock's average trading price was $399.48 during the quarter.

Alphabet Inc (NASDAQ:GOOG) saw a reduction of 122,250 shares, a 12.43% decrease, affecting the portfolio by -0.89%. The stock traded at an average price of $135.69 during the quarter.

Portfolio Overview

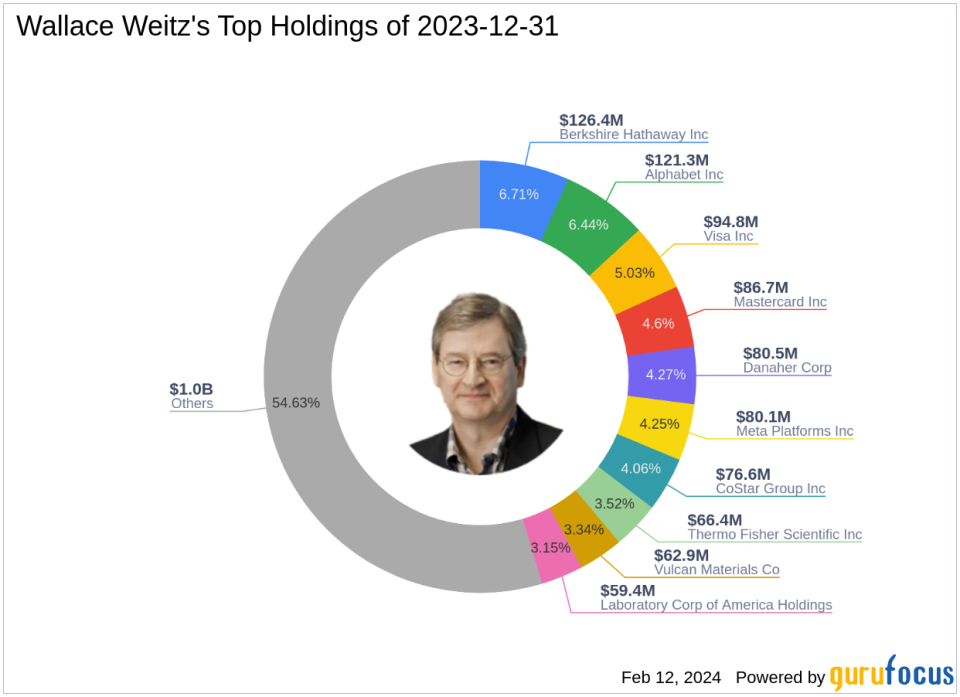

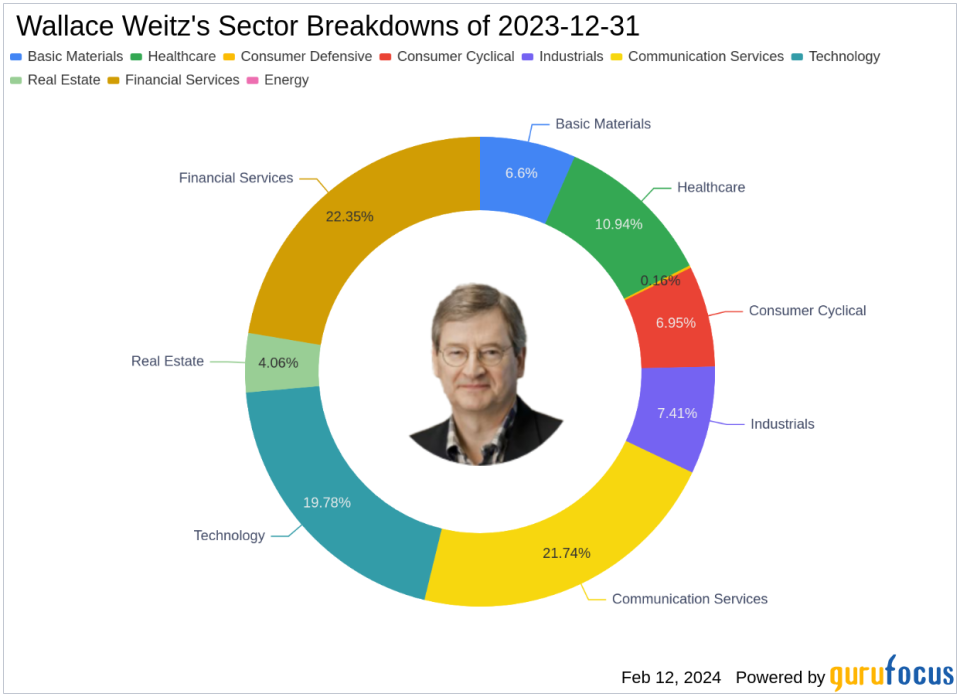

As of the end of Q4 2023, Wallace Weitz (Trades, Portfolio)'s portfolio comprised 53 stocks, with top holdings including 6.71% in Berkshire Hathaway Inc (NYSE:BRK.B), 6.44% in Alphabet Inc (NASDAQ:GOOG), 5.03% in Visa Inc (NYSE:V), 4.6% in Mastercard Inc (NYSE:MA), and 4.27% in Danaher Corp (NYSE:DHR). The investments span across 9 of the 11 industries, with a focus on Financial Services, Communication Services, Technology, Healthcare, Industrials, Consumer Cyclical, Basic Materials, Real Estate, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.