Walmart (WMT) Hikes Drivers' Pay, Reveals Fleet Development Plan

Walmart Inc. WMT is hiking the pay of its truck drivers. Thanks to the hike, drivers can now earn up to $110,000 during their first year of working with the company. Moreover, drivers who have been working for a longer period can earn more according to their tenure and location. The retail behemoth currently employs almost 12,000 drivers.

The company highlighted that workers working with Walmart can enjoy perks under the Live Better U program. In addition, Walmart launched a Private Fleet Development Program. In the 12-week program, supply chain associates across Dallas, Texas, Dover and Delaware obtained commercial driver’s license (CDL) and became full-fledged Private Fleet Walmart drivers. The company’s existing infrastructure built around LBU and Academies supported the program’s launch. The investments in training and pay are improving schedules to allow drivers to spend an increased amount of time at home.

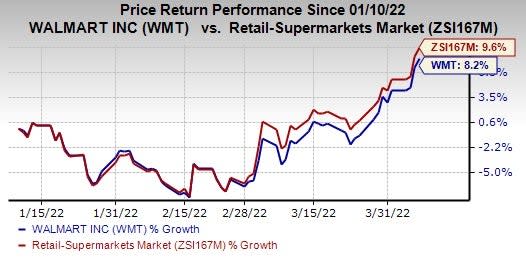

Image Source: Zacks Investment Research

What Else Should You Know?

Per media sources, the retailer’s Indian e-commerce firm — Flipkart — internally lifted its IPO valuation target by approximately a third to $60-70 billion. Sources also revealed that the company is planning a U.S. listing in 2023. Earlier, Flipkart’s IPO valuation target was set at $50 billion, with a listing planned for 2022. Reports suggested that the delay resulted from Flipkart’s willingness to boost its new digital healthcare services and travel businesses. The volatility in the global market stemming from the Russia-Ukraine crisis was also a reason.

Wrapping Up

Walmart’s e-commerce business and omni-channel penetration have been increasing amid the pandemic-led social distancing. The company has taken robust strides to strengthen its delivery arm. Walmart is also undertaking several efforts to enhance merchandise assortments. The company has been focused on store remodeling to upgrade them with advanced in-store and digital innovations. Such upsides along with Walmart’s focus on growing its transportation team, bode well.

Shares of the Zacks Rank #3 (Hold) company have increased 8.2% in the past three months compared with the industry’s 9.6% growth.

3 Retail Stocks to Bet on

Here are some better-ranked stocks — The Kroger Co. KR, Target Corporation TGT and Tractor Supply Co. TSCO.

Kroger, which operates food and drug stores, multi-department stores, marketplace stores and price impact warehouses, sports a Zacks Rank #1 (Strong Buy). Kroger has a trailing four-quarter earnings surprise of 22.1%, on average. Kroger has an expected earnings per share (EPS) growth rate of 9.9% for three to five years. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Kroger’s current financial year sales suggests growth of 2.4% from the year-ago period’s level.

Target, a general merchandise retailer, carries a Zacks Rank #2 (Buy) at present. TGT has a trailing four-quarter earnings surprise of 21.3%, on average. Target has an expected EPS growth rate of 16.5% for three to five years.

The Zacks Consensus Estimate for Target’s current financial year sales suggests growth of 3.5% from the year-ago period’s levels.

Tractor Supply, the largest retail farm and ranch store chain in the United States, currently carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 22%, on average.

The Zacks Consensus Estimate for Tractor Supply’s current financial year sales suggests growth of 8.2%, from the year-ago period’s levels. TSCO has an expected EPS growth rate of 9.8% for three-five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research