Walmart (WMT) Looks Poised to Continue Its Growth Story in 2024

Walmart Inc.’s WMT success story reflects the strength of its highly diversified business, with contributions spanning various segments, markets, channels and formats. The company has been benefiting from an increase in both in-store and digital channel traffic, reflecting its adept navigation of the evolving retail landscape. Gains from higher-margin ventures, such as advertising, are also noteworthy.

Walmart delivered a robust show in the third quarter of fiscal 2024, wherein both the top and bottom lines increased year over year. While management raised its guidance for fiscal 2024, it expects sales growth to moderate in the fourth quarter as the company continues to navigate a tough retail landscape, with customers opting for budget-friendly options due to inflation.

E-Commerce, a Key Driver

Walmart’s e-commerce business and strong omnichannel penetration have been aiding growth. The company has been taking several e-commerce initiatives, including buyouts, alliances and improved delivery and payment systems. E-commerce sales surged 15% globally on pickup and delivery in the third quarter of fiscal 2024 and formed 15% of WMT’s overall net sales. U.S. e-commerce sales rose 24%, driven by strength in pickup & delivery. At Sam’s Club, e-commerce sales jumped 16% on strong curbside and delivery.

Walmart has been innovating in the supply chain and adding capacity as well as building businesses such as Walmart GoLocal, Walmart Connect, Walmart Luminate, Walmart+ and Walmart Fulfillment Services. Other notable strides in the e-commerce realm include the buyout of a major stake in Flipkart, which has been bolstering its International segment. Walmart’s majority stake in India’s digital transaction platform, PhonePe, is also worth mentioning.

Additionally, the company has made aggressive efforts to expand in the booming online grocery space, which has long been a major contributor to e-commerce sales. Walmart has significantly bolstered its delivery capabilities, as exemplified by its Spark Driver platform, partnership with Salesforce, the expansion of the InHome delivery service, investments in DroneUp and the Walmart+ membership program, among others.

The company’s store and curbside pickup options add to customers’ convenience. As of the third quarter of fiscal 2024, Walmart U.S. had nearly 4,600 pickup locations and more than 4,200 same-day delivery stores.

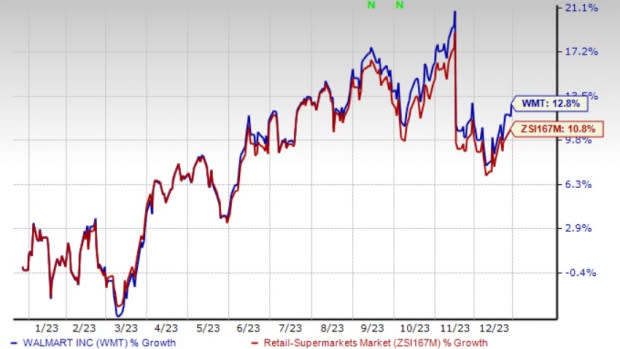

Image Source: Zacks Investment Research

Navigating a Tough Retail Landscape

Walmart has been navigating a dynamic retail landscape due to challenges like inflation and volatile consumer spending. Customers have been displaying discretion in their spending patterns, choosing more affordable options to manage within their budget. In the third quarter of fiscal 2024, Walmart continued to bear category mix-related hurdles stemming from greater rates of grocery and health & wellness compared with general merchandise. Management expects the merchandise mix pressure to persist in the fourth quarter and be more pronounced due to the volatile consumer landscape.

An uneven sales pattern keeps management cautious about customers’ spending patterns. The company expects sales growth to moderate in the fourth quarter compared with the preceding quarters. Apart from this, Walmart has been witnessing a rise in product costs. Though disinflation across some pockets has been a breather, management is hopeful of witnessing better gains, especially in the dry grocery and consumables categories.

For fiscal 2024, the company now expects consolidated net sales growth of 5-5.5% at constant currency or cc compared with the previous view of 4-4.5% growth. Adjusted EPS is envisioned to come in the band of $6.40-$6.48 now, up from the earlier range of $6.36-$6.46. Walmart posted an adjusted EPS of $6.29 in fiscal 2023.

Shares of this Zacks Rank #3 (Hold) company have rallied 12.8% in the past year compared with the industry’s growth of 10.8%.

3 Impressive Picks

Abercrombie & Fitch ANF, a specialty retailer, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here

The Zacks Consensus Estimate for Abercrombie & Fitch’s current financial-year sales suggests growth of 13.3% from the year-ago reported number. ANF’s bottom line has outpaced the Zacks Consensus Estimate by a wide margin in the trailing four quarters, on average.

The Gap, Inc. GPS, a fashion retailer of apparel and accessories, currently sports a Zacks Rank #1. GPS has a trailing four-quarter earnings surprise of 137.9%, on average.

The Zacks Consensus Estimate for Gap’s current financial year EPS indicates growth of 387.5% year over year.

American Eagle Outfitters AEO, a retailer of casual apparel, accessories and footwear, currently has a Zacks Rank #2 (Buy). AEO delivered a trailing four-quarter average earnings surprise of 23%.

The Zacks Consensus Estimate for American Eagle Outfitters’ current financial year sales and EPS implies growth of 4% and 39.2%, respectively, from that reported a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report