Walmart (WMT) Looks Promising: Stock Rallies More Than 15% YTD

Walmart Inc. WMT appears in robust shape. The company has been gaining from its unmatched contributions to boost omnichannel efforts and enhance customer experience. These efforts have been helping the supermarket giant generate favorable comp sales for a while now.

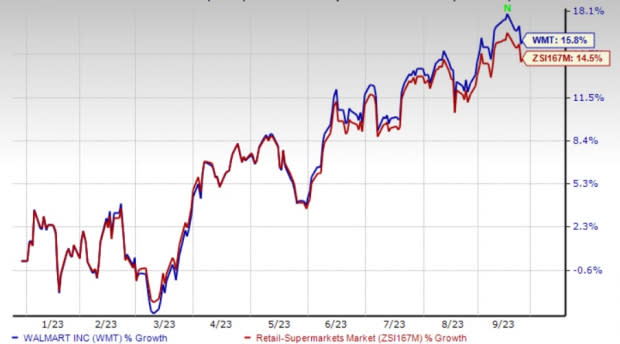

This Zacks Rank #2 (Buy) stock has rallied 15.8% year to date compared with the industry’s growth of 14.5%. The Zacks Consensus Estimate for the current fiscal-year EPS has risen by a penny to $6.43 in the past 30 days.

Favorable Comp Sales & Outlook

Walmart's robust e-commerce business, combined with exceptional in-store operations, has been a significant driver of the company's comp sales growth. WMT has been diligently focusing on revamping its stores, expanding product offerings and implementing both in-store and digital enhancements. In the second quarter of fiscal 2024, Walmart successfully renovated 165 stores across the United States.

One of the key factors contributing to Walmart's success is its effective pricing strategy, which has played a pivotal role in attracting and retaining customers. In the second quarter, U.S. comparable sales, excluding fuel, exhibited a 6.4% improvement. This growth was particularly driven by strong performance in the grocery and health & wellness segments.

Furthermore, e-commerce boosted comp sales by 230 basis points (bps). In addition, Sam's Club experienced healthy growth, with comp sales (excluding fuel) increasing by 5.5%. Comp sales showed strength across various categories, with notable contributions from the food and consumables as well as healthcare sectors.

For fiscal 2024, Walmart expects consolidated net sales growth of 4-4.5% at constant currency or cc. Management expects the consolidated operating income to increase roughly 7-7.5% at cc, including a 30-bps positive impact of LIFO. Management envisions an adjusted EPS in the band of $6.36-$6.46.

Image Source: Zacks Investment Research

Key Drivers

Walmart's e-commerce operations are on a continuous expansion trajectory. In the second quarter, e-commerce net sales represented 15% of the company's total net sales. The company has been undertaking a multitude of e-commerce initiatives, including acquisitions, partnerships and enhancements to delivery and payment systems.

WMT is also making strides in revolutionizing its supply chain, increasing its capacity and venturing into new endeavors such as Walmart GoLocal, Walmart Connect, Walmart Luminate, Walmart+, Spark Delivery, Marketplace and Walmart Fulfillment Services. In the second quarter of fiscal 2024, global e-commerce sales surged by an impressive 24%, underpinned by the strength of its omnichannel capabilities, especially pickup and delivery services.

Within the United States, e-commerce sales experienced a remarkable 24% uptick, primarily propelled by the outstanding performance of pickup and delivery services, alongside effective advertising efforts. Meanwhile, the International segment witnessed a robust 26% increase in e-commerce sales, largely attributed to store-fulfilled orders. At Sam's Club, e-commerce sales grew 18% due to the strong performance of curbside pickup services.

Walmart has been making significant investments to bolster its delivery capabilities, as evidenced by a series of strategic moves. This is exemplified by its partnership with Salesforce, the expansion of the InHome delivery service, investments in DroneUp and the launch of the Walmart+ membership program. Preceding these endeavors, Walmart introduced Express Delivery in April 2021, and in January 2019, it forged partnerships with Point Pickup, Skipcart, AxleHire and Roadie.

The acquisition of Parcel in September 2017 was another strategic move to elevate delivery services. The company’s store and curbside pickup options add to customers’ convenience. As of the second quarter of fiscal 2024, Walmart U.S. had nearly 4,600 pickup locations and more than 4,000 same-day delivery stores. As of Jan 31, 2023, the company had more than 8,100 pickup and nearly 7,000 delivery locations globally.

Walmart has firmly established itself in the realm of retail through its unwavering commitment to refining omnichannel strategies and elevating customer experiences.

Other Robust Picks

Here, we have highlighted three other top-ranked stocks.

Dillard's, Inc. DDS, a department store retailer, currently sports a Zacks Rank #1 (Strong Buy). DDS has a trailing four-quarter negative earnings surprise of 77.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dillard's third-quarter EPS has increased from $6.66 to $7.04 in the past 30 days.

Build-A-Bear Workshop, Inc. BBW has a trailing four-quarter earnings surprise of 21.6%, on average. BBW, which is a multi-channel retailer of plush animals and related products, sports a Zacks Rank #1 at present.

The Zacks Consensus Estimate for Build-A-Bear Workshop’s current financial-year EPS suggests growth of 14.3% from the year-ago reported figure.

Ross Stores ROST, an off-price retailer, currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Ross Stores’ current financial-year EPS suggests growth of 19.4% from the year-ago reported figure. ROST has a trailing four-quarter earnings surprise of 11.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Build-A-Bear Workshop, Inc. (BBW) : Free Stock Analysis Report