Will Walmart's (WMT) New Starting Pay Structure Help Cut Costs?

Walmart Inc. WMT has been undertaking consistent efforts to improve operations, including driving revenues as well as curtailing costs. To lower its cost burden, the supermarket giant is making alterations to its beginning hourly wage structure for entry-level store employees, as reported by various media sources. This move appears appropriate in a slowing labor market.

Inside the Headlines

Sources revealed that store employees like personal shoppers, cashiers, stockers, self-checkout helpers and workers handling departments like sporting goods or electronics would be entitled to the same hourly starting wages paid at the store, unlike being paid differently like before. That said, deli, bakery and auto center employees will continue earning greater entry-level wages.

This move will neither alter WMT’s minimum hourly wage of $14 nor lead to any pay reductions for the current workers. Industry experts believe that the new wage structure will not only help the omnichannel retailer lower costs but also help fuel consistency across store staffing and facilitate improved customer service.

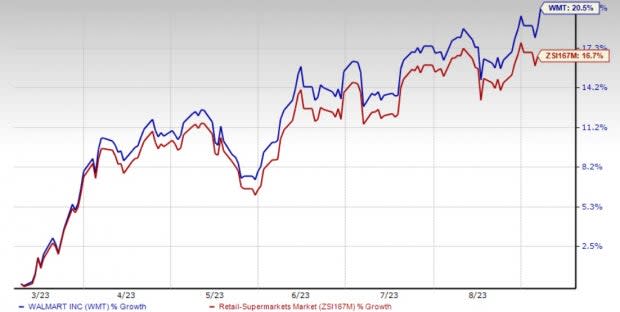

Image Source: Zacks Investment Research

What’s More?

Walmart has been gaining from its sturdy comp sales record, which is driven by its store expansion efforts and splendid e-commerce performance. Walmart has been undertaking several efforts to enhance merchandise assortments.

Also, the company has been focused on store remodeling to upgrade them with advanced in-store and digital innovations. Walmart is also gaining from its compelling pricing strategy, which helps it draw customers.

In the second quarter of fiscal 2024, U.S. comp sales, excluding fuel, improved by 6.4% due to a 3.4% increase in the average ticket and transaction growth of 2.9%. The segment experienced gains from grocery and health & wellness. E-commerce boosted comps by 230 bps.

Sam’s Club’s comp sales, excluding fuel, grew 5.5%. While transactions grew 2.9%, the average ticket rose 2.5%. Comp sales saw strength across most categories, mainly led by food and consumables and healthcare.

Solid results, confidence in the ongoing business momentum and a favorable customer response to its value plan encouraged the company to pull up its guidance for fiscal 2024 in its second-quarter earnings release.

For fiscal 2024, Walmart now expects consolidated net sales growth of 4-4.5% at cc compared with the previous view of nearly 3.5% growth. Management expects the consolidated operating income to increase roughly 7-7.5% at cc now, including a 30-bps positive impact of LIFO. The consolidated operating income was earlier expected to increase 4-4.5% at cc, including the LIFO impact. Management now envisions an adjusted EPS in the band of $6.36-$6.46, up from the earlier range of $6.10-$6.20.

Shares of this Zacks Rank #2 (Buy) company have rallied 20.5% in the past six months compared with the industry’s growth of 16.7%.

Other Solid Picks

Here, we have highlighted three other top-ranked stocks.

Dillard's, Inc. DDS, a department store retailer, currently sports a Zacks Rank #1 (Strong Buy). DDS has a trailing four-quarter negative earnings surprise of 77.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dillard's third-quarter EPS has increased from $6.66 to $7.04 in the past 30 days.

Ross Stores ROST currently carries a Zacks Rank #2. This off-price retailer has an expected EPS growth rate of 11.6% for three to five years.

The Zacks Consensus Estimate for Ross Stores’ current financial-year EPS suggests growth of 19.4% from the year-ago reported figure. ROST has a trailing four-quarter earnings surprise of 11.4%, on average.

Build-A-Bear Workshop, Inc. BBW has a trailing four-quarter earnings surprise of 21.6%, on average. BBW, which is a multi-channel retailer of plush animals and related products, holds a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Build-A-Bear Workshop’s current financial-year EPS suggests growth of 14.3% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Build-A-Bear Workshop, Inc. (BBW) : Free Stock Analysis Report