Walmart's (WMT) Upcoming Milk Facility to Serve Customers Better

Walmart Inc. WMT is known for its unparalleled efforts toward enriching customers’ experiences and catering to their demands. The omnichannel retailer goes all the way to undertake relevant innovation to keep up with customers’ needs. In the latest move, Walmart unveiled plans to introduce an owned and operated milk processing facility in Valdosta, GA, which is expected to break ground later this year.

With this facility, the company aims to serve customers’ burgeoning demand for superior-quality milk. This innovative facility in Valdosta will also solidify Walmart’s supply chain and help the company make sourcing more transparent.

Creating nearly 400 jobs at Walmart, the upcoming facility will utilize locally sourced ingredients to handle the processing and packaging of a diverse range of milk choices. These include gallon, half-gallon, whole, 2%, 1%, skim and 1% chocolate milk under Walmart's Great Value and Sam's Club's Member's Mark brands. These products will be distributed to more than 750 Walmart stores and Sam's Clubs located in the Southeast region.

Incidentally, WMT inaugurated its first milk processing plant in Fort Wayne, IN, in 2018. In subsequent endeavors, the company expanded its investments by launching its inaugural case-ready beef facility in Thomasville, GA, and constructing a second case-ready beef facility in Olathe, KS. Additionally, Walmart forged equity investments and established long-term commercial partnerships with Sustainable Beef LLC (a rancher-owned enterprise) and a vertical farming company, Plenty.

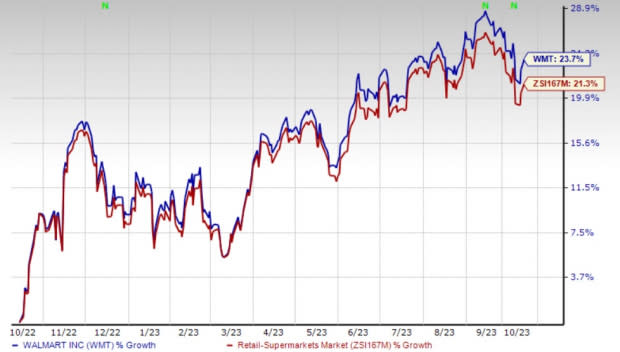

Image Source: Zacks Investment Research

Focus on Elevating Customers’ Experience

Walmart has been pushing the edge out of the envelope with regard to its e-commerce efforts. It has undertaken a series of initiatives, including acquisitions, strategic partnerships and enhancements to its delivery and payment systems. In the realm of the supply chain, the company is fostering innovation, increasing capacity and launching new ventures like Walmart GoLocal, Walmart Connect, Walmart Luminate, Walmart+ and Walmart Fulfillment Services.

In the second quarter of fiscal 2024, e-commerce sales surged 24% globally on omnichannel strength, including pickup and delivery. U.S. e-commerce sales rose 24%, driven by strength in pickup & delivery and advertising. The International segment’s e-commerce sales ascended 26% on store-fulfilled strength. At Sam’s Club, e-commerce sales jumped 18% on strong curbside performance.

Noteworthy milestones for Walmart include the acquisition of a significant stake in Flipkart, which has been bolstering its International segment. Walmart's majority ownership of India's digital transaction platform, PhonePe, is also significant.

Additionally, Walmart is making aggressive efforts to expand in the booming online grocery space, which has long been a major contributor to e-commerce sales. By the second quarter of fiscal 2024, Walmart U.S. had nearly 4,600 pickup locations and more than 4,000 same-day delivery stores.

All said, the abovementioned milk facility highlights Walmart’s commitment to upgrade its offerings and resonate with customers’ needs while keeping its pricing affordable. The Zacks Rank #2 (Buy) stock has rallied 23.7% in the past year compared with the industry’s growth of 21.3%.

3 Other Retail Picks

Ross Stores ROST, which operates off-price retail apparel and home fashion stores, currently sports a Zacks Rank #1 (Strong Buy). ROST has a trailing four-quarter earnings surprise of 11.4%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here

The Zacks Consensus Estimate for Ross Stores’ current financial-year sales and earnings indicates growth of 7.1% and 19.4%, respectively, from the year-ago reported numbers.

Dillard's, Inc. DDS, a department store retailer, currently carries a Zacks Rank #2. DDS has a trailing four-quarter negative earnings surprise of 77.1%, on average.

The Zacks Consensus Estimate for Dillard's third-quarter EPS has increased from $6.66 to $7.04 in the past 60 days.

Grocery Outlet GO, an extreme value retailer of quality, name-brand consumables and fresh products, currently has a Zacks Rank #2.

The Zacks Consensus Estimate for Grocery Outlet’s current financial-year sales and earnings suggests growth of 11.2% and 4.9%, respectively, from the year-ago reported numbers. GO has a trailing four-quarter earnings surprise of 14.3%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report