Walmart's (WMT) Walmart GoLocal Teams Up With SmartKargo

Walmart Inc. WMT is known for its robust omnichannel operations, which include its impressive delivery services. In the latest development, SmartKargo revealed its collaboration with Walmart GoLocal to enhance the range of next-and-two-day delivery services available to retailers and e-commerce businesses.

While SmartKargo is a prominent player in delivering technology and logistics solutions to airlines on a global scale, Walmart GoLocal is a white-label, delivery-as-a-service platform by Walmart. The integration of SmartKargo's software-as-a-service solution with Walmart GoLocal is likely to help retailers offer improved delivery of small packages.

With this partnership, SmartKargo will benefit from Walmart GoLocal’s local delivery solutions and retail and logistics proficiency. Also, the move will help Walmart GoLocal as it will speed up the process of retailers and e-commerce companies transferring the inventory from their fulfillment centers to customers’ doors, alongside facilitating steadfast next and two-day delivery.

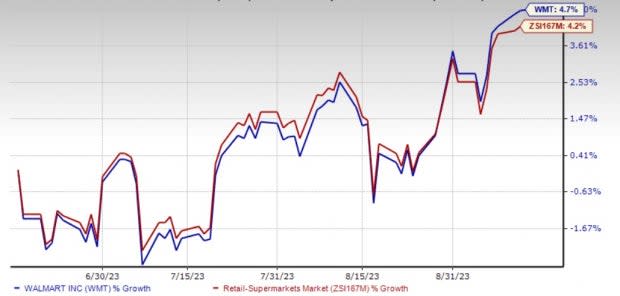

Image Source: Zacks Investment Research

What Else to Know?

Walmart has made significant strides in strengthening its delivery capabilities, as evidenced by various strategic moves. These include partnering with Salesforce, expanding its InHome delivery service, investing in DroneUp, launching the Walmart+ membership program and conducting a pilot program with Cruise to explore grocery delivery using self-driving electric vehicles.

Prior to these initiatives, Walmart introduced Express Delivery in April 2021 and formed partnerships with Point Pickup, Skipcart, AxleHire and Roadie in January 2019. Additionally, the acquisition of Parcel in September 2017 was a key strategic move to enhance its delivery services. Additionally, WMT offers store and curbside pickup options.

As of the second quarter of fiscal 2024, Walmart U.S. had nearly 4,600 pickup locations and more than 4,000 same-day delivery stores. As of Jan 31, 2023, the company had more than 8,100 pickups and nearly 7,000 delivery locations globally.

A strong delivery arm has been boosting the supermarket giant’s e-commerce business. In the second quarter, e-commerce net sales accounted for 15% of the company's total net sales. WMT has been actively pursuing numerous e-commerce initiatives, which encompass acquisitions, partnerships and enhancements to delivery and payment systems.

Walmart is also making innovations in its supply chain and increasing capacity. Other than Walmart GoLocal, the company is establishing new ventures such as Walmart Connect, Walmart Luminate, Walmart+, Spark Delivery, Marketplace and Walmart Fulfillment Services. In the second quarter of fiscal 2024, global e-commerce sales saw an impressive 24% increase, driven by the strength of its omnichannel capabilities, including pickup and delivery services.

Shares of this Zacks Rank #2 (Buy) company have risen 4.7% in the past three months compared with the industry’s growth of 4.2%.

Other Solid Picks

Here, we have highlighted three other top-ranked stocks.

Dillard's, Inc. DDS, a department store retailer, currently sports a Zacks Rank #1 (Strong Buy). DDS has a trailing four-quarter negative earnings surprise of 77.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dillard's third-quarter EPS has increased from $6.66 to $7.04 in the past 30 days.

Ross Stores ROST currently carries a Zacks Rank #2. This off-price retailer has an expected EPS growth rate of 11.6% for three to five years.

The Zacks Consensus Estimate for Ross Stores’ current financial-year EPS suggests growth of 19.4% from the year-ago reported figure. ROST has a trailing four-quarter earnings surprise of 11.4%, on average.

Build-A-Bear Workshop, Inc. BBW has a trailing four-quarter earnings surprise of 21.6%, on average. BBW, which is a multi-channel retailer of plush animals and related products, holds a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Build-A-Bear Workshop’s current financial-year EPS suggests growth of 14.3% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Build-A-Bear Workshop, Inc. (BBW) : Free Stock Analysis Report