Want to Get Off to a Strong Start in 2024? Buy These Stocks Before It's Too Late.

This past year was a strong one for the stock market. The S&P 500 was up about 25%, closing near its all-time high.

However, not all stocks joined that rally. Utilities, in particular, were under pressure last year due to the impact of higher interest rates and some company-specific issues. Those headwinds could fade in 2024. Because of that, utilities could have the power to produce strong total returns. Black Hills (NYSE: BKH), Enbridge (NYSE: ENB), and NextEra Energy (NYSE: NEE) currently stand out to a few Fool.com contributors as stocks that could get off to a strong start in the new year.

Black Hills: A reliable dividend stock with a historically high yield

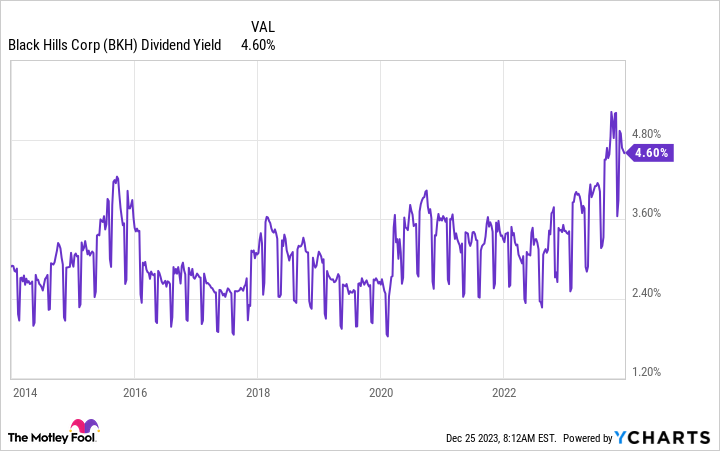

Reuben Gregg Brewer (Black Hills): The first thing that dividend investors will be attracted to at Black Hills is its status as a Dividend King, with 53 years of annual dividend increases under its belt. The next key feature is the 4.6% dividend yield, which is toward the high end of the stock's yield range over the past decade. This suggests it is a historically good time to buy this regulated utility.

One of the big reasons for the high yield is the rise in interest rates over the past year or so, which has made other income options, like CDs, more competitive. Rising rates have also increased the utility's interest expense, though it has been working to reduce debt to offset the impact. Debt reduction, however, has required a reduction in capital investment, which slows near-term growth. But given the long history of dividend reliability here, this is likely to be a temporary headwind for investors who think in decades.

Notably, Black Hills' regulated business has monopolies in regions where its customer count is growing at nearly 3 times as fast as average U.S. population growth. In other words, once the natural gas and electric utility gets its balance sheet back in shape, it will have to increase spending back to previous levels just to keep up with demand. And that means there's no reason to expect dividend growth to come to an end anytime soon. But if you don't act now you could end up missing the opportunity.

A needle-moving catalyst ahead

Matt DiLallo (Enbridge): Enbridge shares fell about 9% in 2023. The main factor weighing on its stock was the pipeline and utility company's decision to acquire three natural gas utilities from Dominion Energy. The market didn't like the deal because it's such a large undertaking.

However, Enbridge believes the $14 billion transaction will be a needle-mover. CEO Greg Ebel commented on the deal, saying that "adding natural gas utilities of this scale and quality, at a historically attractive multiple, is a once-in-a-generation opportunity." The company believes the acquisition will be accretive to its earnings and cash flow within the first year while enhancing its long-term growth profile.

The market is taking a more wait-and-see approach to the transaction. Its initial skepticism is enabling investors to buy shares of Enbridge at a cheaper price (8.5 times 2024 cash flow per share) and higher dividend yield (currently 7.5%). That discount might not be around for too long. Shares should bounce back as investors grow more comfortable with the transaction.

That eventual recovery sets investors up to potentially earn very strong returns. Enbridge expects to grow its earnings at a 5% annual rate over the medium term, driven by contract rate increases, its massive backlog of expansion projects, and bolt-on acquisitions. Add that earnings growth to Enbridge's high-yielding and steadily rising dividend (it gave investors a 3.1% raise for 2024, its 29th straight year of dividend growth), and the company has the fuel to produce an average annual total return in the double digits. Meanwhile, there's further upside as its share price recovers. That's a very strong total return potential for such a low-risk stock.

NextEra Energy stock could rebound in 2024 if this happens

Neha Chamaria (NextEra Energy): 2023 was a bummer year for NextEra Energy stock, with higher interest rates proving to be a major growth hurdle for the renewable energy giant. Dividend stocks were already taking a hit amid rising interest rates when NextEra Energy's limited partnership company, NextEra Energy Partners unexpectedly slashed its dividend growth targets citing difficulty in accessing low-cost funds in the current interest rate environment.

Investors feared NextEra Energy would follow suit and reduce its dividend growth, too, especially since a dividend cut at the partnership will also mean a fall in extra income for the parent company. Also, since NextEra Energy typically dropped down its assets to NextEra Energy Partners to raise funds for growth, a shift in the partnership's strategy to not pursue acquisitions in the near term could make it harder for the parent company to access capital. These fears pummeled NextEra Energy stock.

NextEra Energy, however, has tried to dispel investors' fears since and has stuck with its growth plans. It still expects to grow its annual adjusted earnings per share (EPS) by 6% to 8% through 2026 off its 2024 estimate and is confident of increasing its dividend by around 10% in 2024, driven by its capital deployment program and a strong balance sheet. NextEra Energy plans to invest $32 billion to $34 billion in its electric utility, Florida Power & Light, between 2022 and 2025, and has a backlog of more than 21 gigawatts at its clean energy arm, Energy Resources.

The biggest factor that could propel NextEra Energy stock higher, though, is a change in the Federal Reserve's stance. With the Fed now even expected to cut rates in the coming year, NextEra Energy stock could be an interesting turnaround story for 2024.

Should you invest $1,000 in Enbridge right now?

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Enbridge wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Matthew DiLallo has positions in Enbridge, NextEra Energy, and NextEra Energy Partners. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in Black Hills, Dominion Energy, and Enbridge. The Motley Fool has positions in and recommends Enbridge and NextEra Energy. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.

Want to Get Off to a Strong Start in 2024? Buy These Stocks Before It's Too Late. was originally published by The Motley Fool